Welcome back

Welcome back to our Sensibly Sweet journey, "Sweet. Less.," where we share undiscovered insights about consumer’s sweetness habits and attitudes. In this series we share the top preferred sweeteners across 24 countries and bring to the foray a key consumer need - the case for sugar reduction.

What's in my food?

It is simple - people love sweetened food and drinks and delight in new flavour experiences that these products deliver. But that is precisely where things get complex. Sweeteners have come a long way since the early 80’s with several types from natural to high intensity sweeteners giving people a lot of choice with relatively less information to educate them on its benefits and misgivings. Having dealt with the uncertainties of the pandemic, today’s consumer wants to know more and has increasingly asked - ‘what’s in my food?’.

64%

64% of global consumers believe sugar is important in food and drinks because they taste good.

76%

76% of global consumers find details regarding sweeteners in food and drinks are important.

77%

77% indicate that the type of sweetener used is extremely important detail to them.

Sweeteners’ preferences are unique

While honey is the most preferred sweetener in each country, the preference for honey certainly is driven by attributes well beyond its sweetness delivery – unique taste, nutrition, and healthy-halo.

There are different degrees of preference for the different sweeteners around the globe.

Join us while we unveil the top consumer preferred

sweeteners across the 24 countries.

(Click on the  below to read country specific insight)

below to read country specific insight)

Top consumer preferred sweeteners

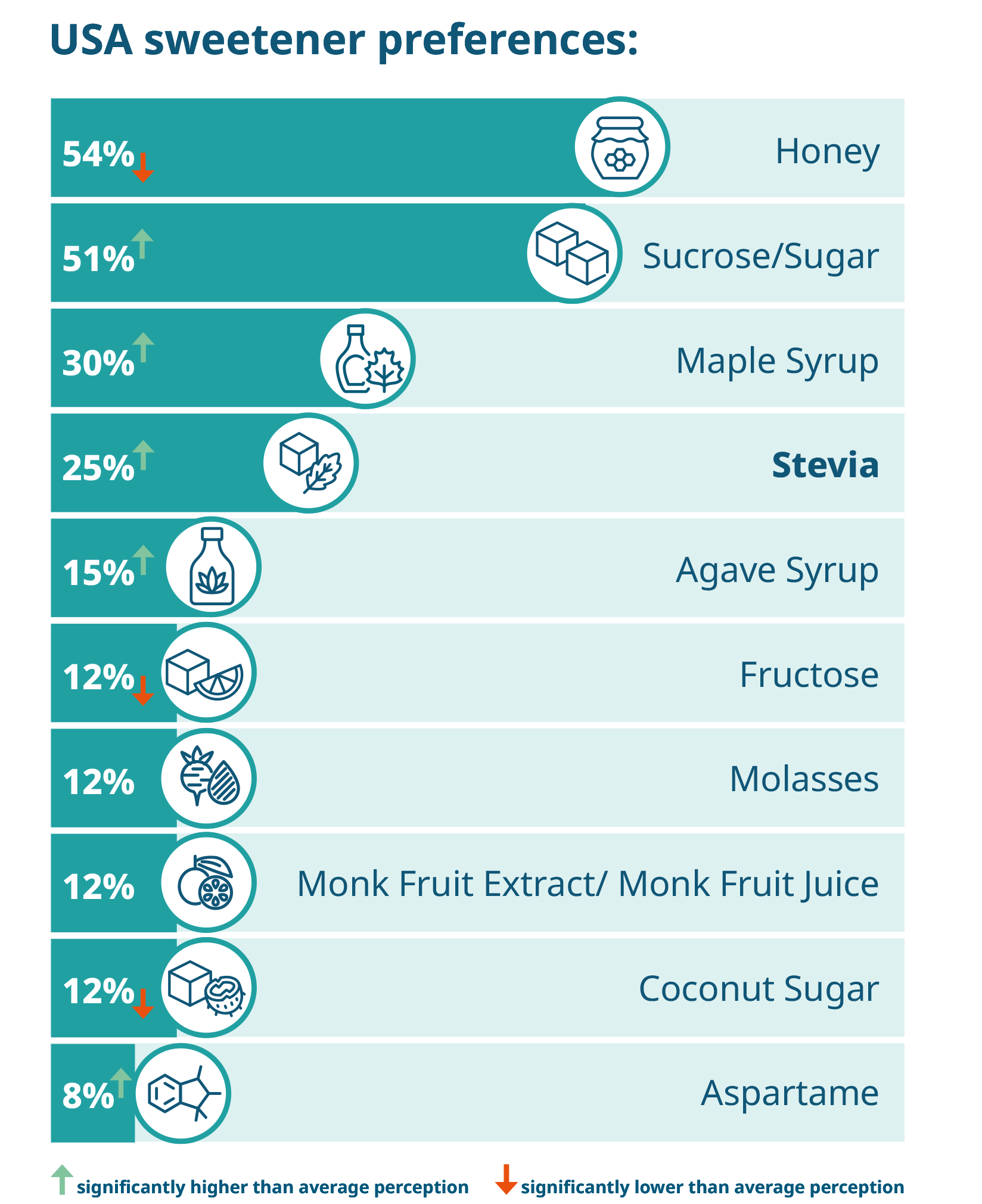

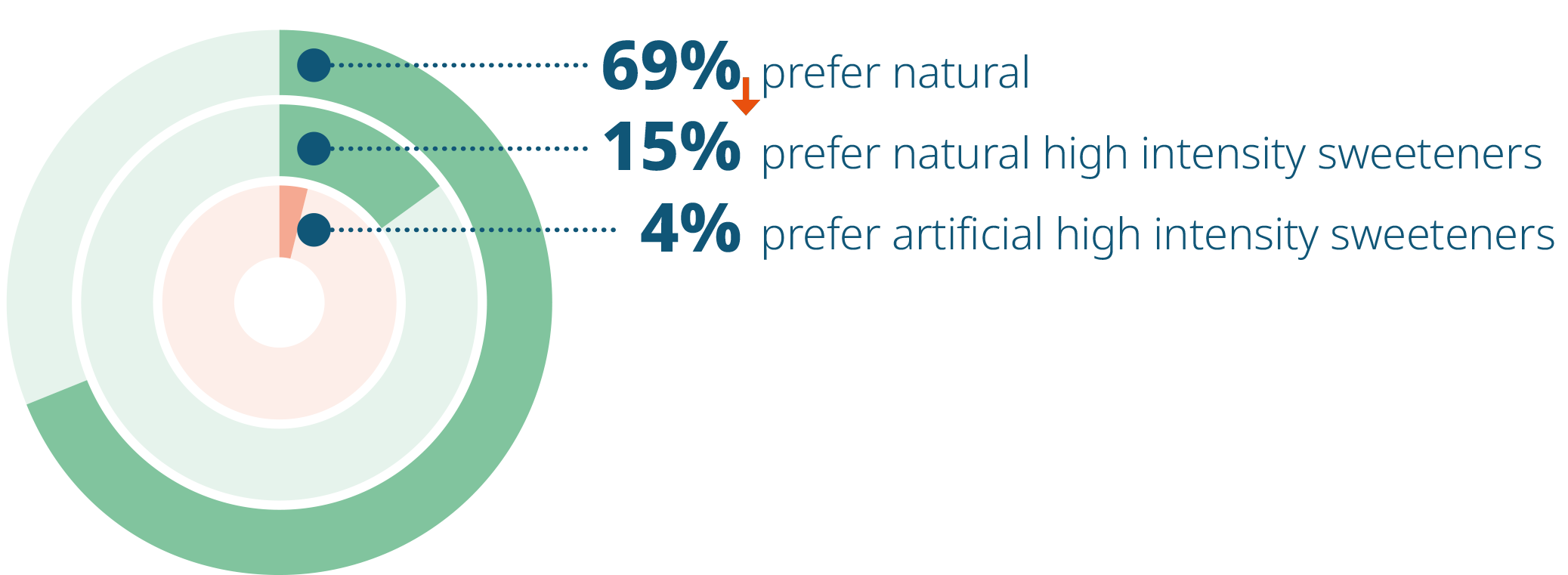

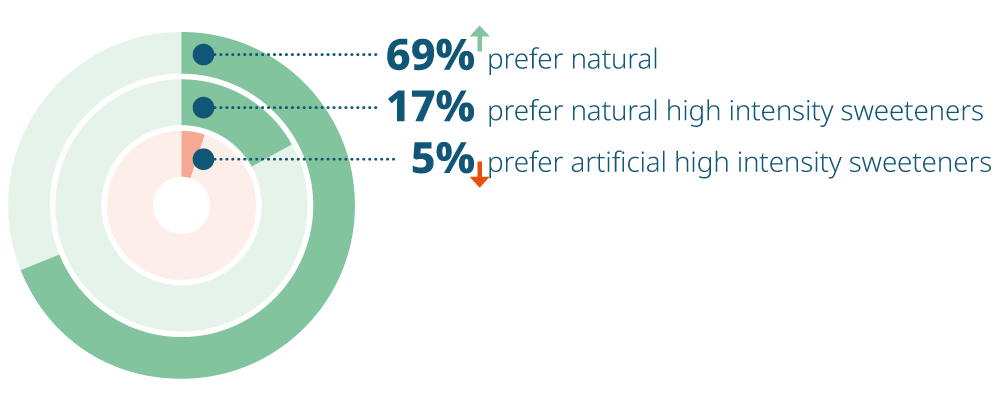

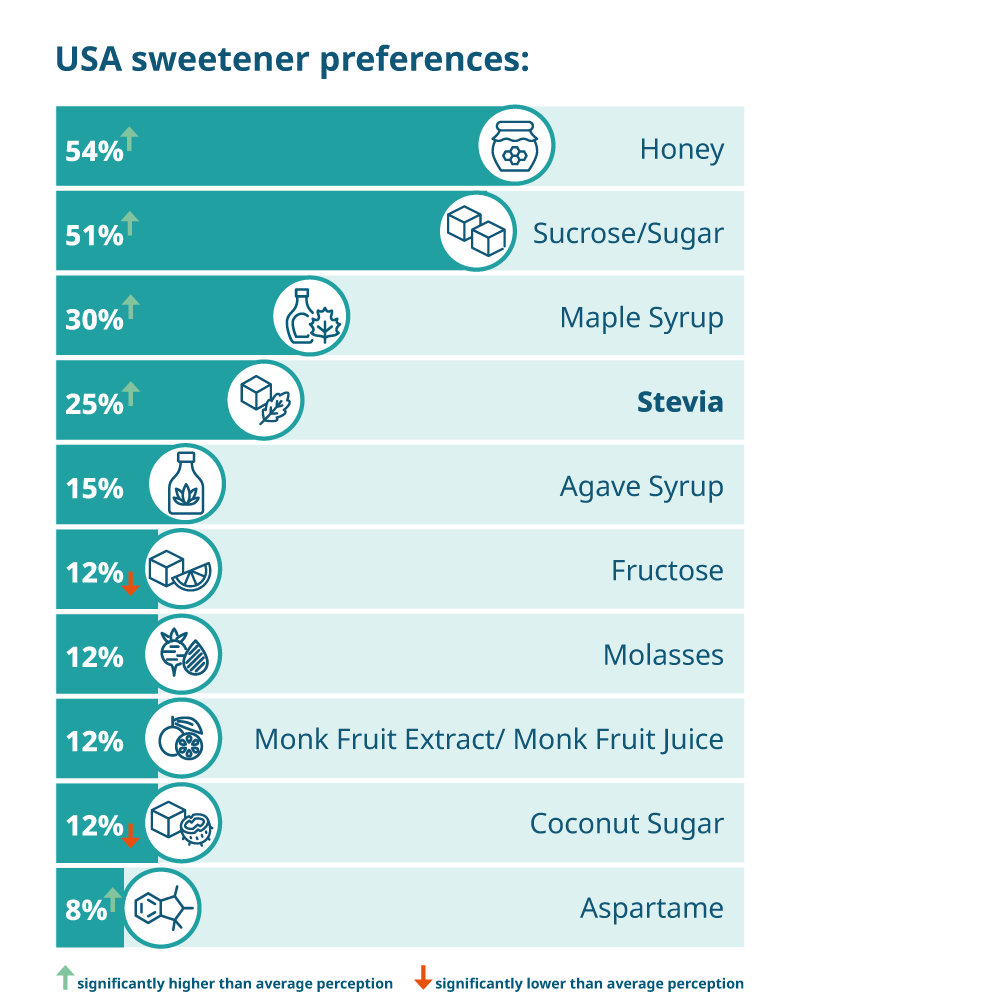

Americans have a high preference for natural sweeteners and natural high intensity sweeteners (despite being lower than other countries). The preference for sugar, maple syrup, and agave syrup were significantly higher in the US vs. the global average. And stevia maintained its strong position in the US over the years (growing from 22% in 2018 to 25% in 2023). Additionally, the preference for monk fruit in the US has risen greatly; growing from 3% preference in 2018* to 12% today. While still widely used, the negative messaging around high fructose corn syrup has significantly lowered its consumer preference, falling out from the top 10 most preferred sweeteners in the US.

Top consumer preferred sweeteners

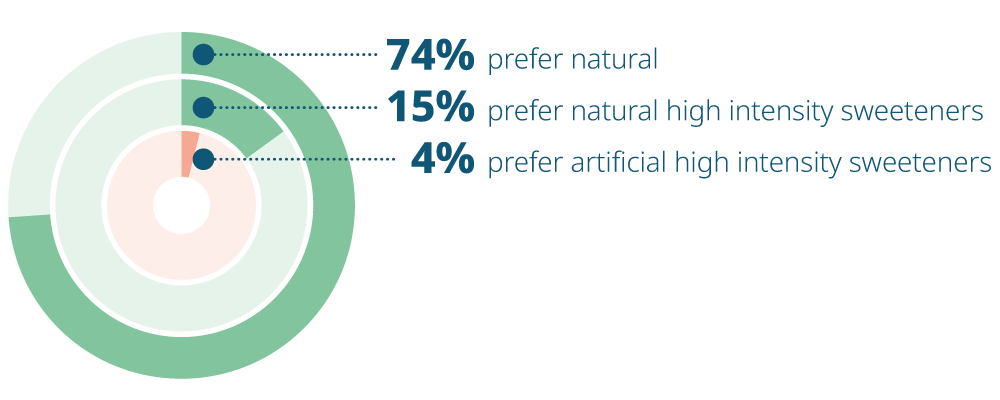

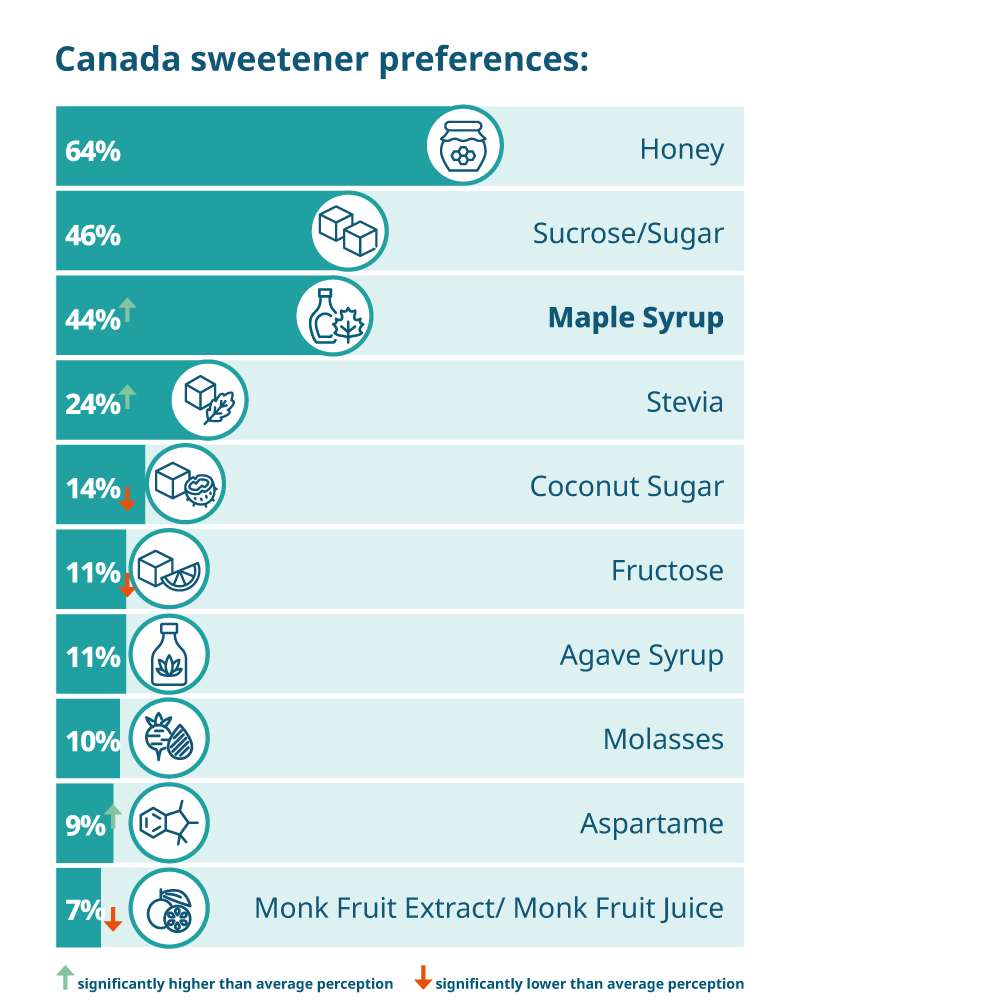

The preference for natural sweeteners and natural high intensity sweeteners is Canada is similar to that of the global average. Maple syrup is beyond a doubt the most preferred in Canada, owing to the authenticity and of origin nature of Maple, and challenges the preference for sugar/sucrose. Agave syrup and monk fruit positioning in the top ten is driven by Canadian women's preference for these sweeteners, indicating significantly higher preference as compared to their male counterparts.

