Welcome back

Welcome back to our Sensibly Sweet Journey where we share the latest insights on consumers’ sweetness habits and preferences. Diving deeper into specific food and drink options, we uncover the world’s evolving relationship with sweeteners and the impact this brings to our food and drink choices.

Striking the balance

Striking the balance between taste and nutrition is now more crucial than ever before. People are not demanding but expecting food and drink that provide them with accessible and nutritional solutions that also cater to their taste buds. The need for sugar reduction is undeniable.

79% of global consumers believe that reduced sugar food and drinks are healthier than full sugar versions.

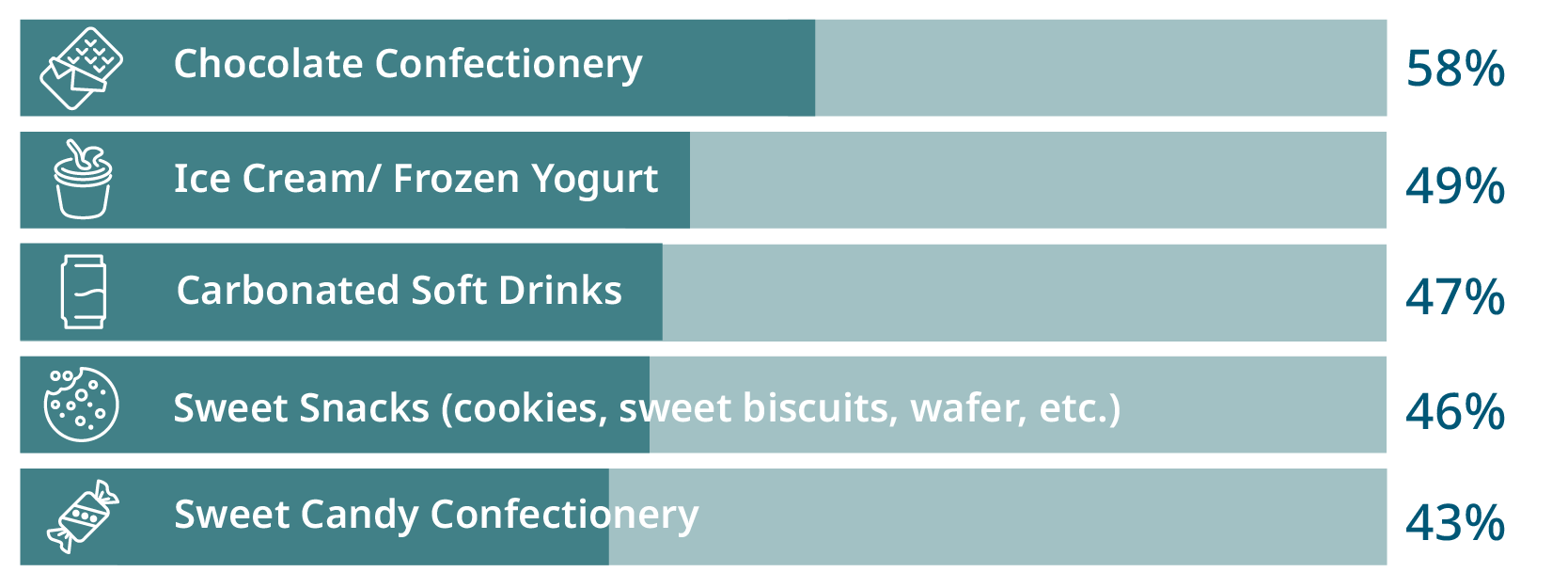

However, this demand varies by the food and drink in question.

In our Sensibly Sweet Journey, we shared the role indulgence plays in consumers’ decision-making:

Mindless consumption moments - High frequency snacking occasions demand for a higher degree of sugar reduction (carbonated soft drinks, flavoured sparkling water, juices, sweet gummies and snacks).

Experiential, emotive moments - Intentional indulgences tied to nostalgia, and comfort call for a comparatively lower degree of sugar reduction (beer, alcoholic spirits, ice-cream, chocolate confectionary, and sweet baked goods).