Top consumer preferred sweeteners

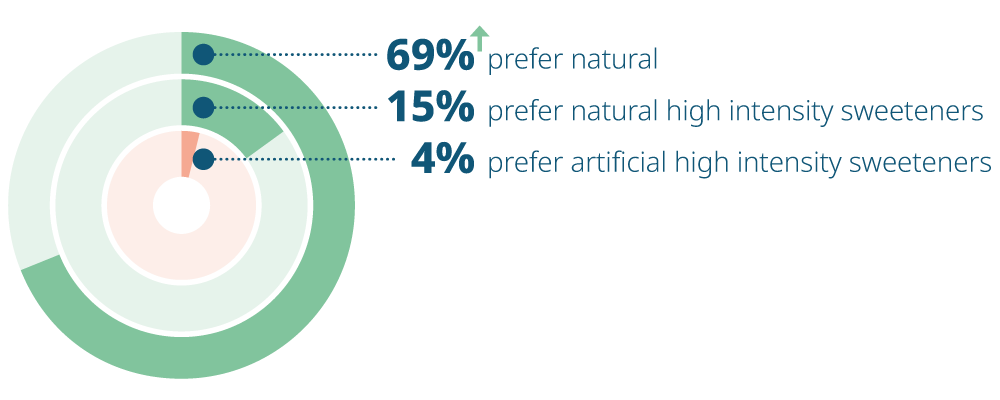

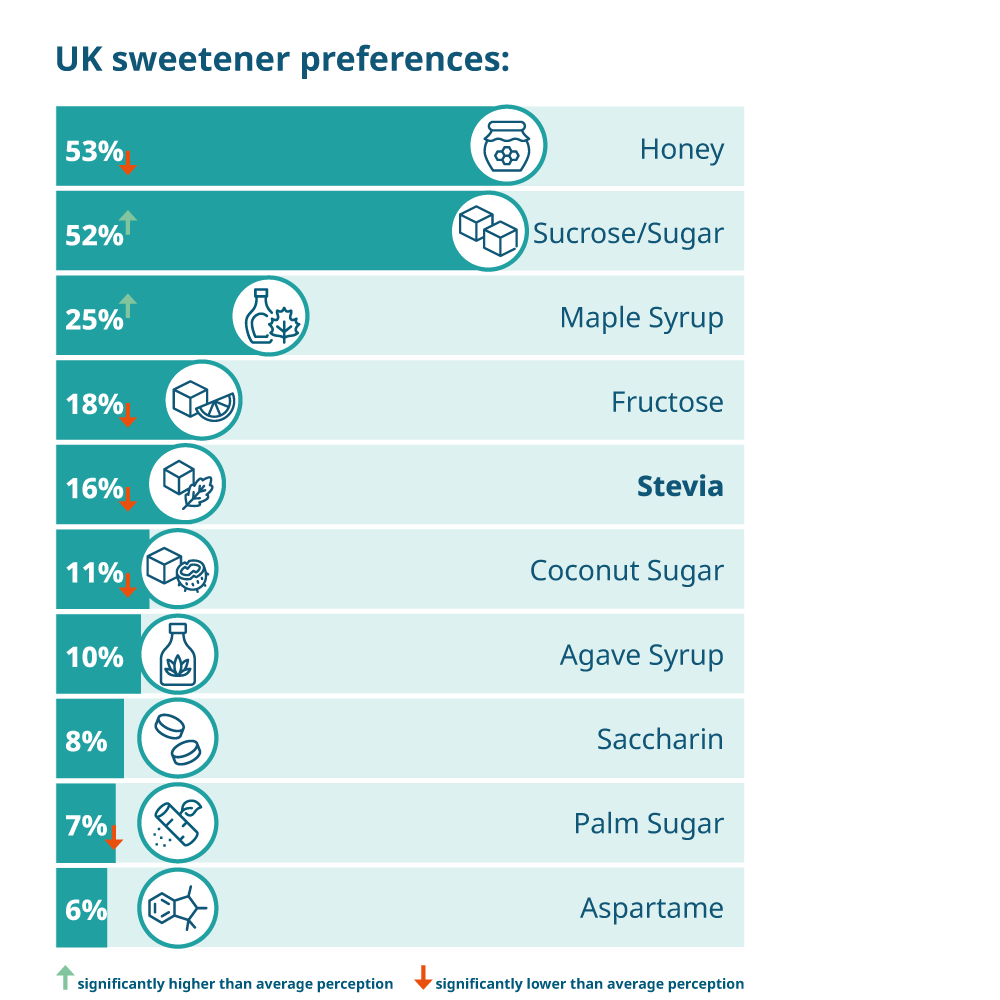

The preference for honey and sugar/sucrose is nearly identical in the UK. The preference for other types of sweeteners sharply falls beyond honey and sugar among the British, with preference for natural sweeteners significantly lower when compared with the global average. Despite this, they would prefer natural high intensity sweeteners over artificial high intensity sweeteners, which contradicts with the number of retailed products that are sweetened with artificial HIS (Innova NPDs 2000-2023). Stevia on the other hand has grown 12% in new product launches (Innova NPD 2018-2022), rising now to the 5th most consumer preferred sweetener in the UK.

Top consumer preferred sweeteners

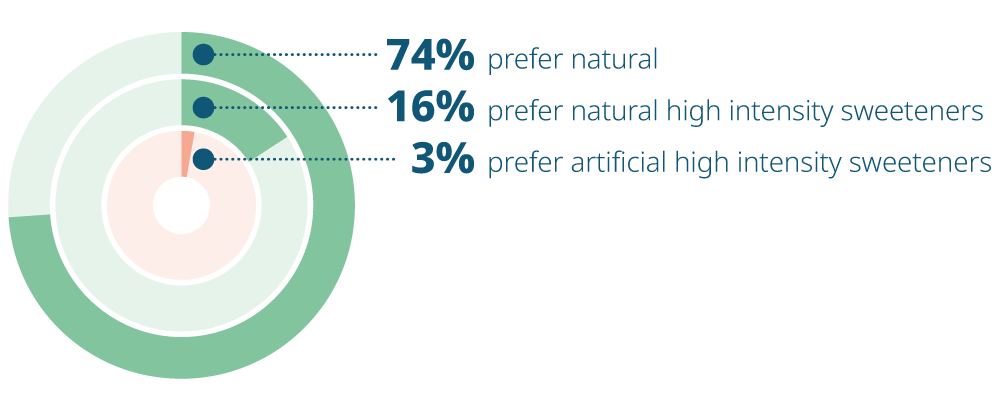

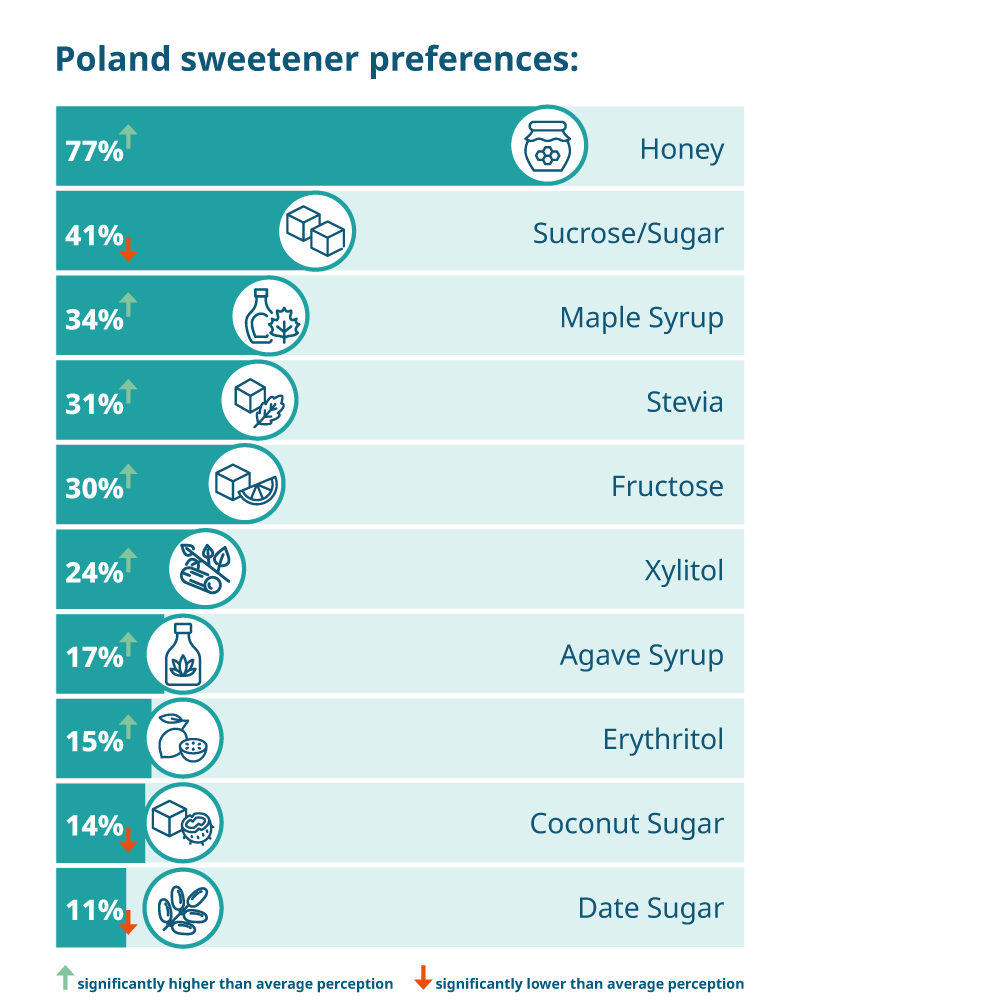

The preference for honey among the Polish is extremely high, with a sharp difference between their preference for honey and sugar. The consumer continues to prefer natural sweeteners and maple syrup, stevia, fructose, and xylitol, significantly more by Polish women over men. The Polish also have the highest preference for agave syrup and erythritol vs. the rest of world. In a country where sucralose is the most utilized artificial HIS across product launches (Innova NPDs 2000-2023); it is interesting that the consumer ranked it among the least preferred sweetener; 4%.

Top consumer preferred sweeteners

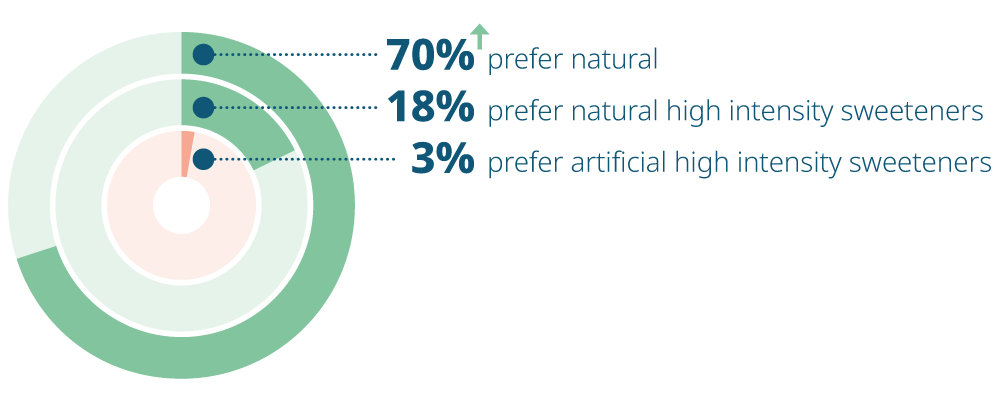

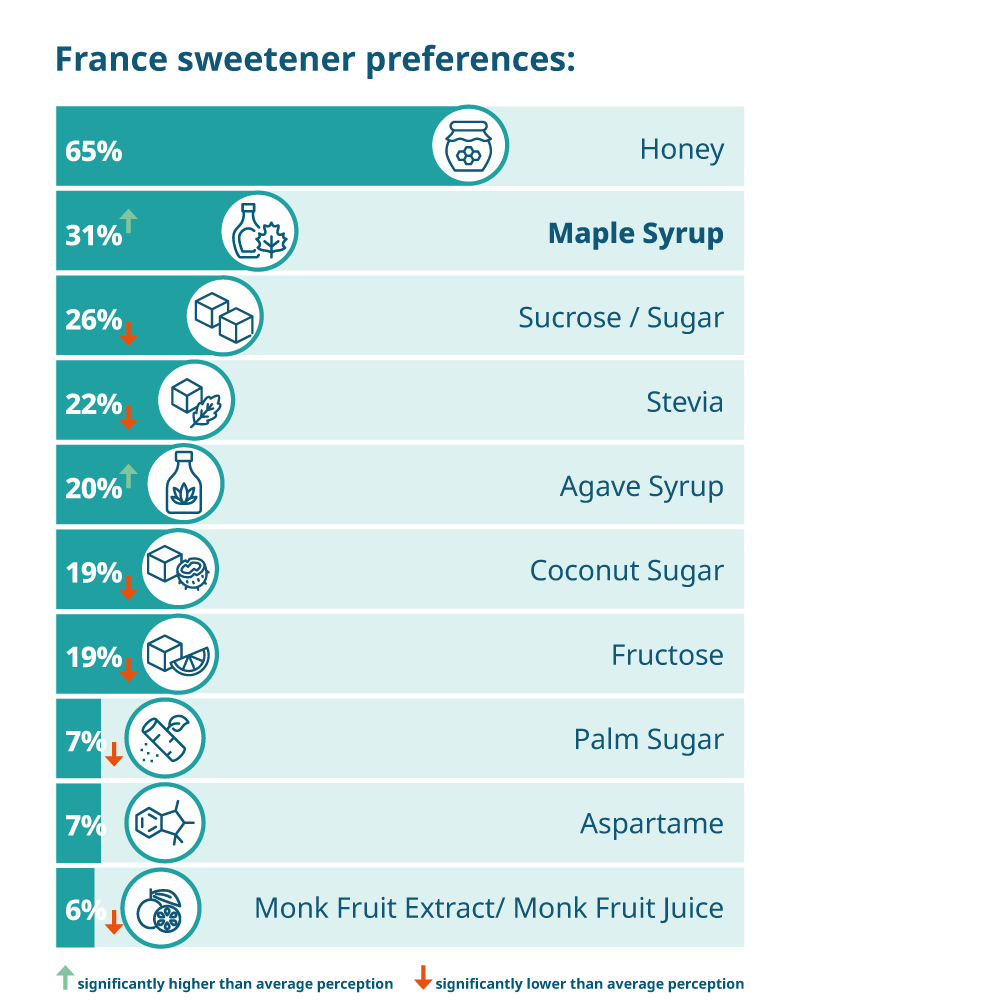

The French consumer is more sensitive to the environmental impact of sugar consumption than the rest of the world (23% of French vs. 15% global), but their desire to reduce their overall sugar consumption for a healthier future is much higher.

Maple syrup is the second most preferred sweetener, displacing sugar from the top 3 in France. While sugar has the lowest comparative preference in France, sweetness and sweet treats are an integral part of the patisserie culture. Agave syrup also has the highest preference in France compared to the rest of the world also growing by 3% in new food and drink launches over the years (Innova NPD, 2018-22).

Top consumer preferred sweeteners

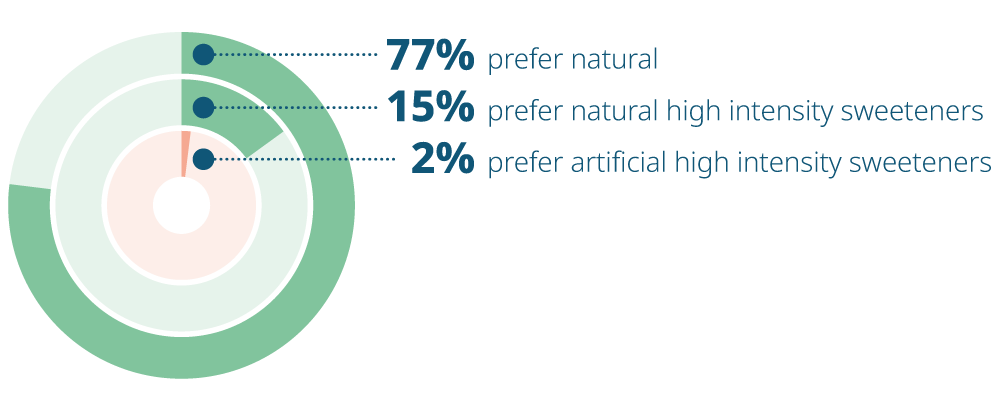

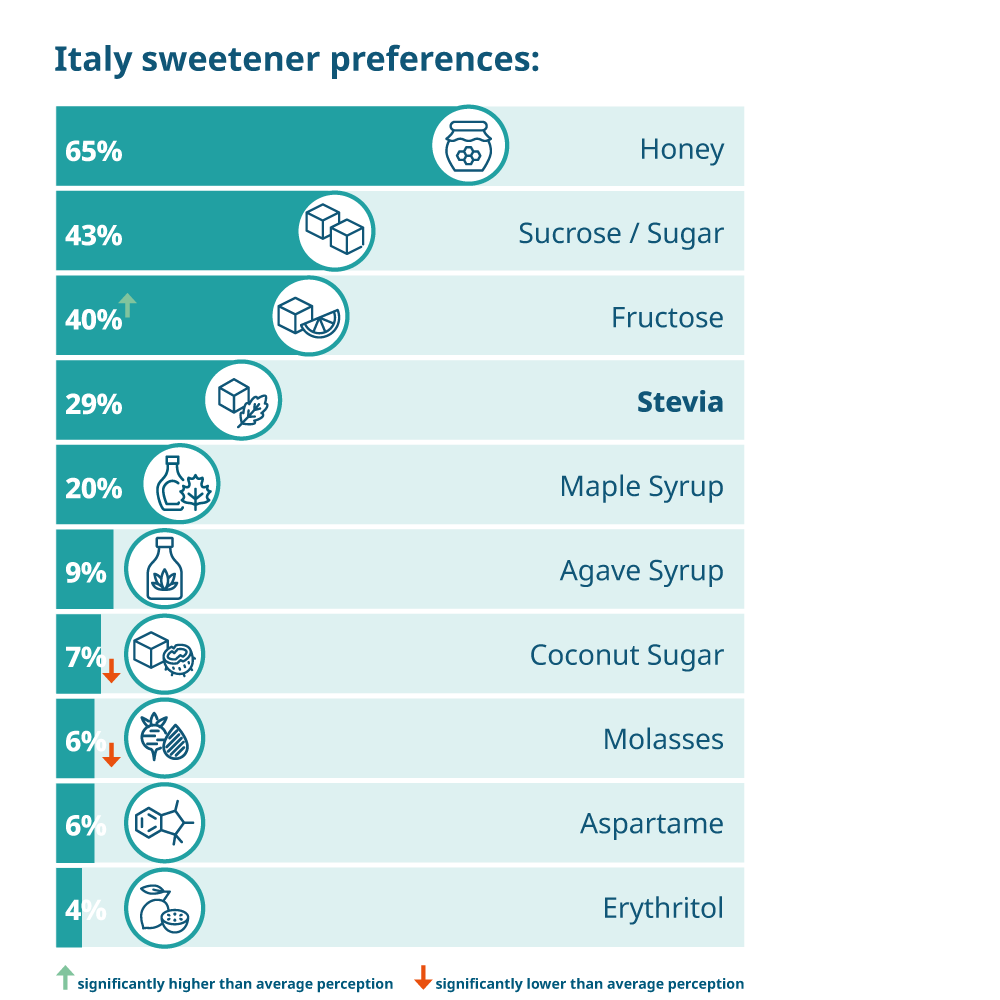

The type of sweetener in food and drinks is important to 77% Italians over any other sweetener feature; and they also have a dominant preference for naturally derived sweeteners. Italians have the highest preference for fructose of all other countries and comes very close to their preference for sugar.

A higher degree of locals (39%) want to reduce sugar in their food and drinks so it can fit with the diet/lifestyle they are leading. Stevia, a high intensity sweetener, ranks high in Italy with the highest preference among older millennials while trending lower with younger.

Top consumer preferred sweeteners

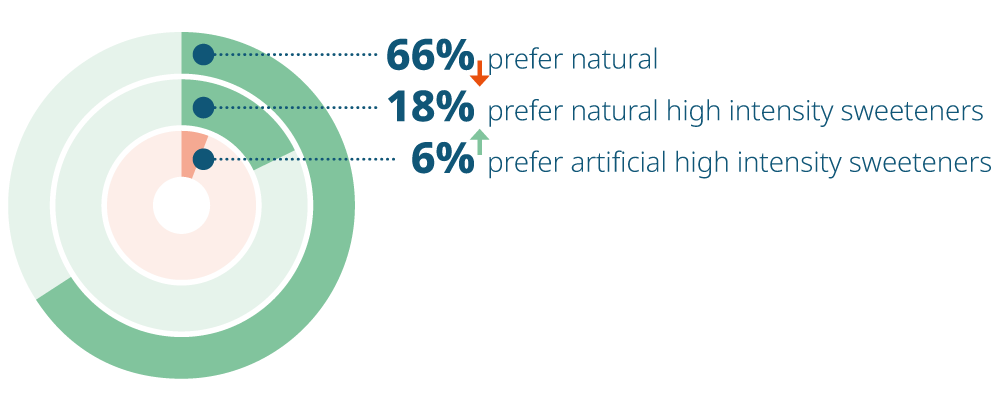

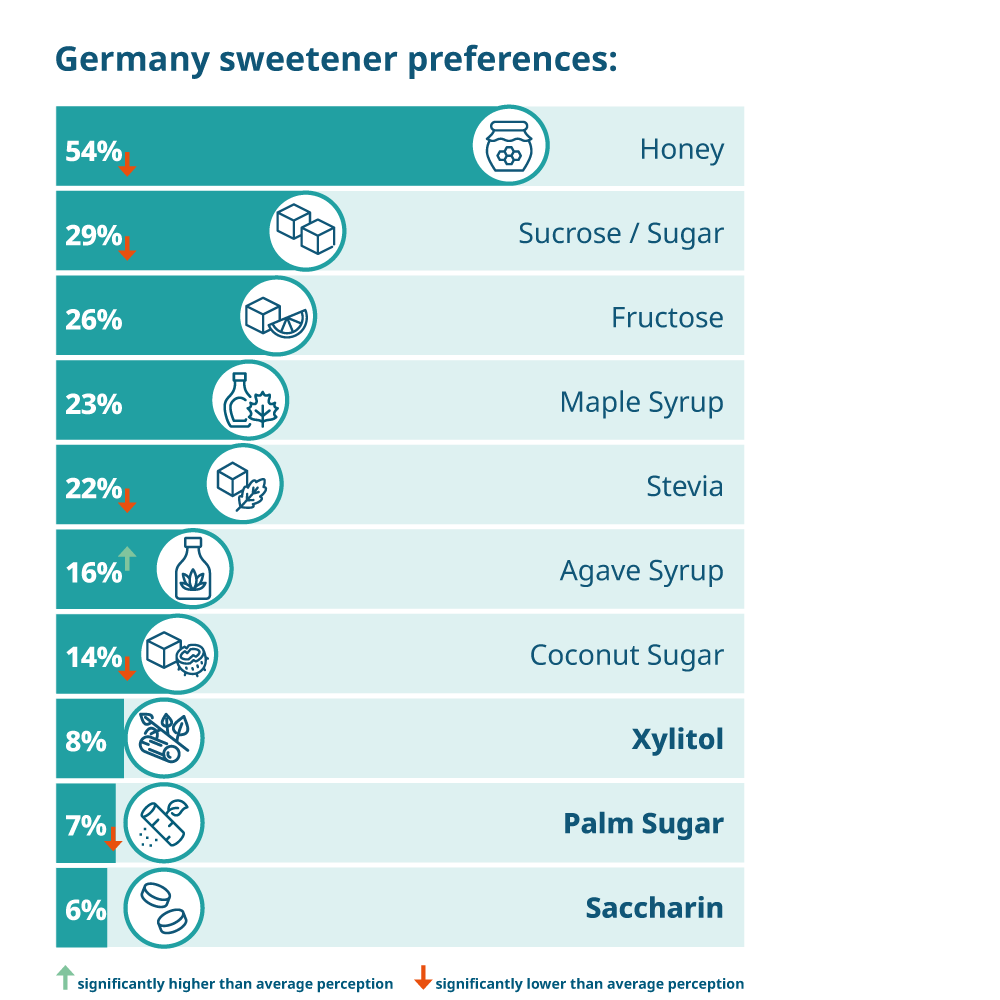

Sugar has among the lowest comparative preference in Germany, while agave syrup resonated more positively with Germany vs. the rest of the world. Sucralose is not among the topmost preferred sweeteners; however German Generation X consumer has preference for it; 21% vs. 4% overall. Similarly, Advantame has low overall preference (2%) but younger Millennials preferred it slightly more (7%). Interesting though for a country that regulates so closely high intensity sweeteners, local consumers seemed to prefer artificial high intensity sweeteners more than the global average.

Top consumer preferred sweeteners

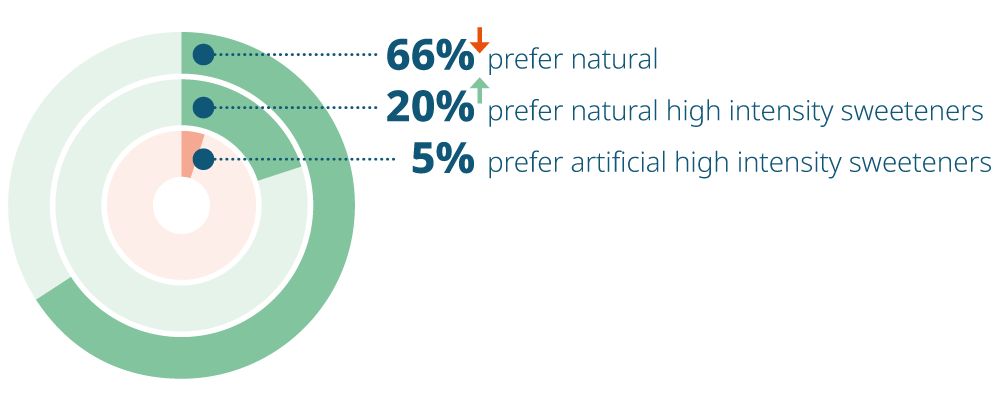

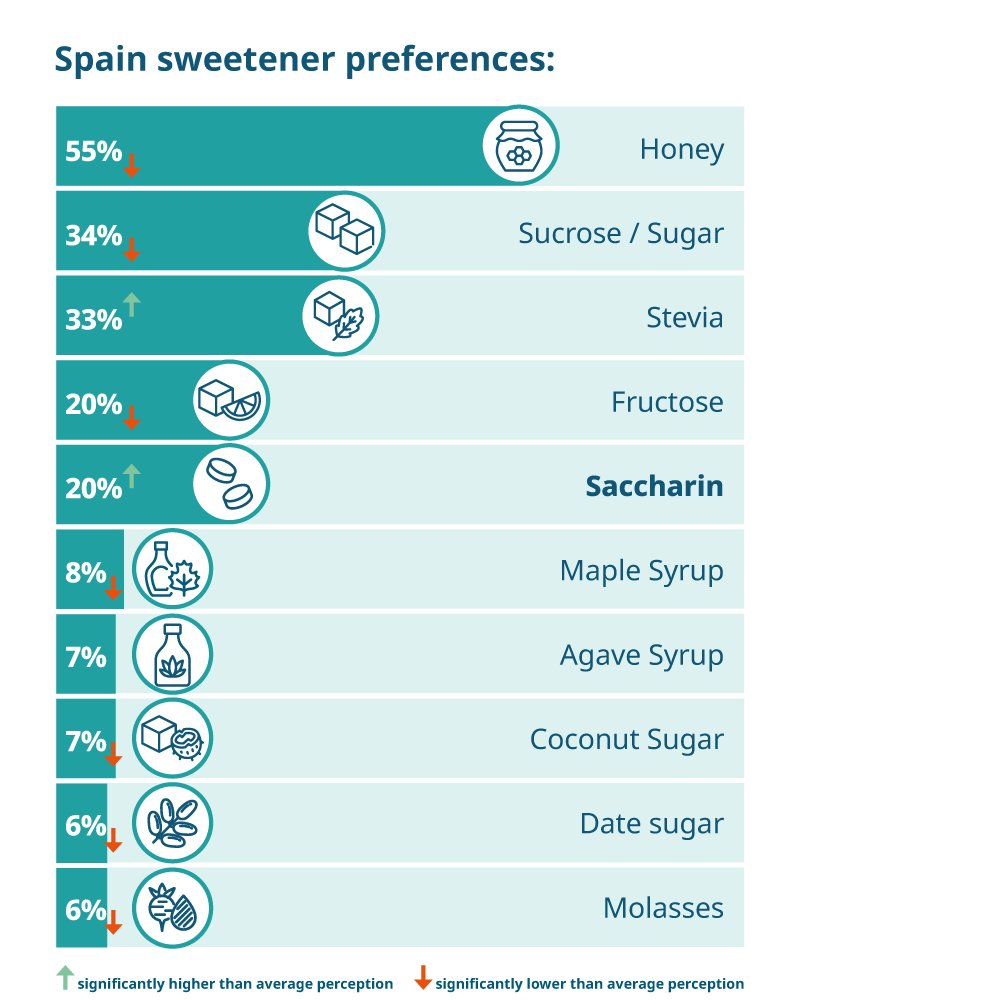

Stevia is ranked the third most preferred sweetener in Spain and consumers seem to prefer natural high intensity sweeteners significantly more than the global average. Largely considered a natural sweetener (66%), it has the highest preference among all the countries. On the other hand, saccharin is considered artificial (85%) but still has the highest comparative preference in Spain.

Top consumer preferred sweeteners

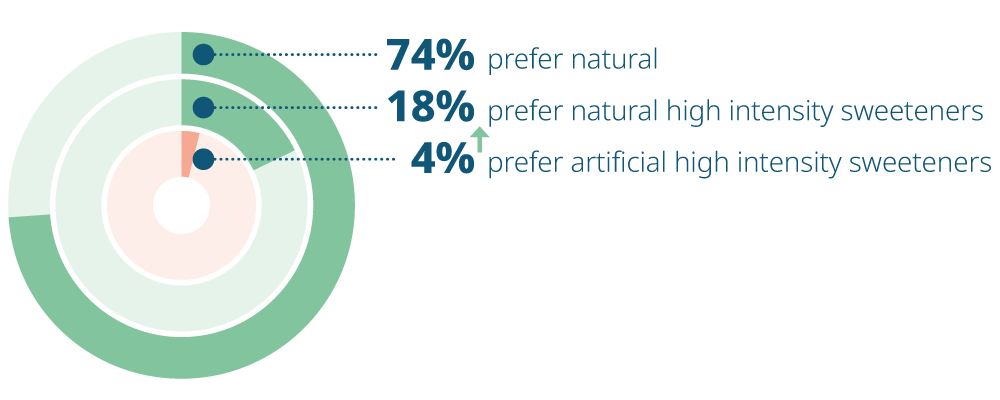

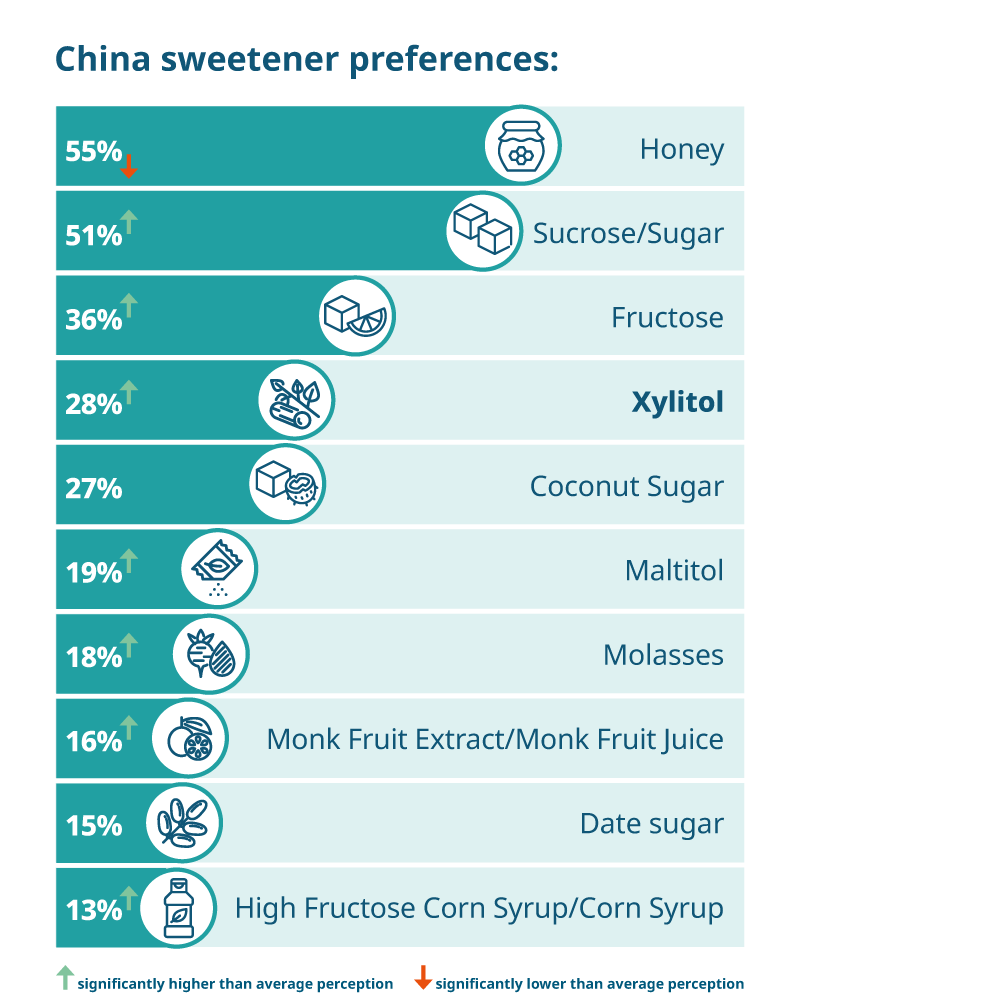

China has the highest preference for naturally derived sweeteners (honey, sugar, etc.), but also has a comparatively high preference for high intensity sweeteners as well. Xylitol coming at the fourth spot, outperformed in consumer preference to the global average and has the highest preference among Chinese Millennials (34%). The high consumer preference for Xylitol is attributed to its wide range of application potential across food and drinks as well as its health halo as a diabetic friendly sweetener. Monk Fruit (Luo Han Guo) over indexes equally across all gender and generations, consumed for centuries in China.