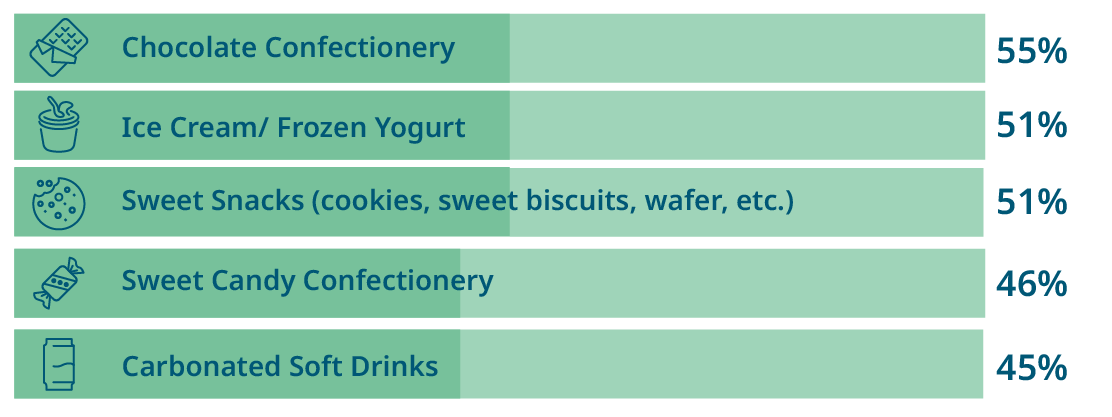

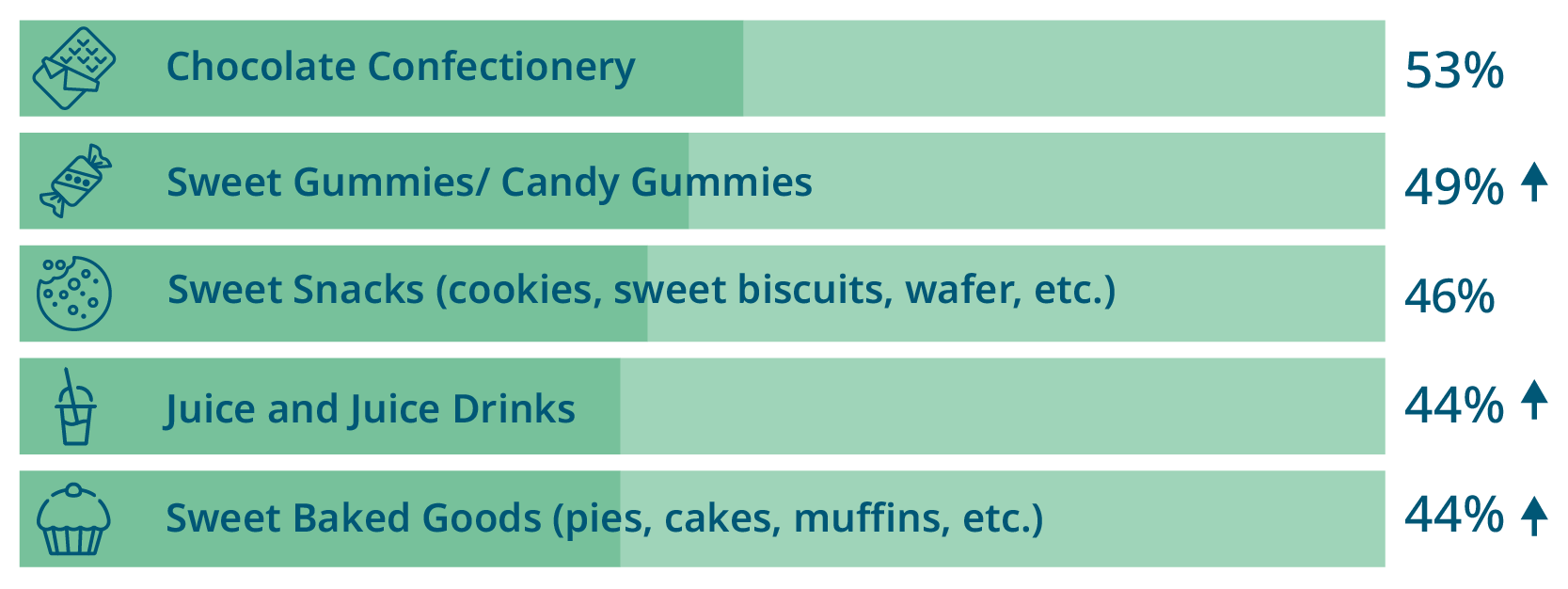