Top consumer preferred sweeteners

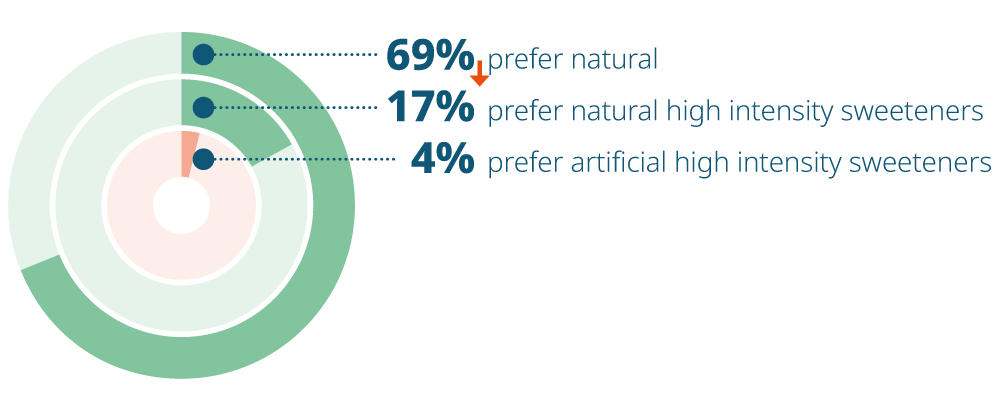

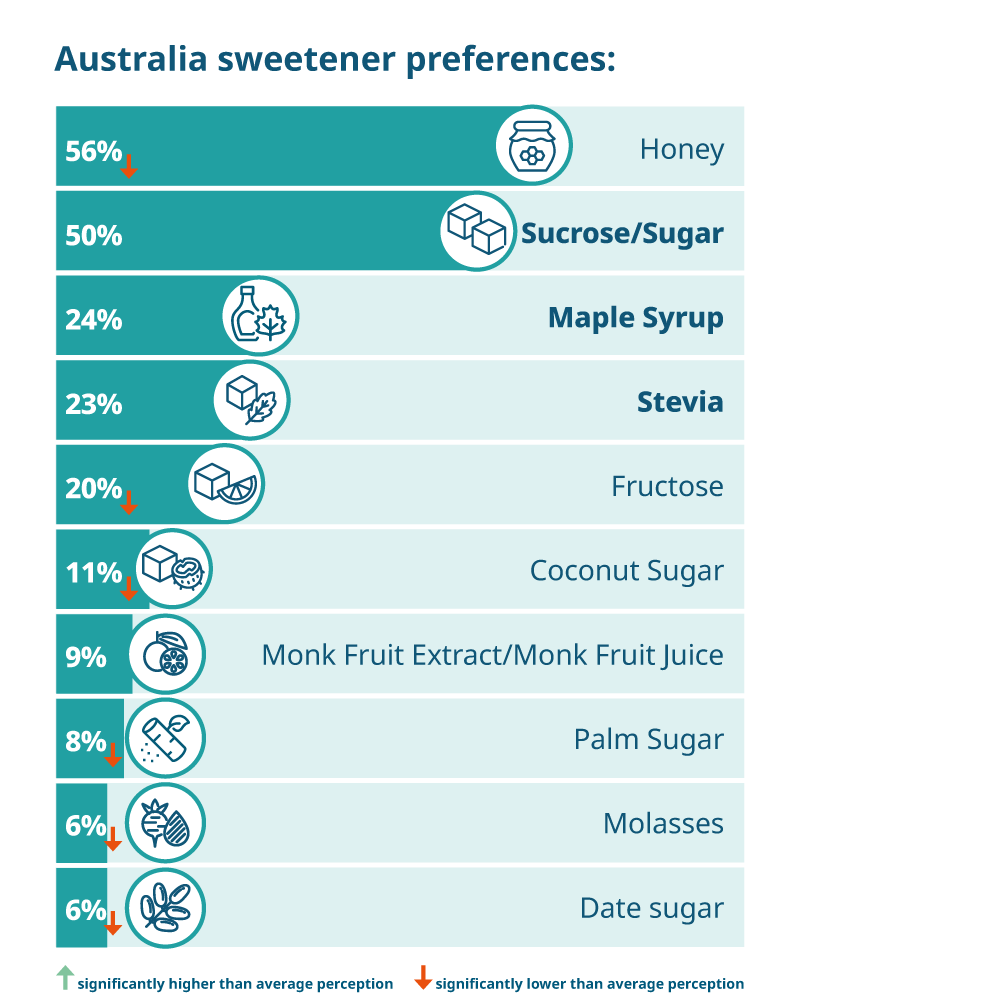

Australians are consuming less sugars than they were 20 years ago (Source: University of Sydney). Consumer demand for better-for-you products is shifting manufacturer's focus toward reduced sugar solutions and the use of natural sweeteners in their new product development. Our study found that a significantly higher percentage of Australians are looking for reduced sugar food and drinks to help them achieve their weight goals – to lose weight and keep it off. (69% of Australians want reduced sugar solutions to lose weight and/or keep the weight off)

Australians had average to global preference for sugar, maple syrup and stevia. Moreover, their most preferred sweeteners, ranked in the top 10, were natural and naturally derived sweeteners.

Top consumer preferred sweeteners

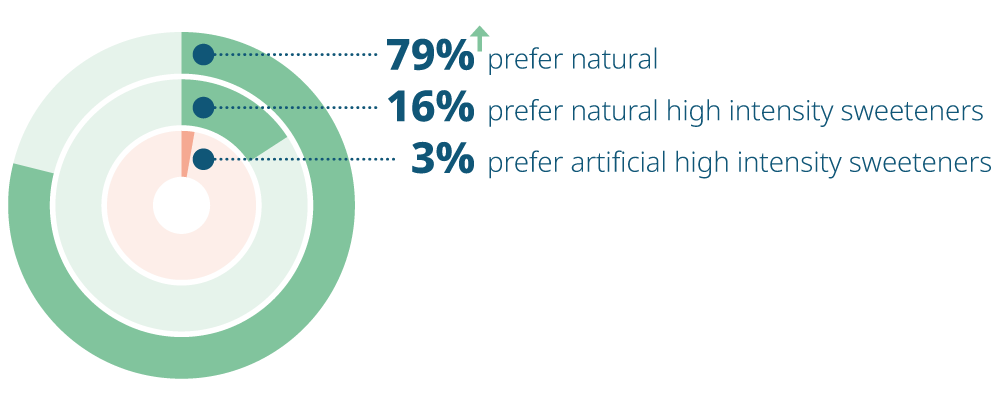

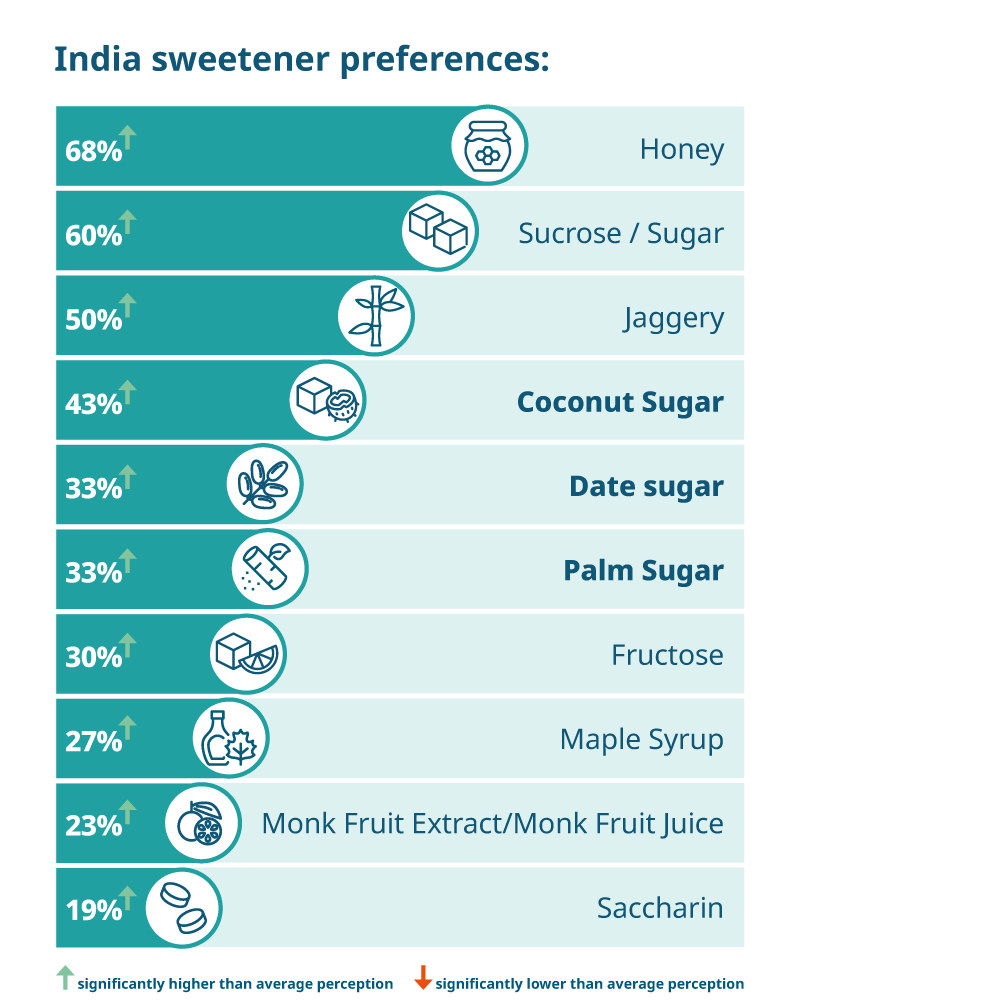

Naturally sourced nutritive sweeteners were the most preferred by Indians. Beyond honey and sugar, jaggery has a very close place in Indian cuisine with heritage value associated with the sweetener. Coconut, date, and palm sugars have higher preference in the Asia Pacific region and does so in India as well. High intensity sweeteners are seen as a diabetic alternative to sweetener, although this position is changing with the introduction of alternative diets that has boosted the preference for monk fruit.

Top consumer preferred sweeteners

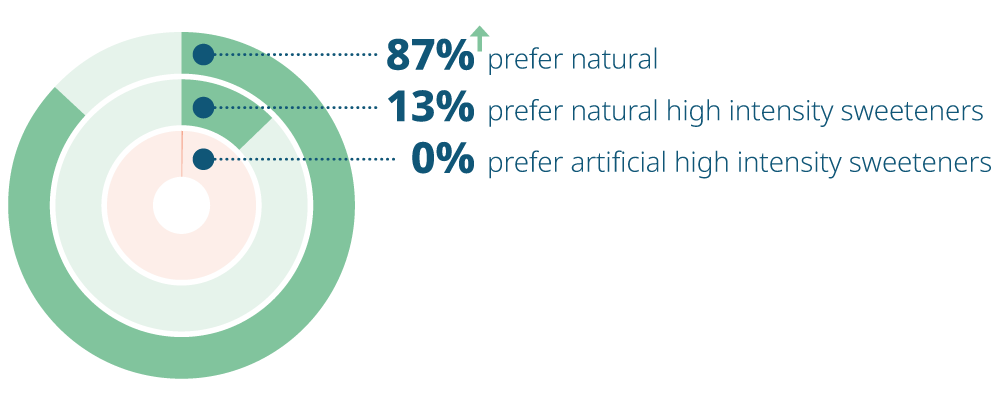

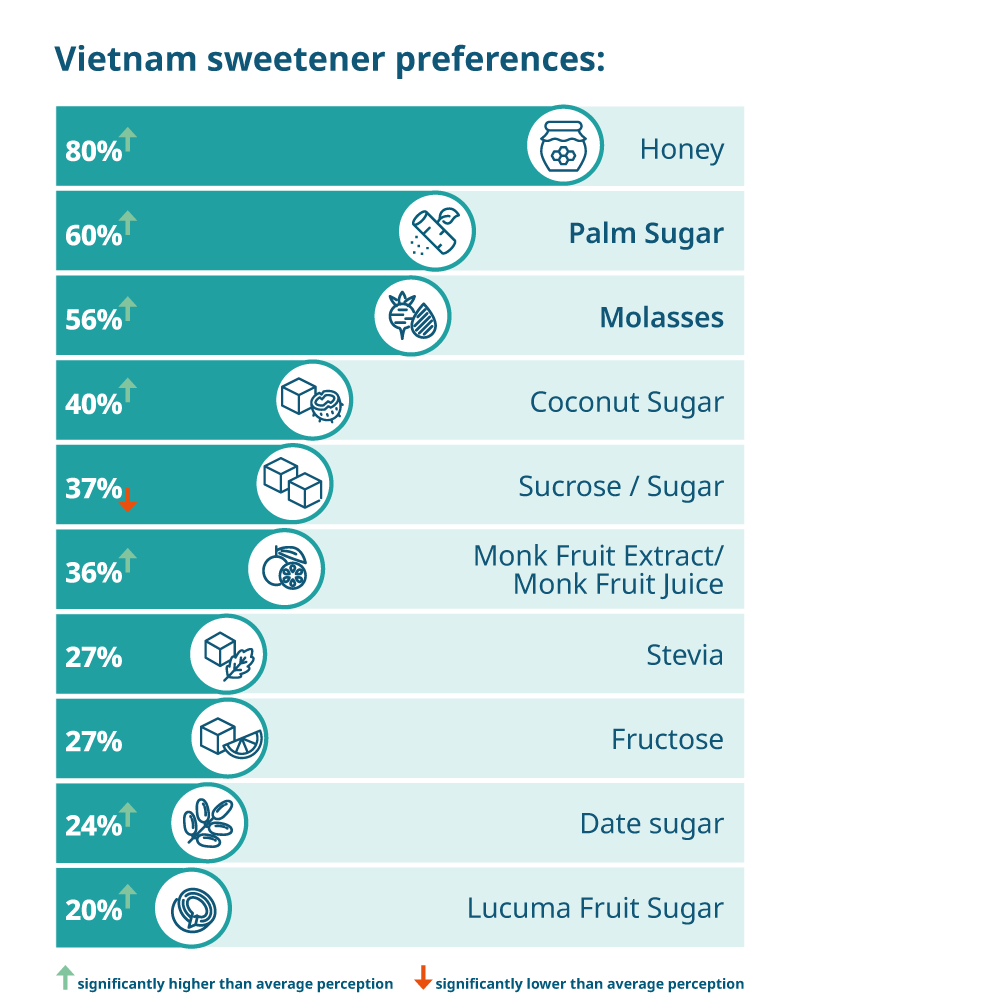

In Vietnam there is virtually zero preference for high intensity artificial sweeteners. The preference for natural sweeteners is higher than global average in Vietnam.

The preference for sugar is quite low in the country, with palm sugar, molasses, coconut sugar being more popular than sugar. The Vietnamese perceive molasses as brown sugar and justifies the high preference for it as a sweetener. In Vietnam, monk fruit is ranked the highest in consumer preference vs. any other country.

Top consumer preferred sweeteners

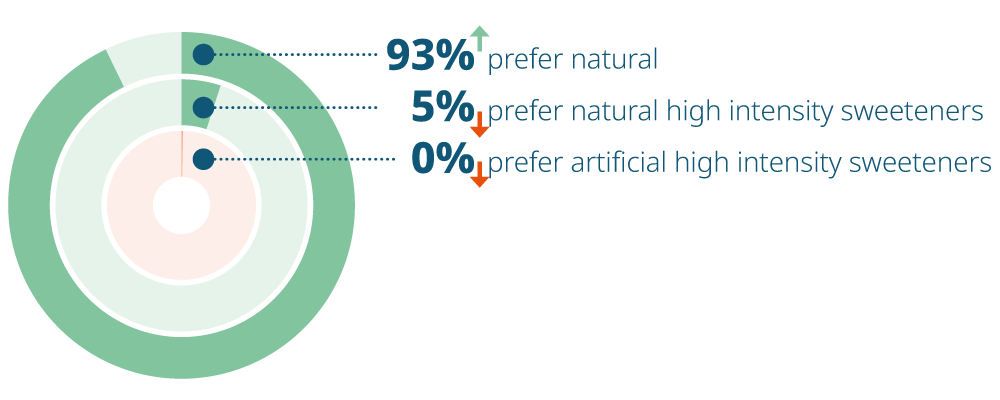

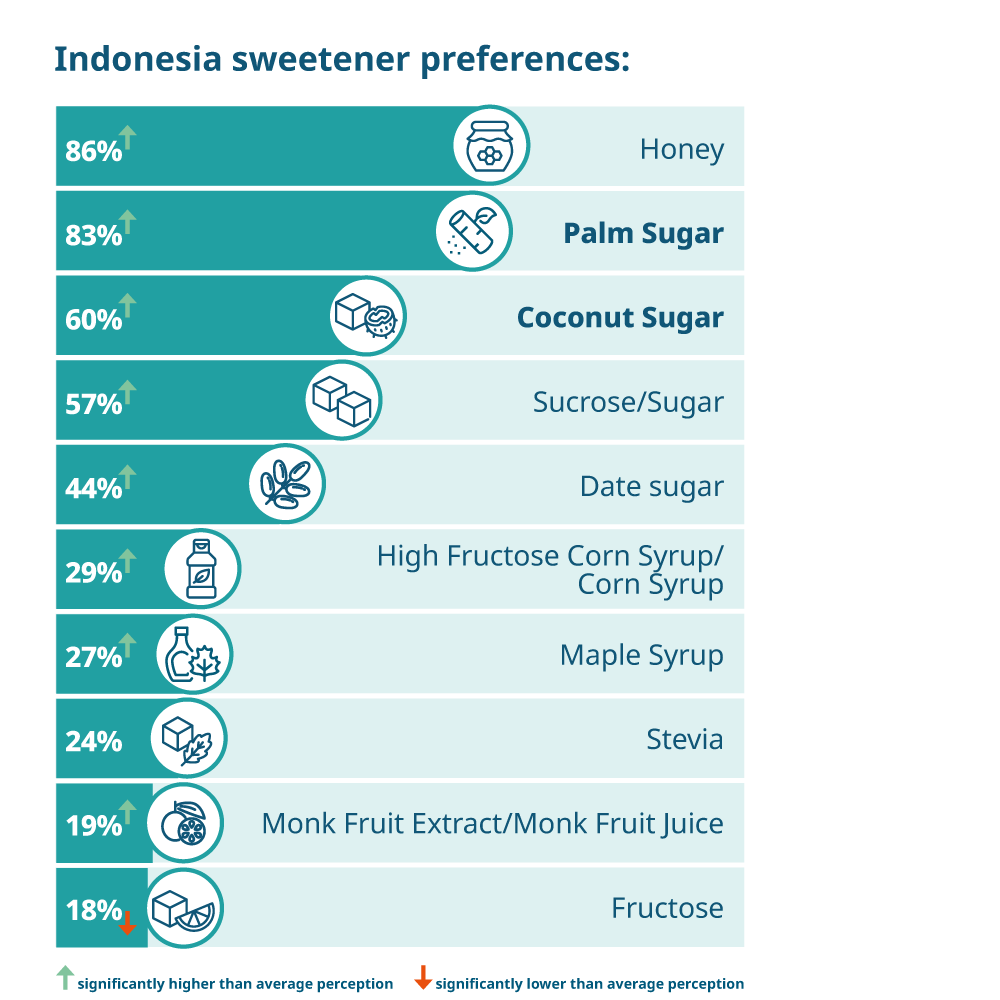

Indonesians had amongst the highest preference for natural sweeteners such as palm sugar (gula aren) and coconut sugar than any other country, linked strongly with their cultural roots. Indonesians have amongst the highest preference for natural sweeteners and virtually no preference for artificial high intensity sweeteners.