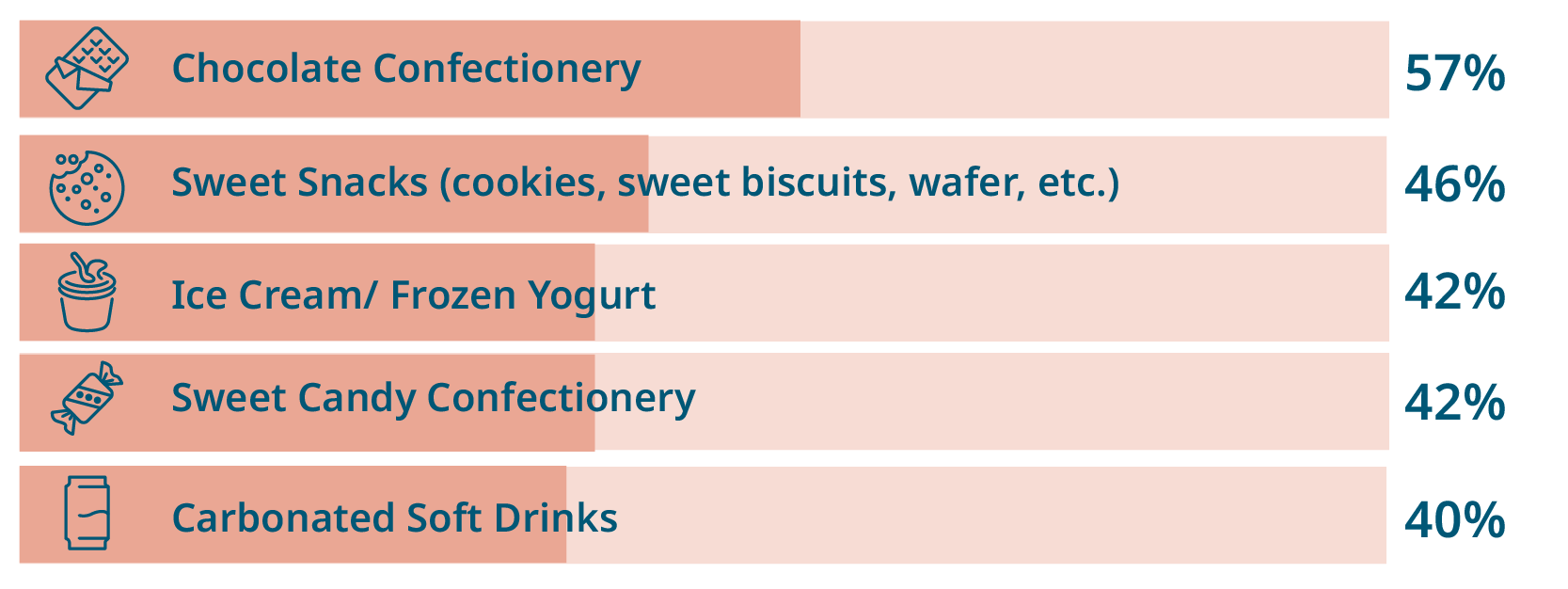

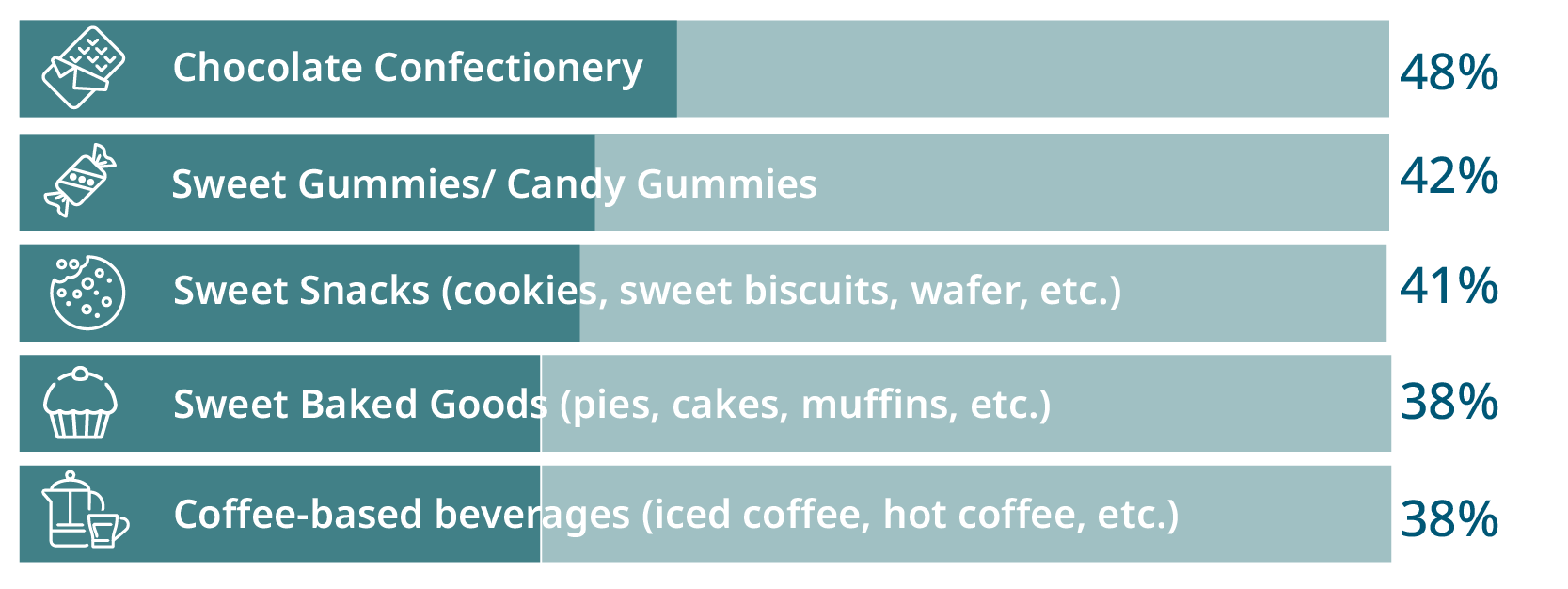

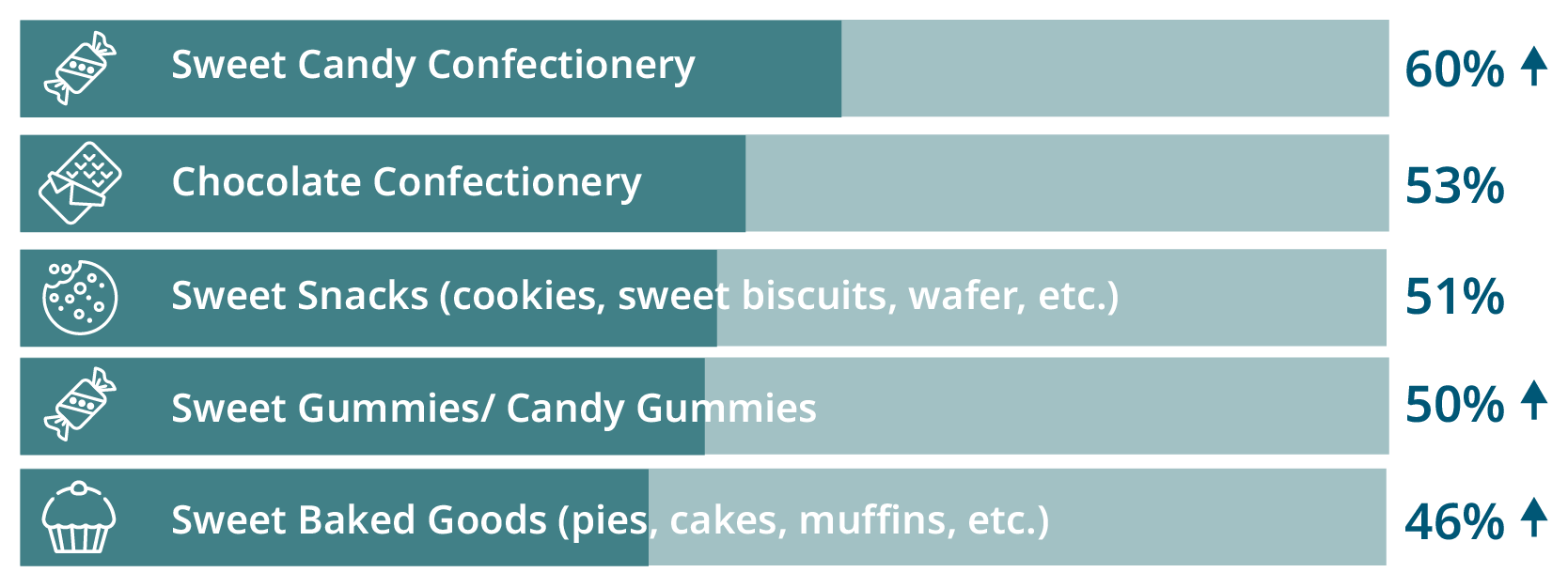