While overall preference for stevia is comparable to the global average, Indonesian women (30%↑) preferred stevia significantly more than men (18%↓), as women focus more on weight loss. New product launches containing the natural high intensity sweetener have also grown by 11% over the past 5 years (Innova NPD 2018-2022).

On the flipside, high fructose corn syrup continues to be in the consumer radar with preference for this sweetener highest of any country in Asia because taste and cost continue to be top priorities for manufacturer and consumers. Sugar content is not heavily regulated in Indonesia.

Top consumer preferred sweeteners

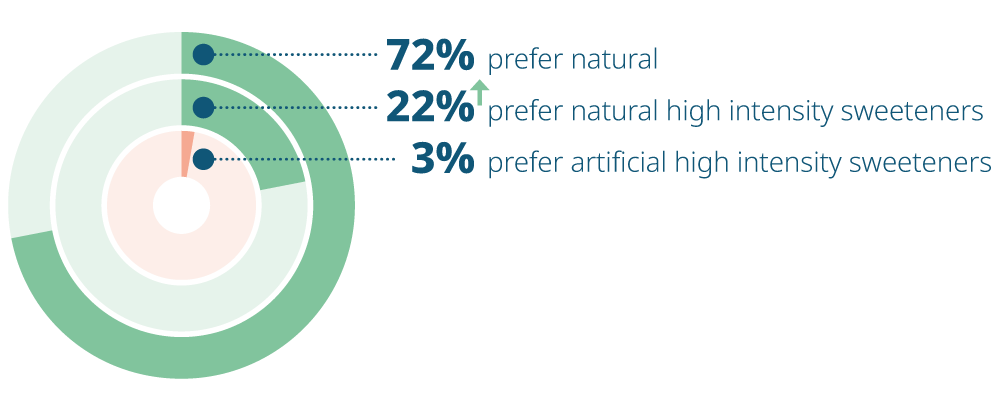

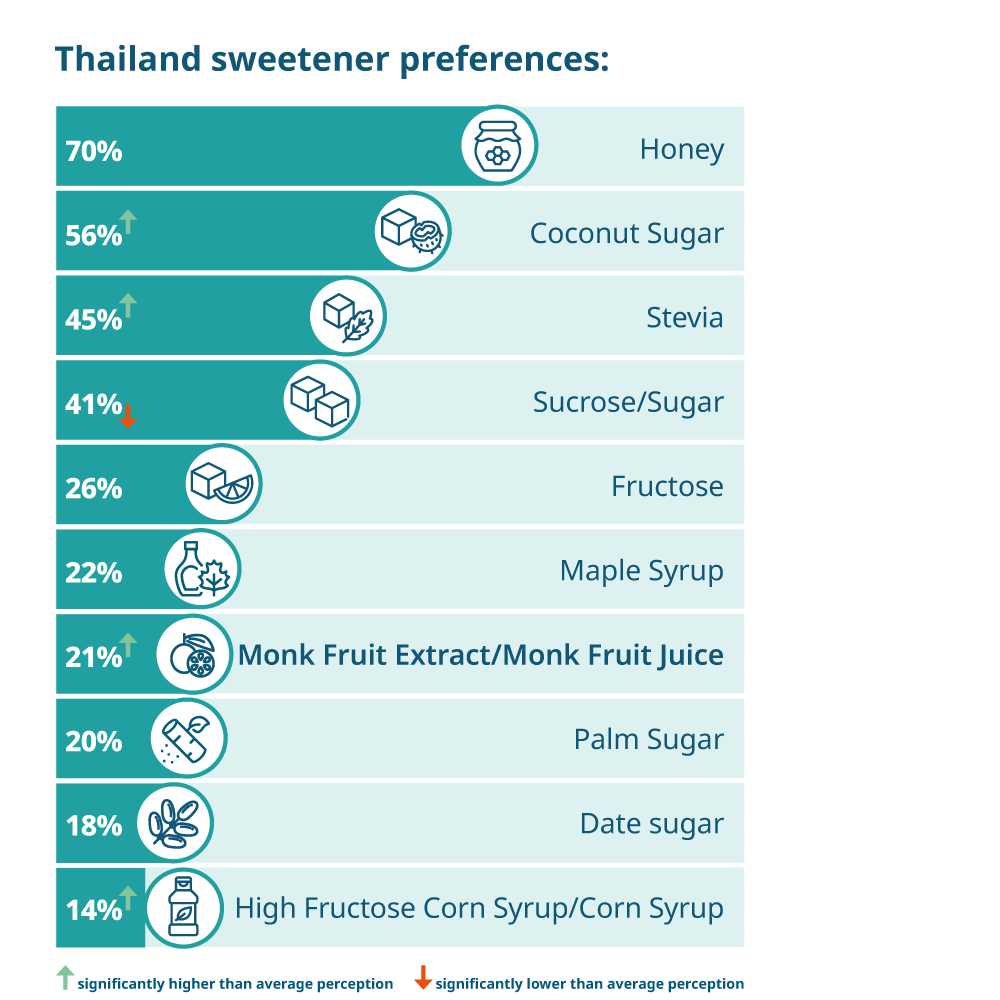

Thai focus on sugar-related nutrition facts and on-pack certifications/warning/claims are important. Thus, preference for natural high intensity sweeteners such as Stevia are highest in Southeast Asian countries. Monk fruit extract is gaining popularity because it has similar function and application to sugar. The natural sweetener - coconut sugar is most preferred, owing to its heritage and usage in Thai culture.

Top consumer preferred sweeteners

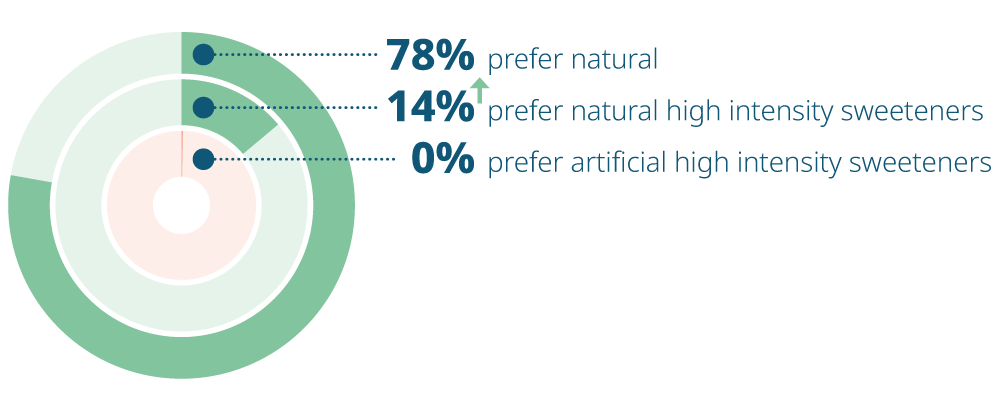

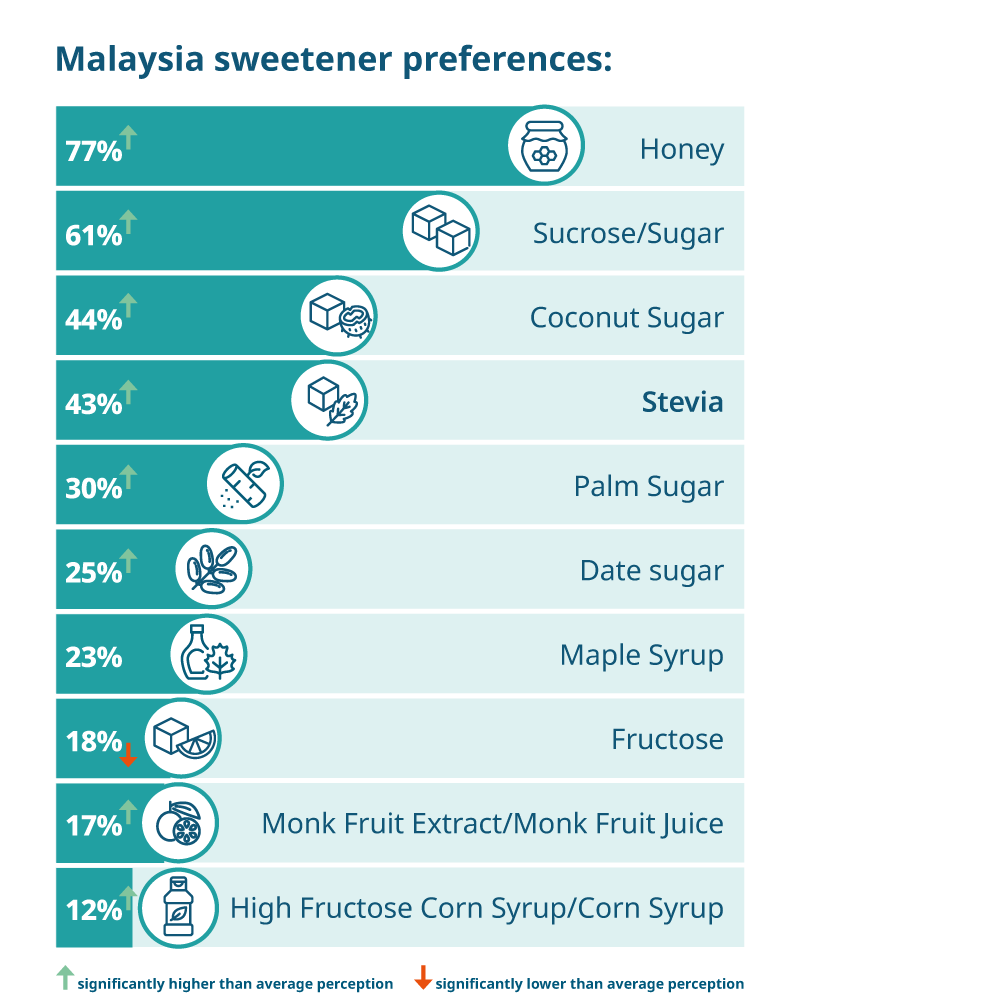

Malaysians have had a long history in sugar production and consumption, but with the rising rate of diabetes in the country, their focus is shifting to incorporating sugar alternatives. Natural is a key call-out for Malaysia. They continue to prefer naturally derived sugars but preference for high intensity natural sweeteners has grown.

Sugar tops their preference, however coconut sugar, palm, and date sugar are quite highly preferred among Malaysians, higher than the global average preference. Stevia, as a high intensity sweetener has high preference among Malaysians and had also experienced a 34% growth in new food and drink launches (Innova NPD, 2018-2022).

Top consumer preferred sweeteners

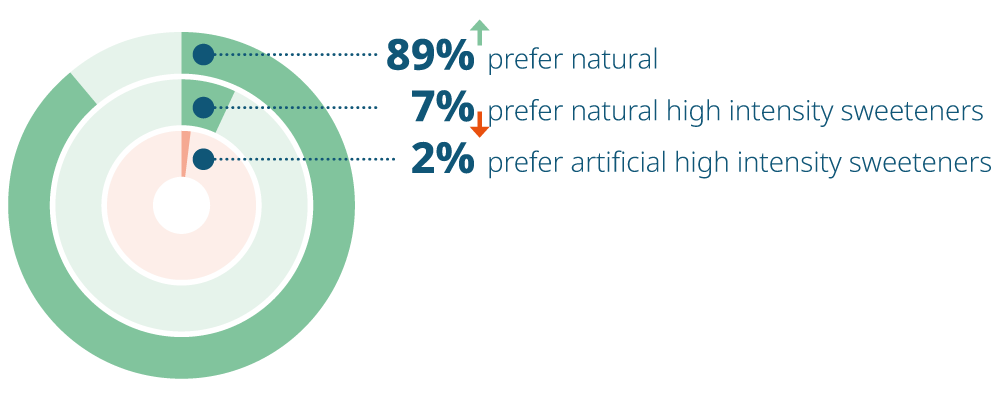

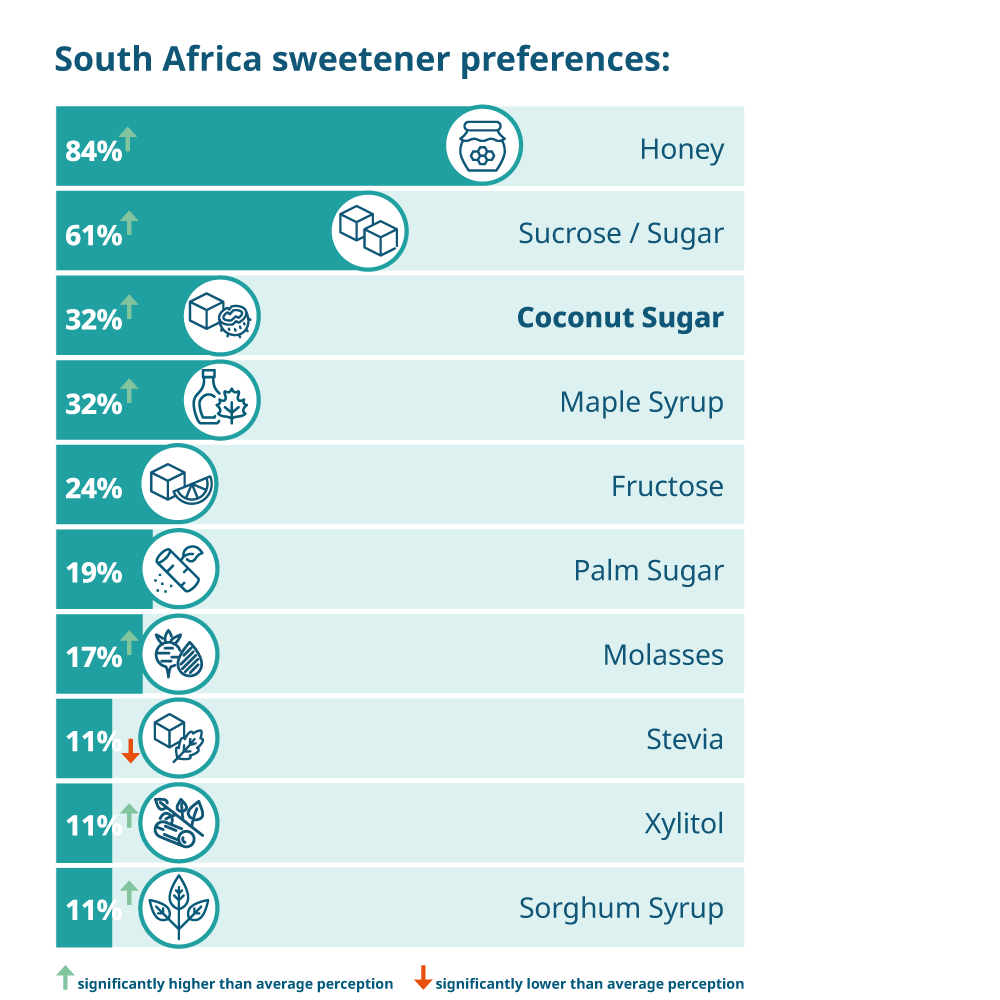

Preference for nutritive sweeteners is much higher in South Africa – with honey, sugar, maple syrup, among the top 10 preferred list. Newer sources of sweetness such as coconut sugar are growing as the desire for newer alternatives to sugar emerge, with preference highest among young Gen Z’s (51%↑) and lowest with younger baby boomers (13%↓).

Sorghum syrup, native to the region and popular among all generations, ranked among the top 10 most preferred sweeteners, significantly high in all African countries studied (Kenya, South Africa, and Nigeria).

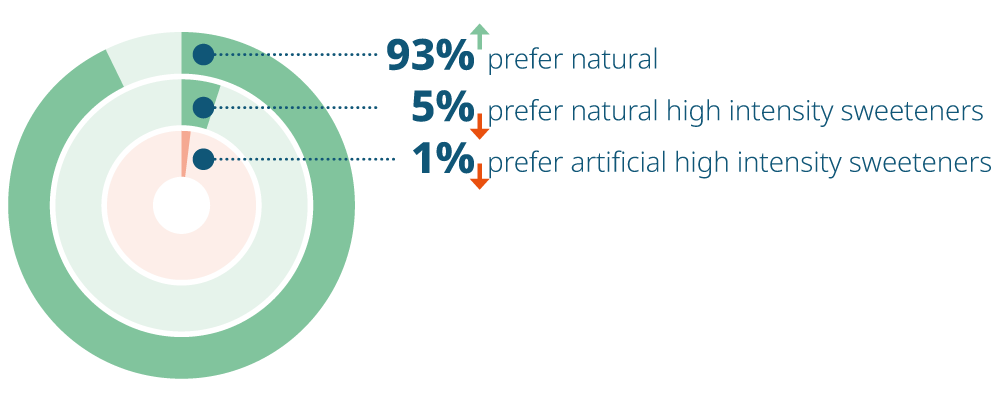

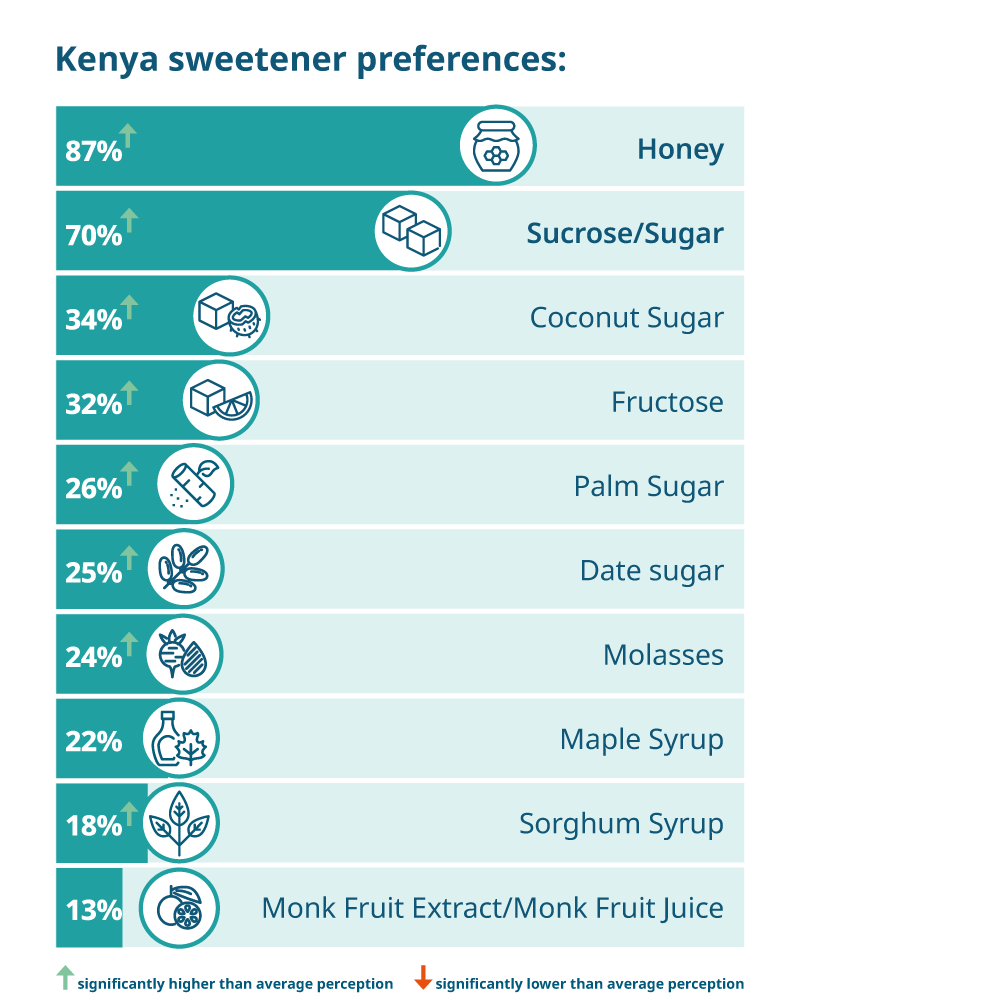

Top consumer preferred sweeteners

Natural, nutritive sweeteners such as honey, sugar, ranked amongst the most preferred sweeteners in Kenya as consumers associate them to a necessary source of energy. However, preference for sugar as a sweetener in food and drink fell significantly below average among older boomer Kenyans (58%↓), as they take active steps to manage their sugar intake driven by health reasons.