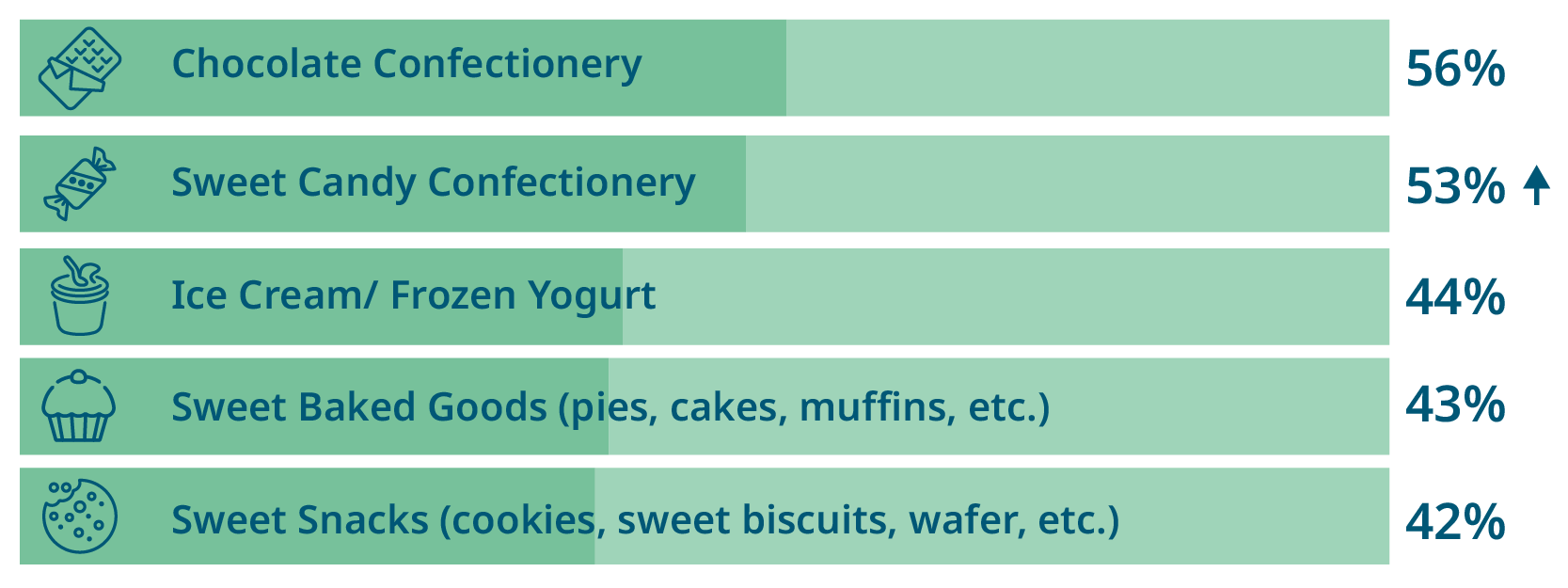

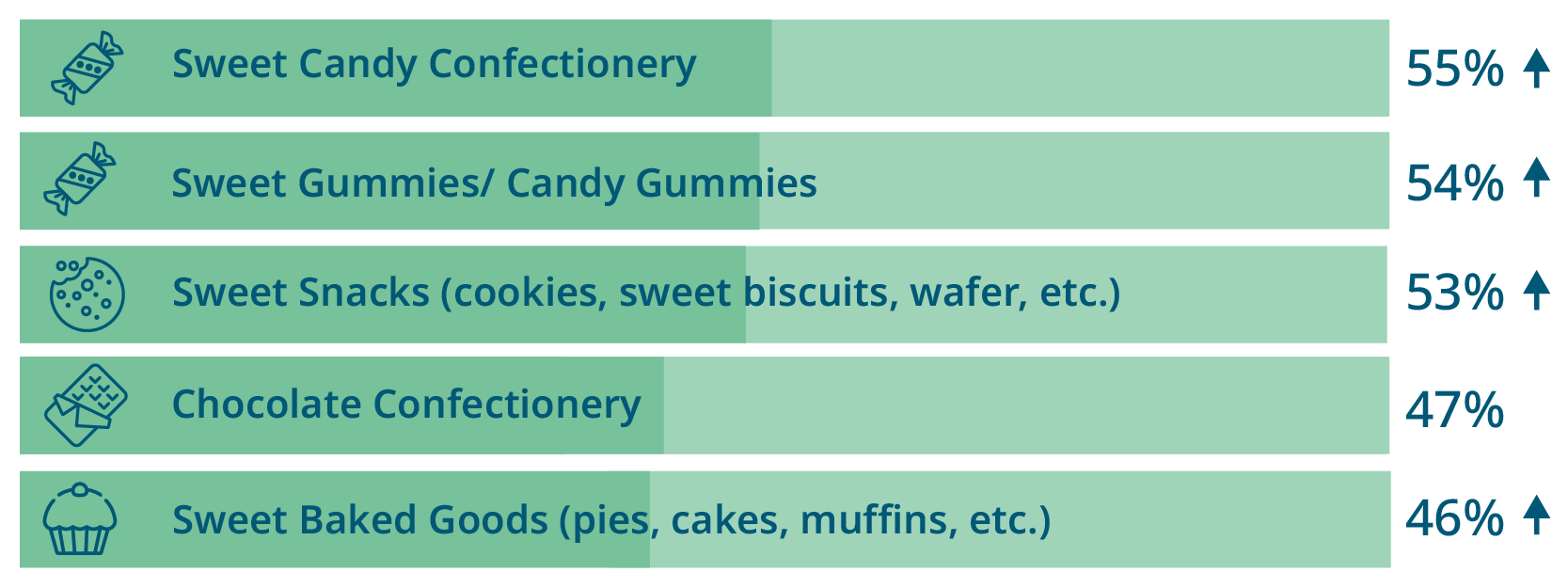

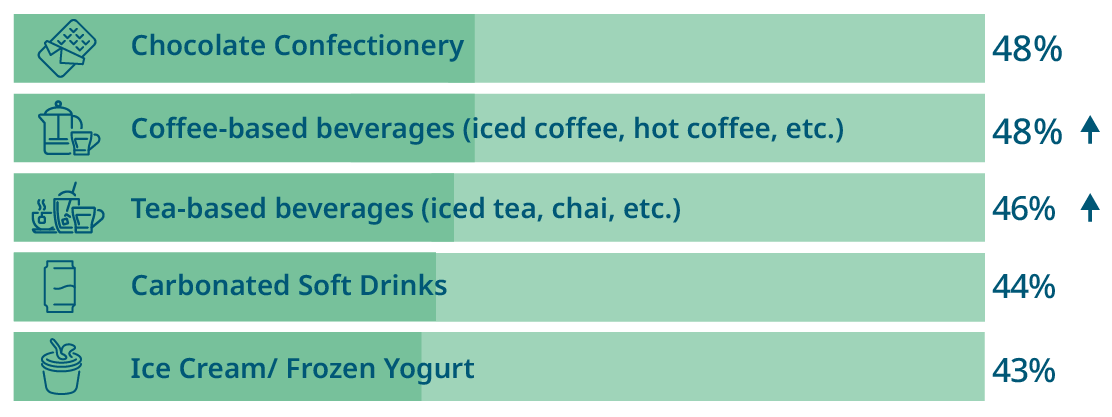