Other sources of natural and nutritive sweeteners are traditionally used to brew liquor (molasses) and coconut sugar meets specific dietary needs.

Sorghum syrup is ranked on the top 10 sweeteners for Kenya, as consumers are familiar to the native natural sweetener.

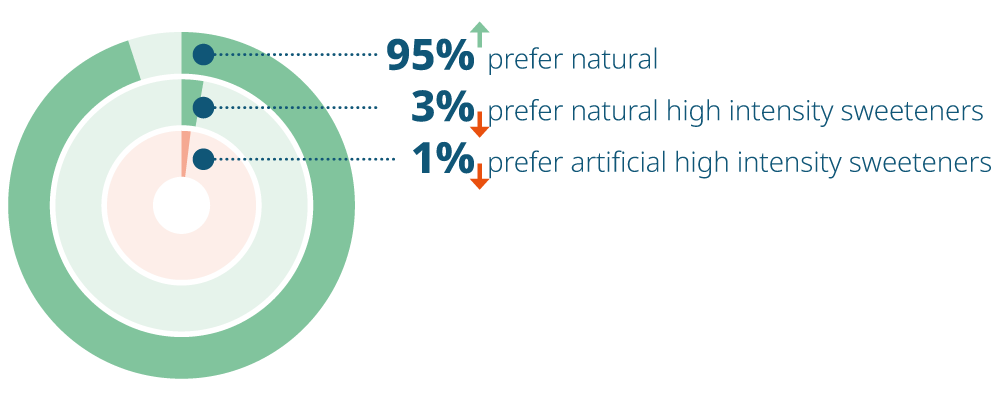

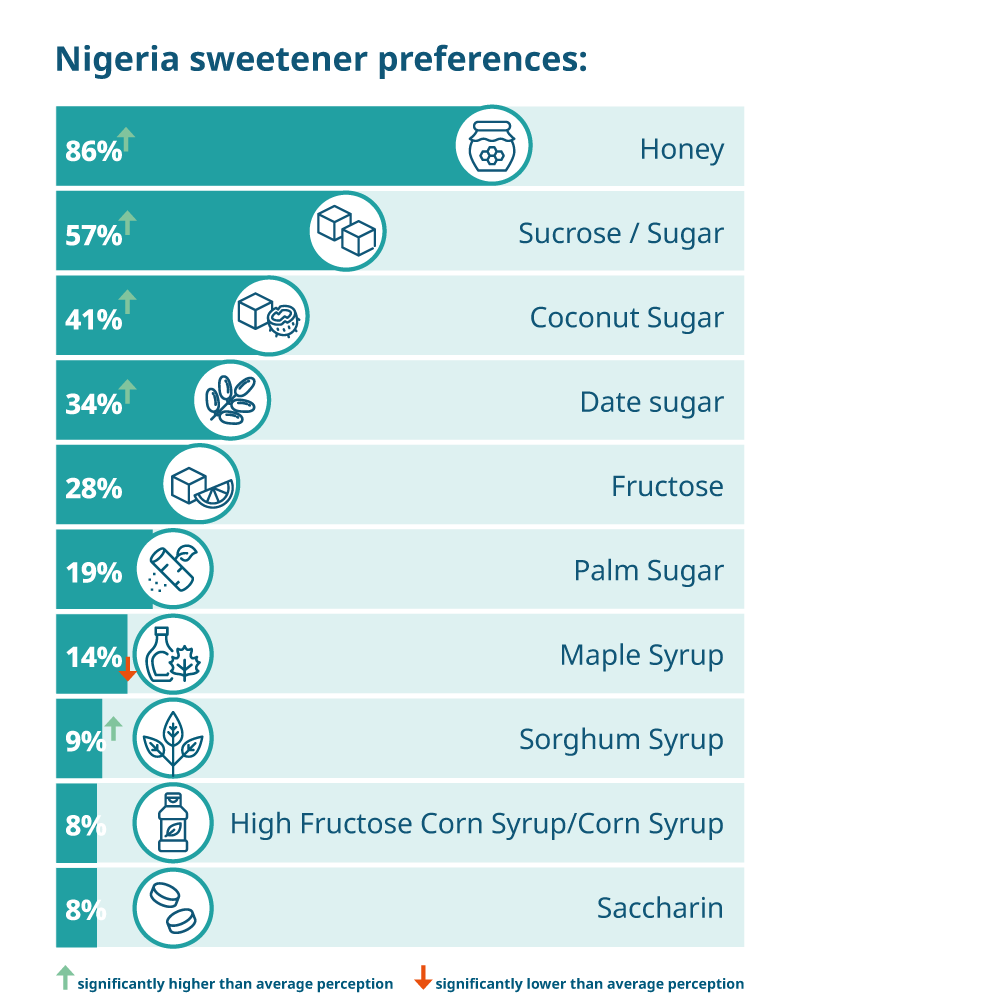

Top consumer preferred sweeteners

The preference for natural, nutritive sweeteners ranked high among Nigerians. With the Nigerian government adopting sugary drink tax, awareness around the potential negative impact of sugar on health has increased.

The preference for sugar as a sweetener ranked high for Nigerians, especially among Gen Z Nigerians (73%), with virtually no preference for stevia in the region.

Naturally consumers preference for sorghum syrup ranks it among the top 10 sweeteners as consumers are familiar with the sweetener being one of the top producers of Sorghum syrup in the region. (Source: ttp://www.afripro.org.uk/papers/paper01taylor.pdf)

Top consumer preferred sweeteners

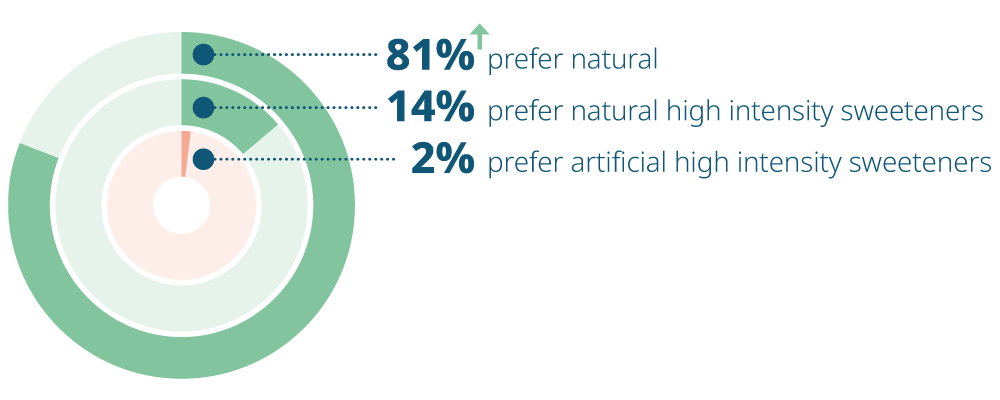

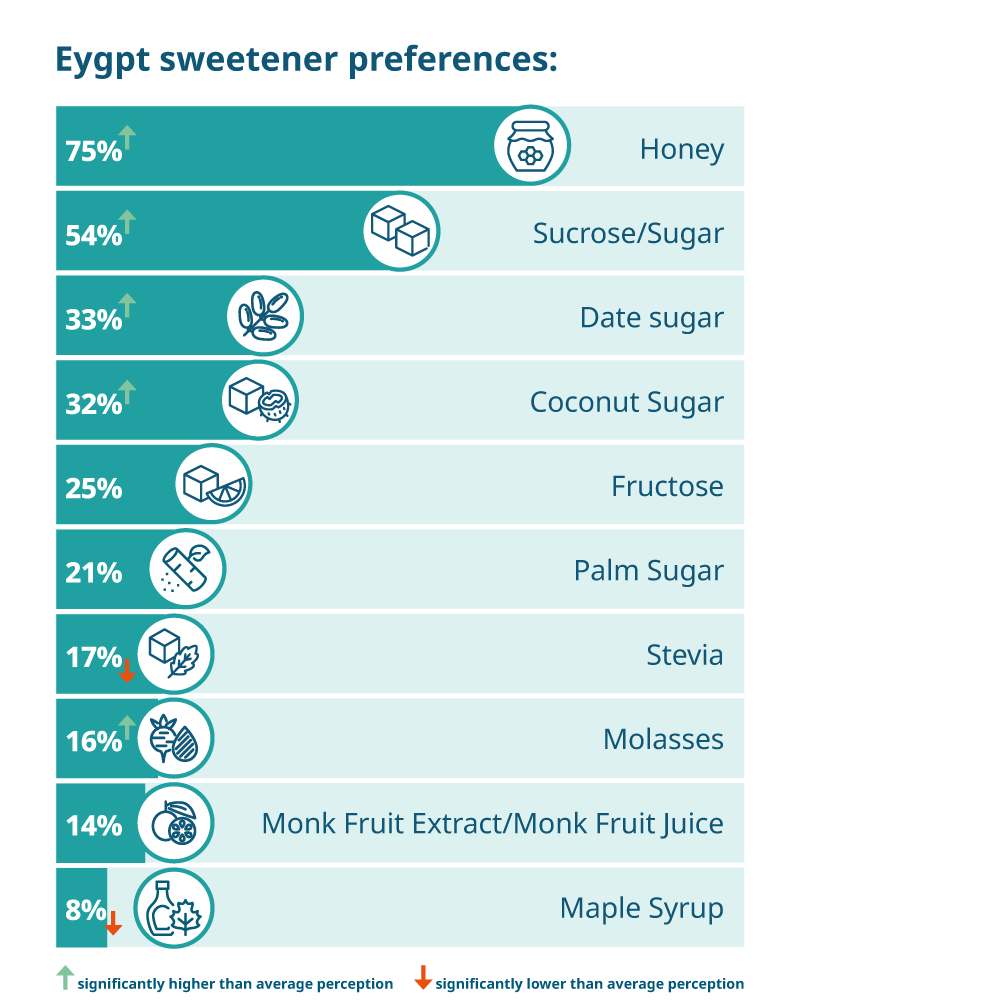

Egyptians preferred natural sweeteners by a large degree vs. all high intensity sweeteners.Monk fruit is preferred significantly more by older millennials (21%) in Egypt. Mixed opinions about the natural vs. artificial classification of stevia and molasses might have factored into the average preference for these sweeteners. Diabetes and weight gain are significant concerns with sugar consumption among Egyptians, factoring in their growing preference for alternative sweeteners.

Top consumer preferred sweeteners

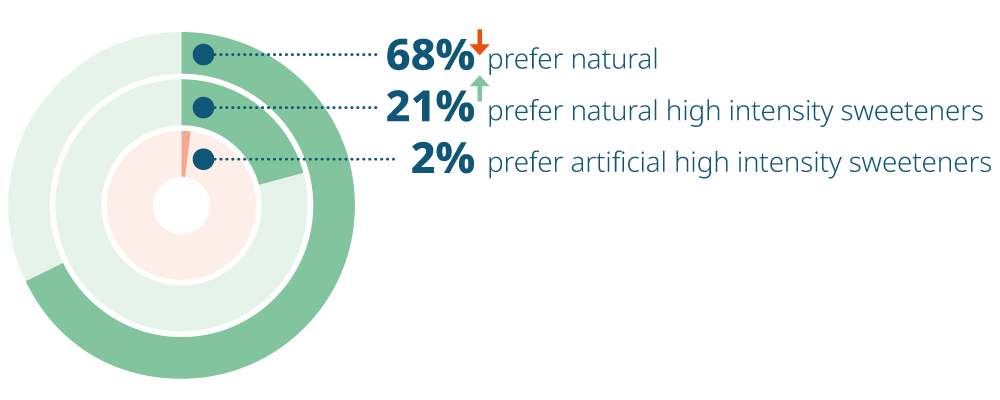

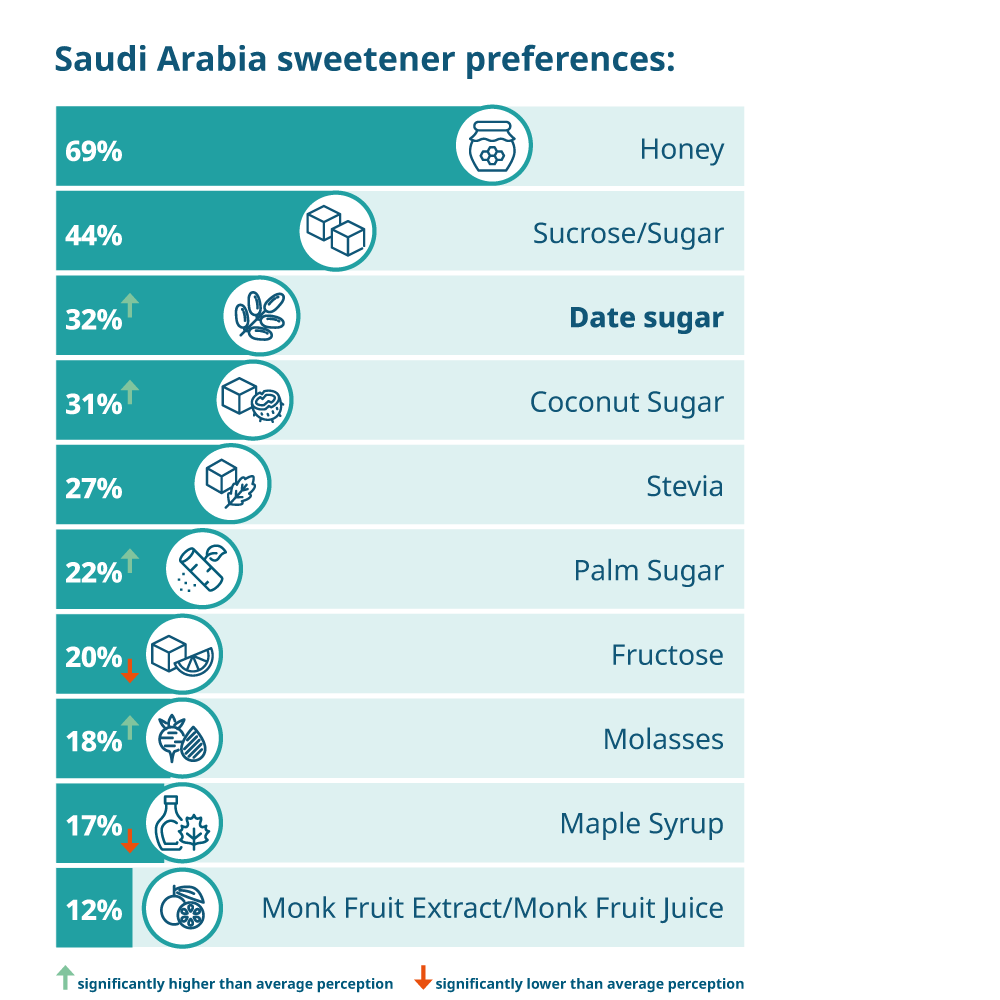

There is a lot of heritage bound with dates in Saudi Arabia, and hence the higher consumer preference for date sugar. All sweeteners that top the list of most preferred in Saudi Arabia were perceived as natural sweeteners. While stevia is the 5th most preferred sweetener, it has a more natural perception among the Saudi people. 53% perceive it as a natural sweetener, while 38% perceived it as artificial. Additionally, Saudi women have a higher preference (35%↑) vs. 20% men.