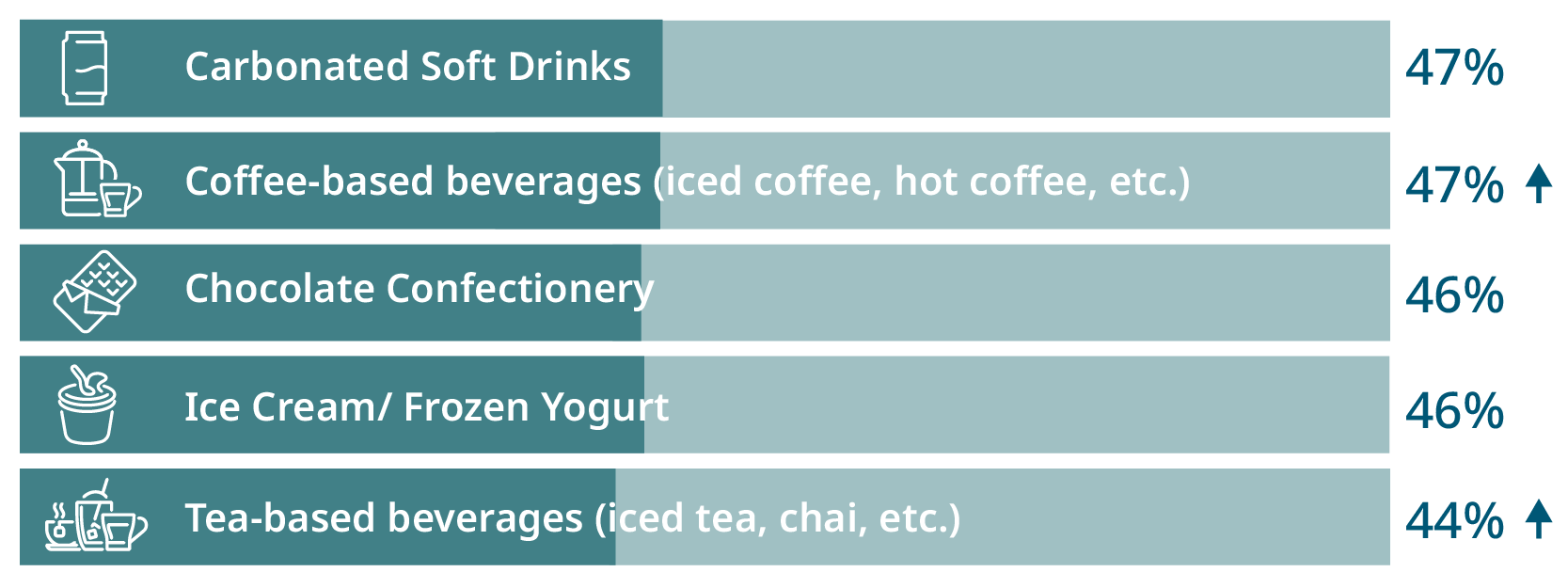