Top consumer preferred sweeteners

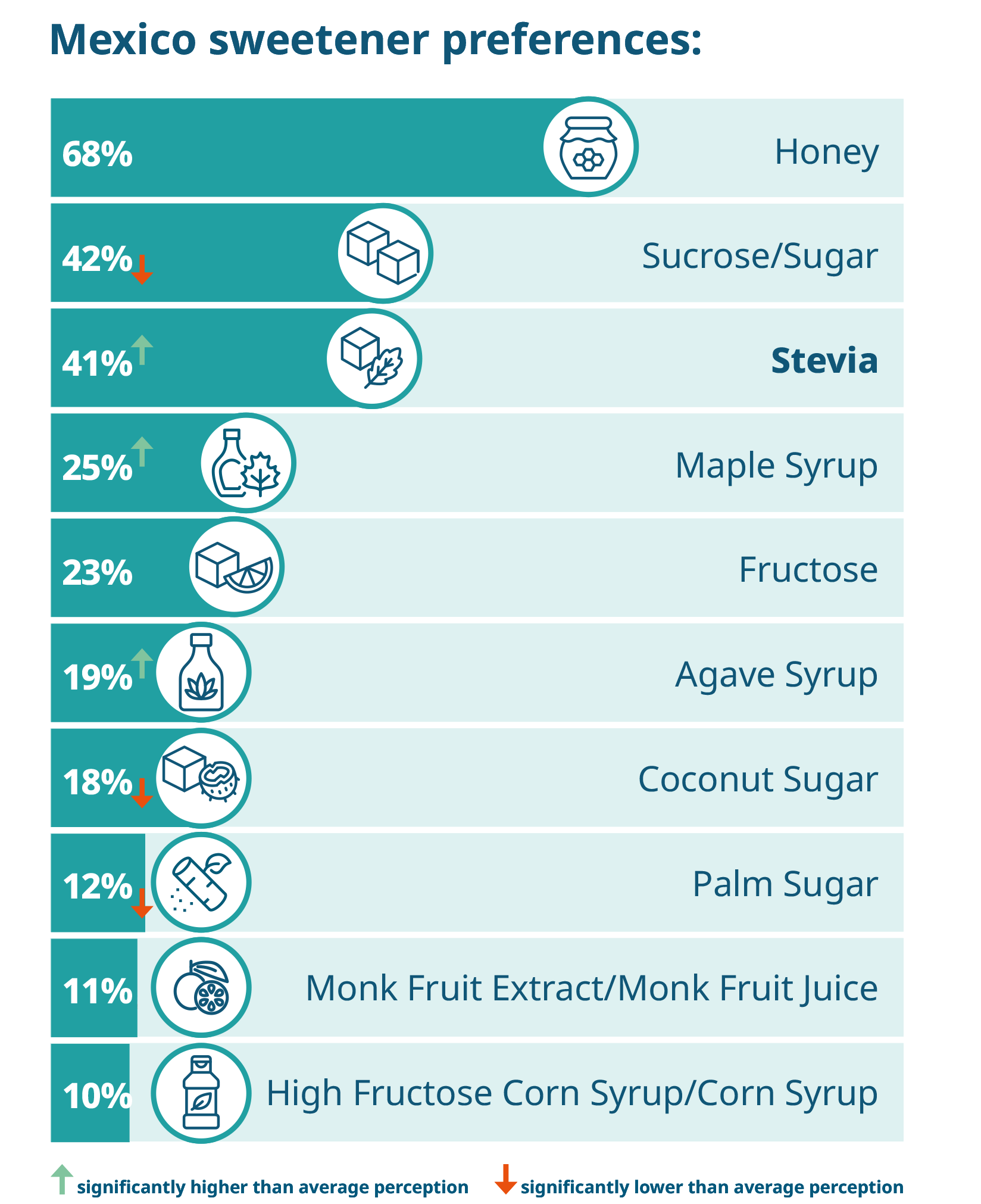

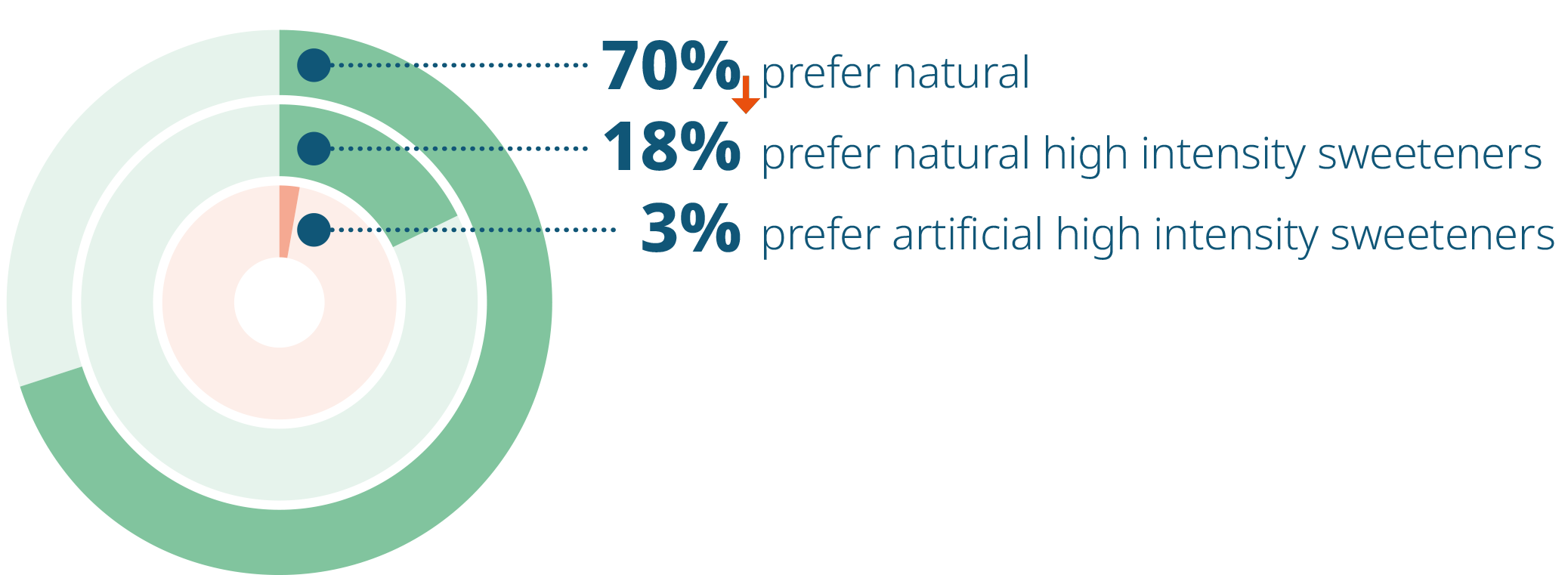

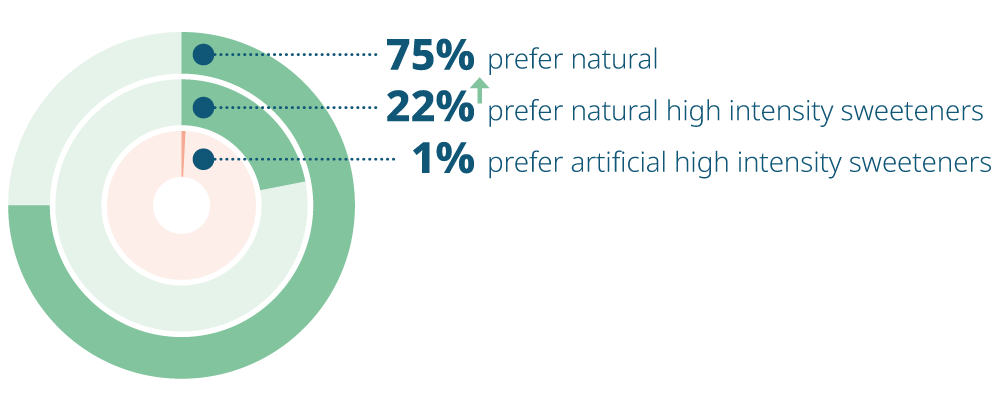

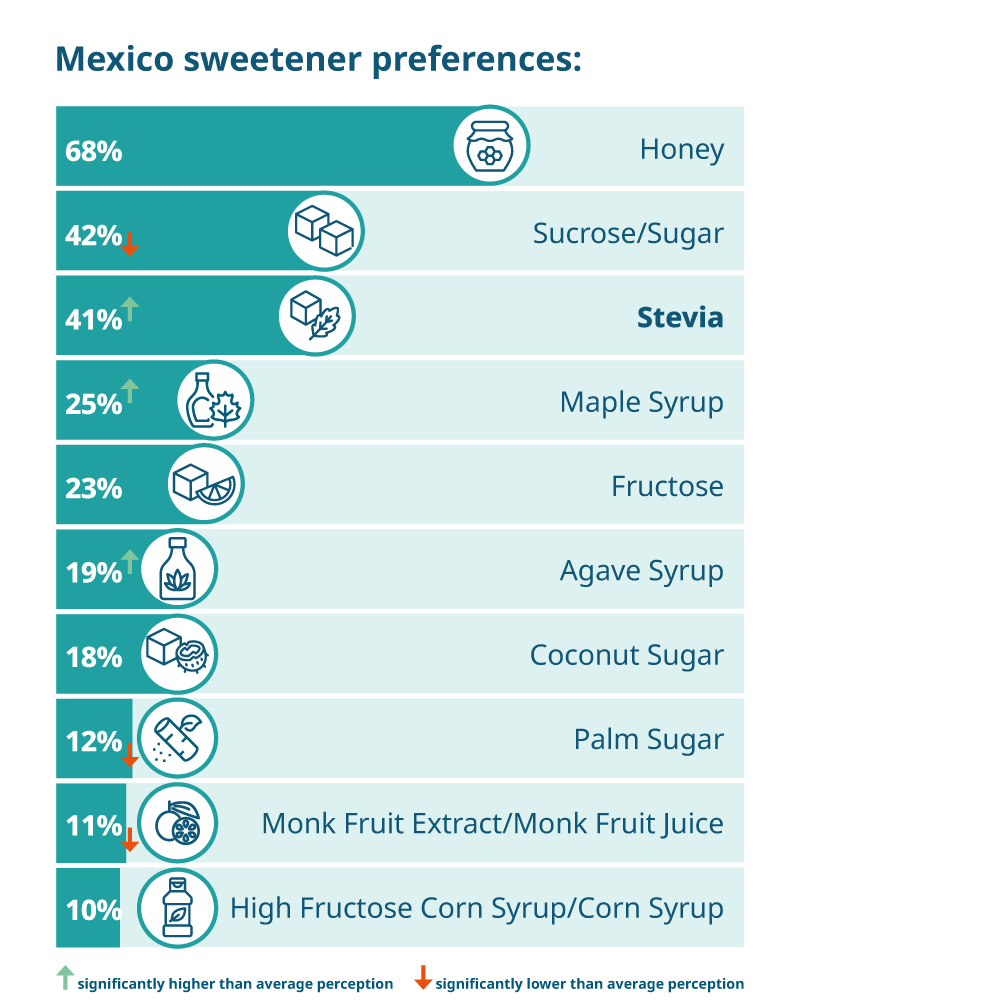

Mexico is a country with a long tradition of sugar consumption. However, since the implementation of front-of-pack octagon system, consumers have become more aware of the need for sugar reduction in food and drinks. In Mexico, the preference for stevia is high compared to the global average, despite a confusion of where it is of natural or artificial origin. Agave syrup also enjoyed among the highest preference in Mexico over other countries.

Top consumer preferred sweeteners

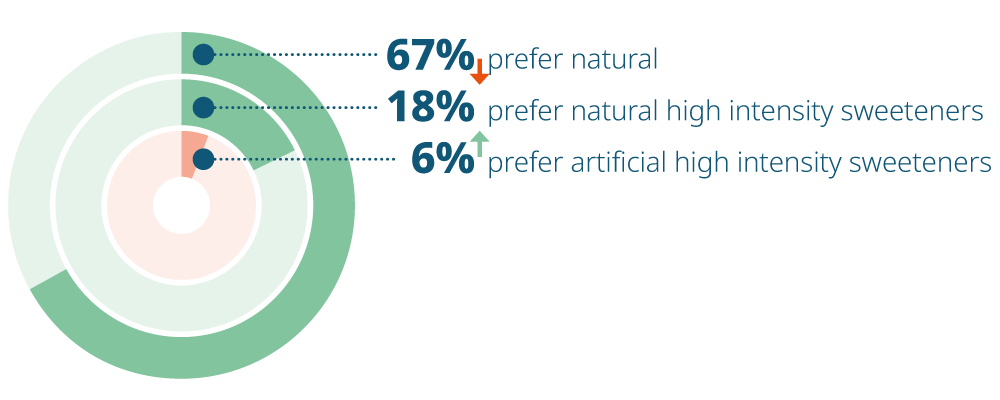

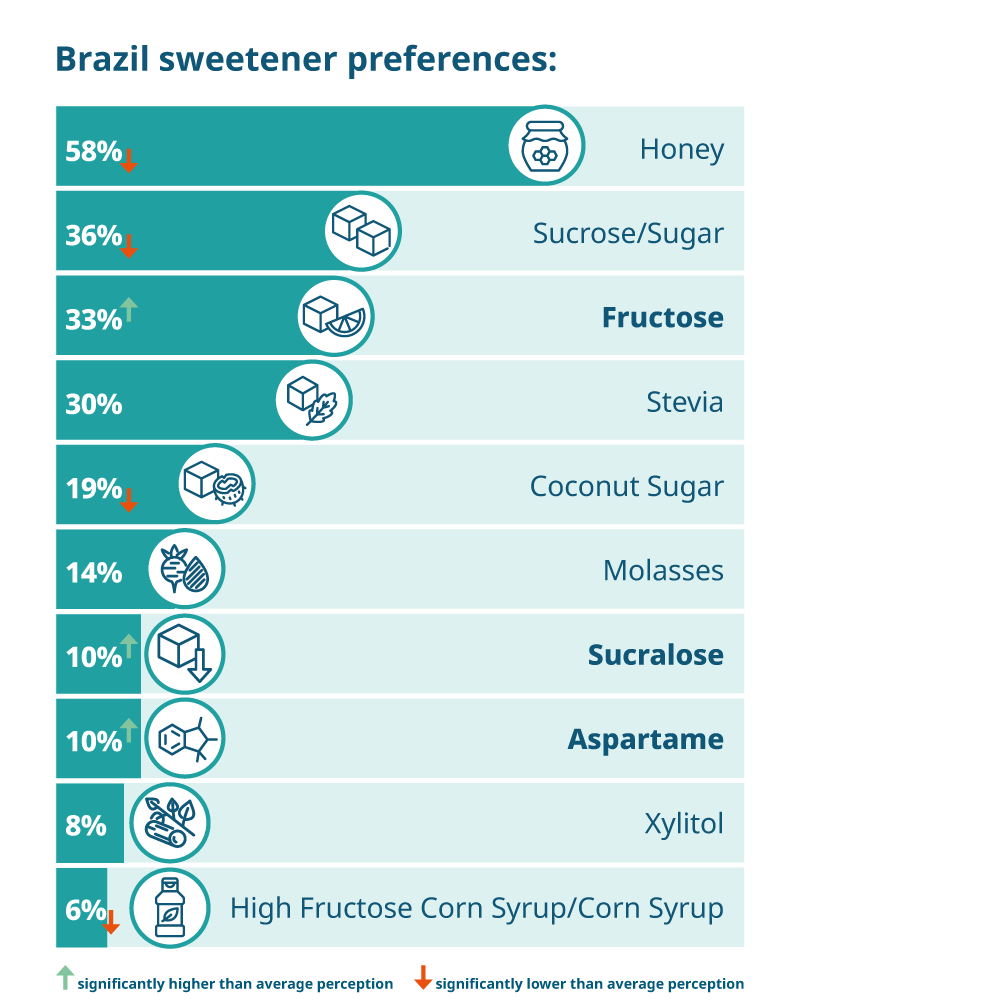

Sugar plantations paint the landscape of Brazil, a dominant contributor to the world’s sugar supply. Despite this, the preference for sugar as a sweetener in food and drinks is lower than the global average preference. Brazil ranks aspartame, fructose, and sucralose significantly more than the rest of world. The appreciation for artificial high intensity sweeteners is also significantly higher in Brazil vs. other countries, and this is indicative of their preference for aspartame and sucralose that they associate with the artificial nature.

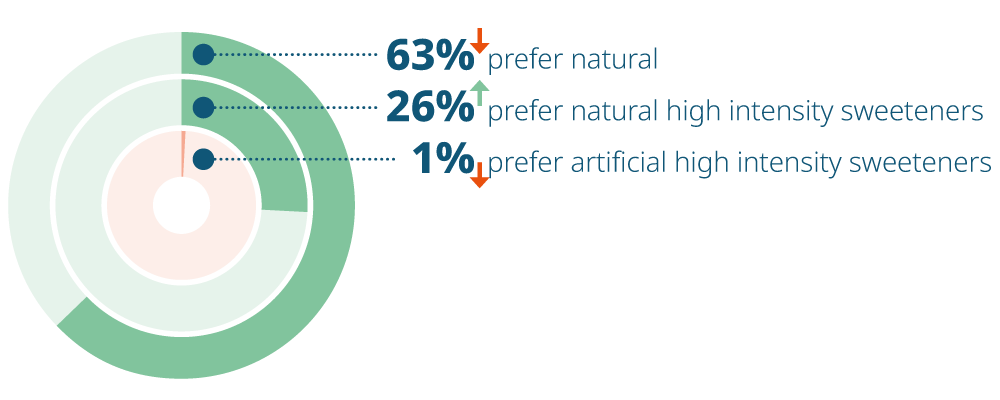

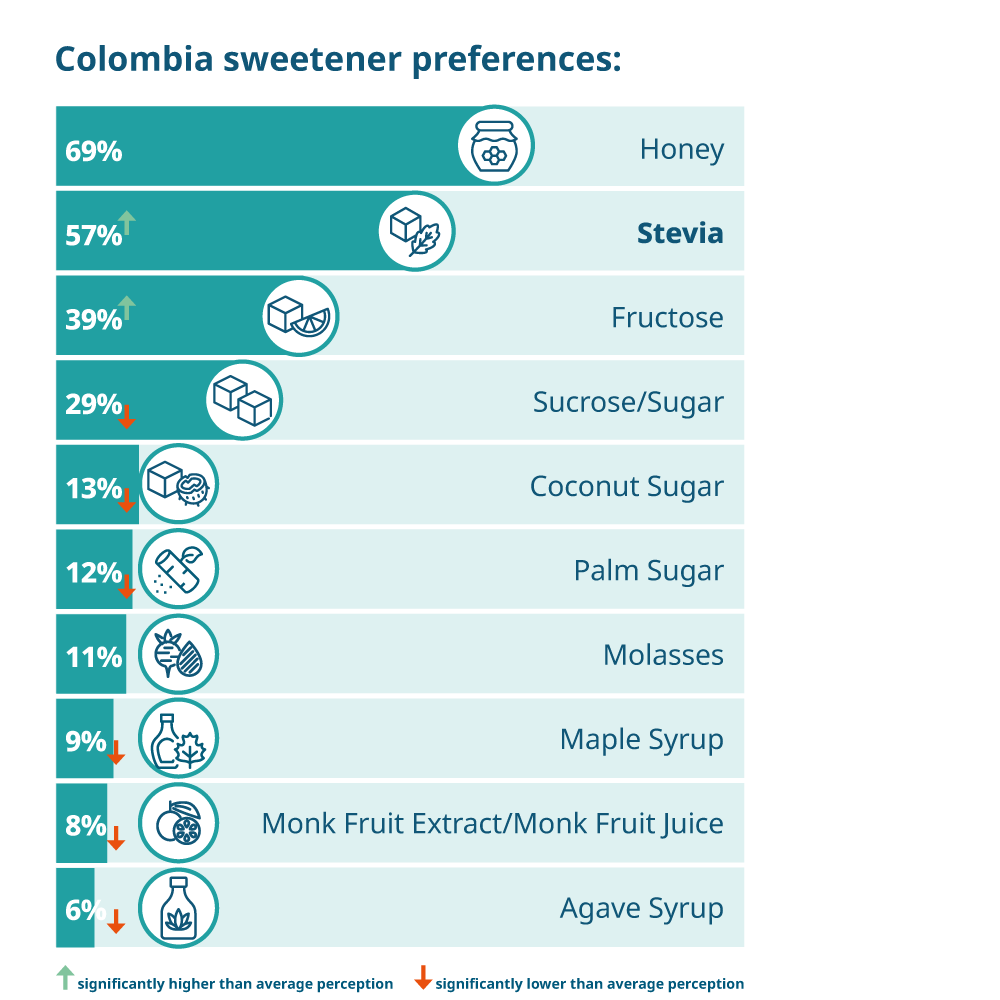

Top consumer preferred sweeteners

The focus on reducing sugar intake in the country has driven the need for alternative sweeteners which has changed the preference for these sweeteners over the years. The per capita consumption of Columbia has trended down since the declaration of the sugar taxes.

Introductions of alternative sweeteners to reduce overall sugar consumption has boosted the preference for Stevia. Stevia ranked very highly in Colombia, highest among all countries. It is noticed that there is a life stage influence on the preference for stevia in Colombia.

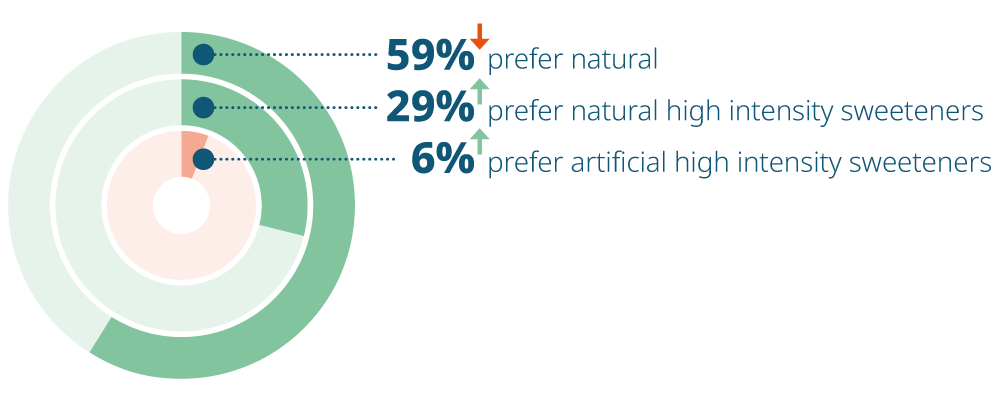

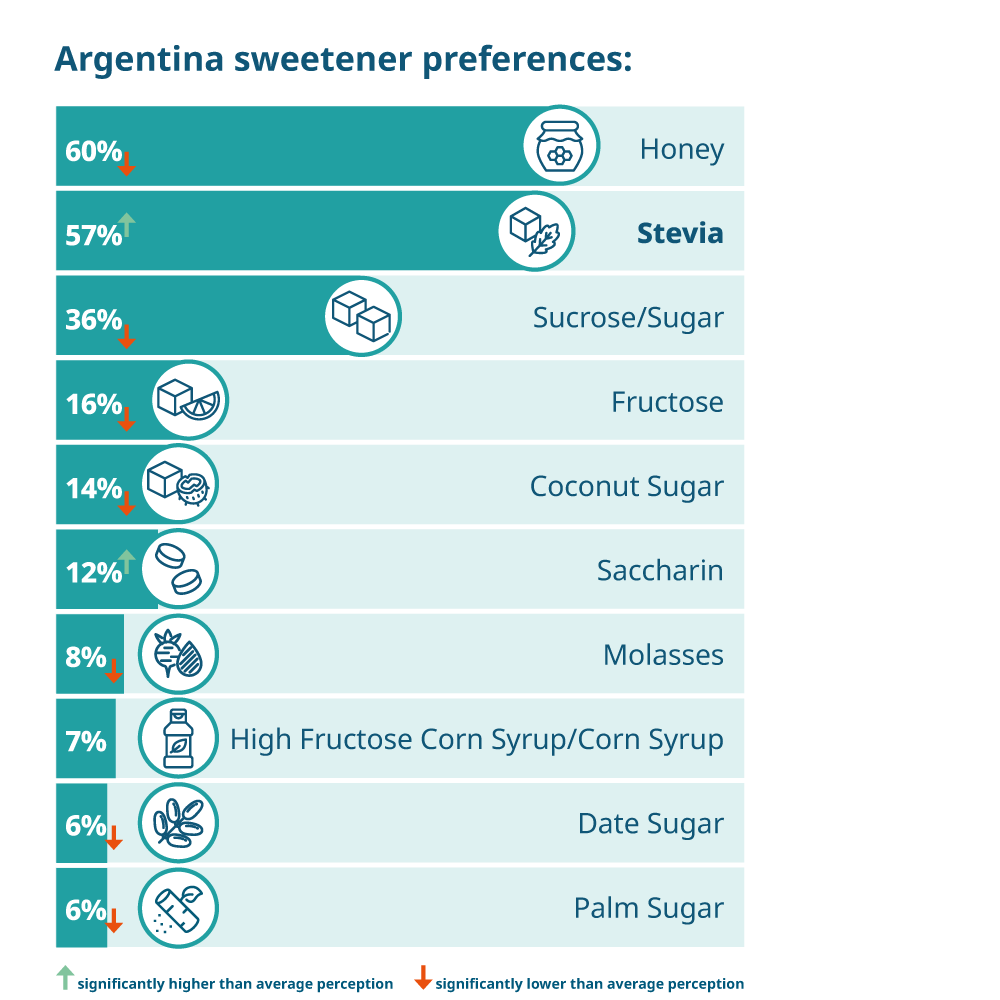

Top consumer preferred sweeteners

Argentina has the lowest comparative preference for natural sweeteners, and among the highest preference for stevia of any country. With a historically high consumption of added sugars, there has been high focus on public health and reduction of sugar consumption. Hence, stevia has come on the top in consumer preference, also with a largely natural halo association, 76% of Argentinians perceiving stevia as a natural sweetener, displacing sugar to the third spot.

Case for sugar reduction

While consumer preferences for sweeteners differ across countries, one thing remains universal - the need for healthier alternatives and reduced sugar solutions. Sugar has long been at the centre of the 'healthy vs. unhealthy' debate, but people are now questioning the amount of sugar in their food and drinks and the ingredients used to replace and displace sugar. They are more proactive on finding the right balance between reducing vs. replacing their sugar consumption and want to do so for a healthier future.

3 Key Revelations

Calling for sugar reduction

Elevating taste

Eliminating barriers

Sugar reduction is not a universal consumer need across all food and drinks. Sugar reduction is expected in beverages first, food right after.

91%

People indicate a higher importance for sugar in foods (91%) over drinks (86%); needed not only to make food and drinks taste sweet and good, but also as a key nutrient - energy and calorie source.

Drinks first

Drinks are at the top of the list for sugar reduction, with carbonated soft drinks taking the first spot.

Indulgence plays a critical role while reducing sugar.

Consumer's occasion specific needs

- There is a high need for reduced sugar solutions in “mindless munching” indulgences - Soft drinks, candies, gummies, sweet snacks, and juice.

- While there is low desire for reduced sugar in “intentional indulgences” – occasions that are triggered by the conscious consumer choice to indulge - Beer, alcohol/spirits, ice cream/frozen yogurt, hard seltzers.

'Inferior' taste remains a barrier for adoption of reduced sugar food and drinks

Nutrition still a priority

43% agree; 35% disagree.

Consumers perceive several drawbacks of sugar including weight gain, addiction, high blood pressure, higher risk for heart attacks, liver disease and stroke.

North Americans are least likely to think that reduced sugar food and drinks taste the same as the full sugar solutions.

On the other hand, 76% of Mexicans perceive that the sugar content in food and drinks has increased over the years and 75% believe reduced sugar products are healthier for them over the full sugar versions.

3 Key Revelations

Calling for sugar reduction

Sugar reduction is not a universal consumer need across all food and drinks. Sugar reduction is expected in beverages first, food right after.

91%

People indicate a higher importance for sugar in foods (91%) over drinks (86%); needed not only to make food and drinks taste sweet and good, but also as a key nutrient - energy and calorie source.

Drinks first

Drinks are at the top of the list for sugar reduction, with carbonated soft drinks taking the first spot.

Elevating taste

Indulgence plays a critical role while reducing sugar.

Consumer's occasion specific needs

- There is a high need for reduced sugar solutions in “mindless munching” indulgences - Soft drinks, candies, gummies, sweet snacks, and juice.

- While there is low desire for reduced sugar in “intentional indulgences” – occasions that are triggered by the conscious consumer choice to indulge - Beer, alcohol/spirits, ice cream/frozen yogurt, hard seltzers.

'Inferior' taste remains a barrier for adoption of reduced sugar food and drinks

Nutrition still a priority

43% agree; 35% disagree.

Consumers perceive several drawbacks of sugar including weight gain, addiction, high blood pressure, higher risk for heart attacks, liver disease and stroke.

North Americans however are least likely to think that reduced sugar food and drinks taste the same as the full sugar solutions.

On the other hand, 76% of Mexicans perceive that the sugar content in food and drinks has increased over the years and 75% believe reduced sugar products are healthier for them over the full sugar versions.

Kerry Tastesense™

Embarking on a new era of sweetness.

Beyond just sugar reduction to sweetness satisfaction.

Tastesense™ is a range of taste solutions that support development of nutritionally optimized products with low/no sugar that still imparts a clean sweetness profile, full-bodied mouthfeel and no off-notes, addressing the need of your consumer.

Solutions that enable sweetness optimization from 3 brix and beyond, carbon emissions reduction from 20% and water usage reduction by 30%

Making sustainable nutrition taste great.

Tastesense

Sweet

For 3° Brix sucrose sweetness equivalence, an innovative range covering upfront, middle and end sweetness, addressing consumer needs for clean label.

Tastesense

Plus

Beyond 3° Brix sucrose sweetness equivalence, an original range of taste solutions meeting cost conscious needs and no added sugar claims.

Tastesense

Advanced

Beyond 3° Brix sucrose sweetness equivalence, a range that advanced innovation enabling plant-derived and no sugar added claims.

Follow along as we conclude our Sensibly Sweet journey. In the third and final part “Welcome to the Sugar Shift” we will share the changing consumer preferences for the amount and type of sweeteners used across food and drinks.

- Sweetener preferences across various food and drinks

- The need for different degrees of sugar reduction

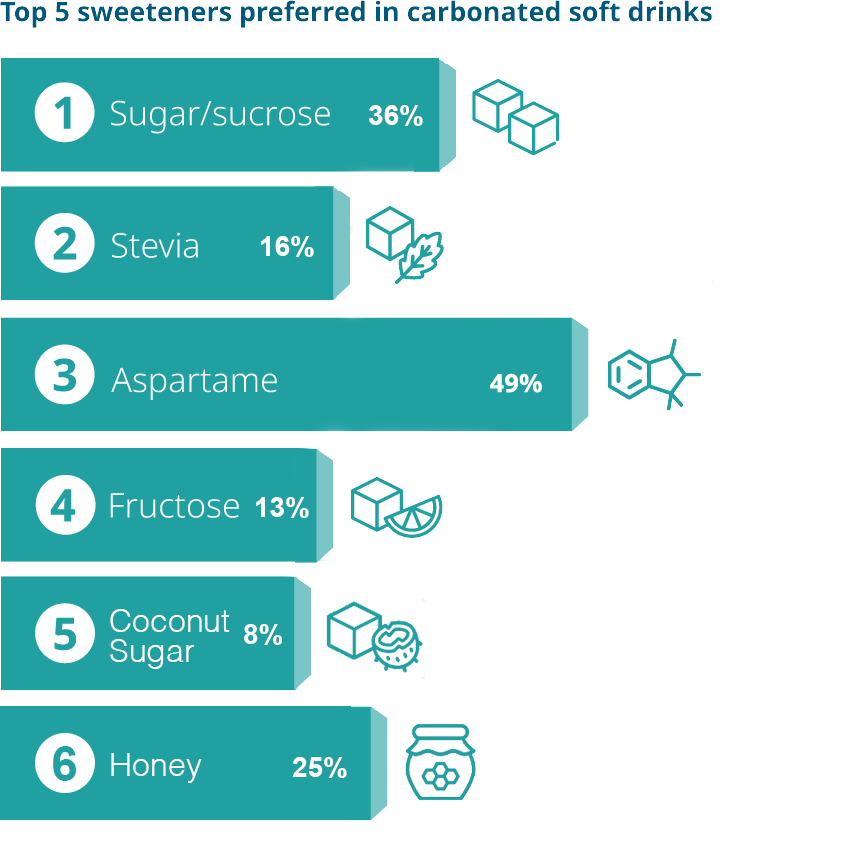

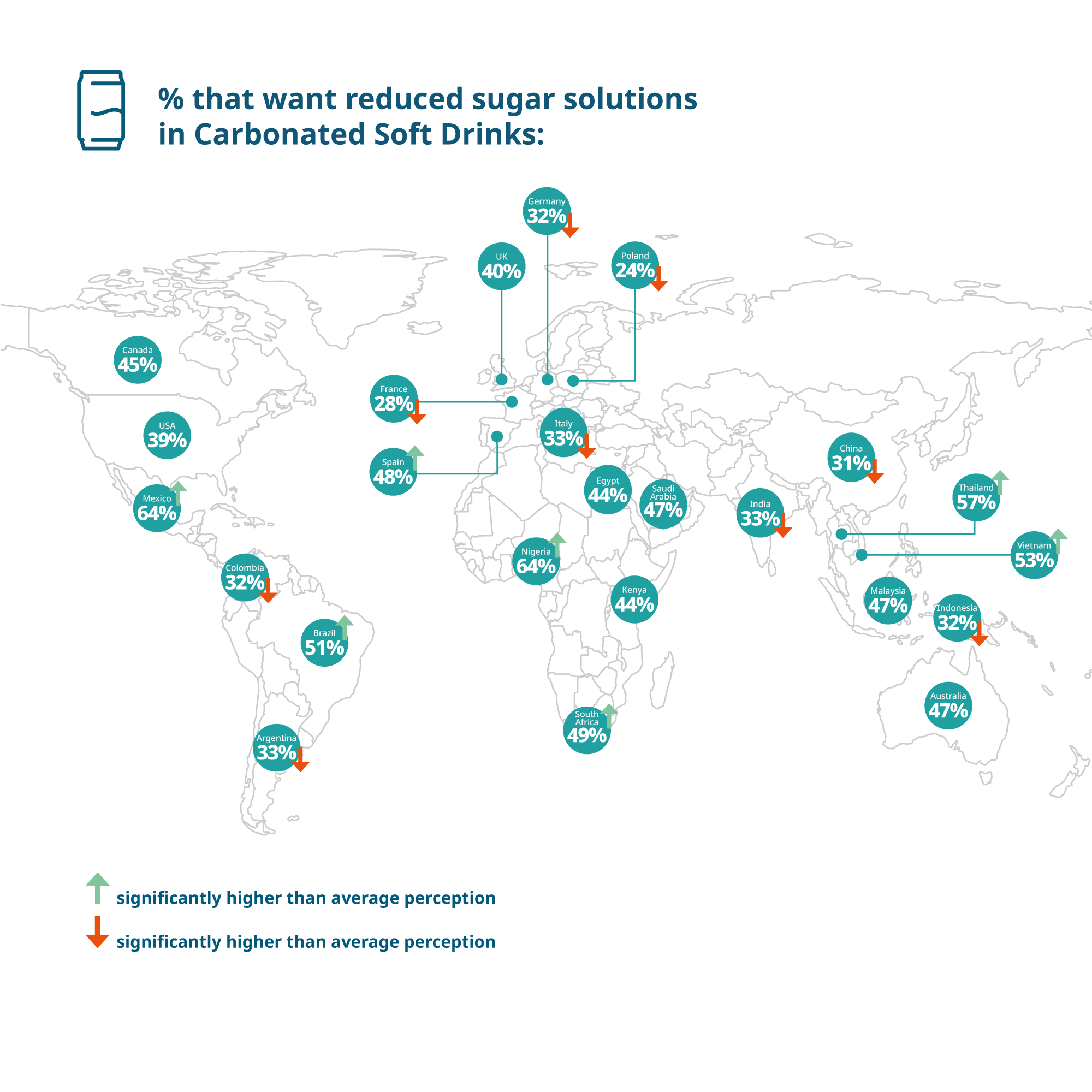

Here is a sneak preview into consumers’ sugar reduction preferences in carbonated soft drinks.

Not only are consumers seeking reduced sugar solutions in carbonated soft drinks, but a majority of them are seeking a 50% reduction in the amount of sugar in these drinks.

Sugar is the most preferred sweetener in carbonated soft drinks, but stevia is rising to the top as well as fructose.

At the least a third of consumers in each country wants reduced sugar carbonated soft drinks, several countries over index – Nigeria, Mexico, Thailand at the top.

42% of consumers seeking reduced sugar alternatives are looking for it from carbonated soft drinks.

Return to the top