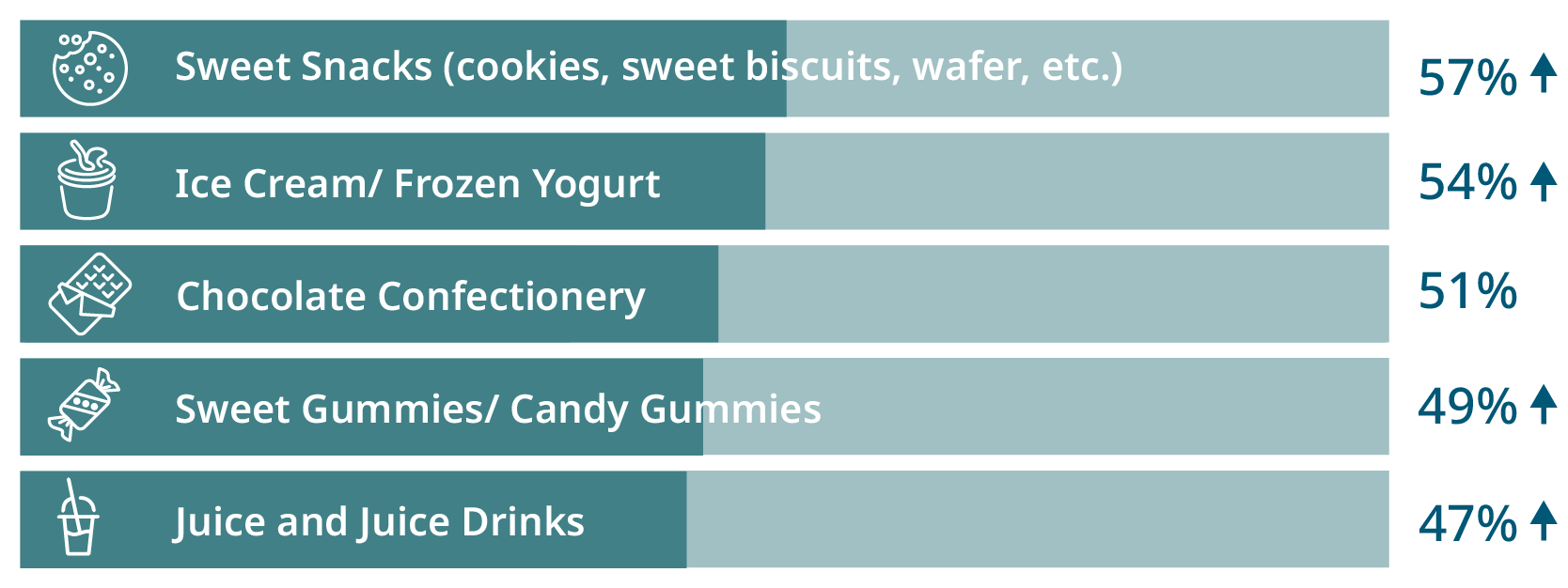

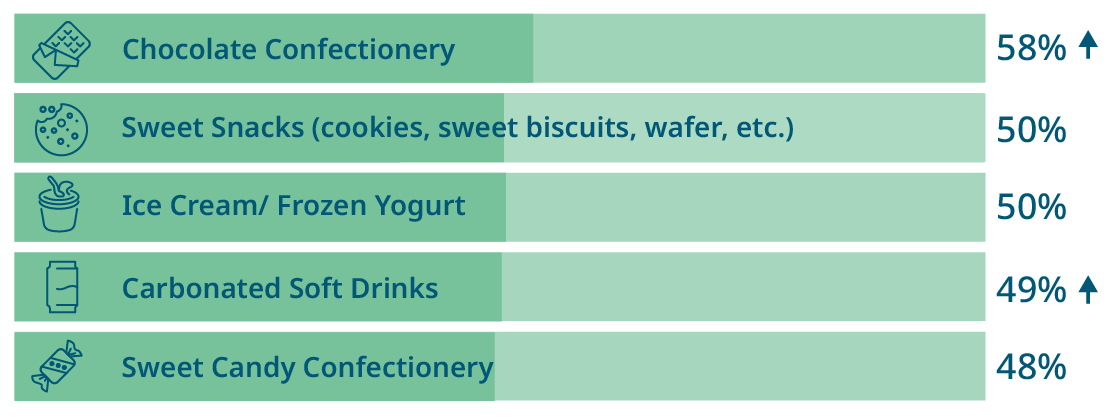

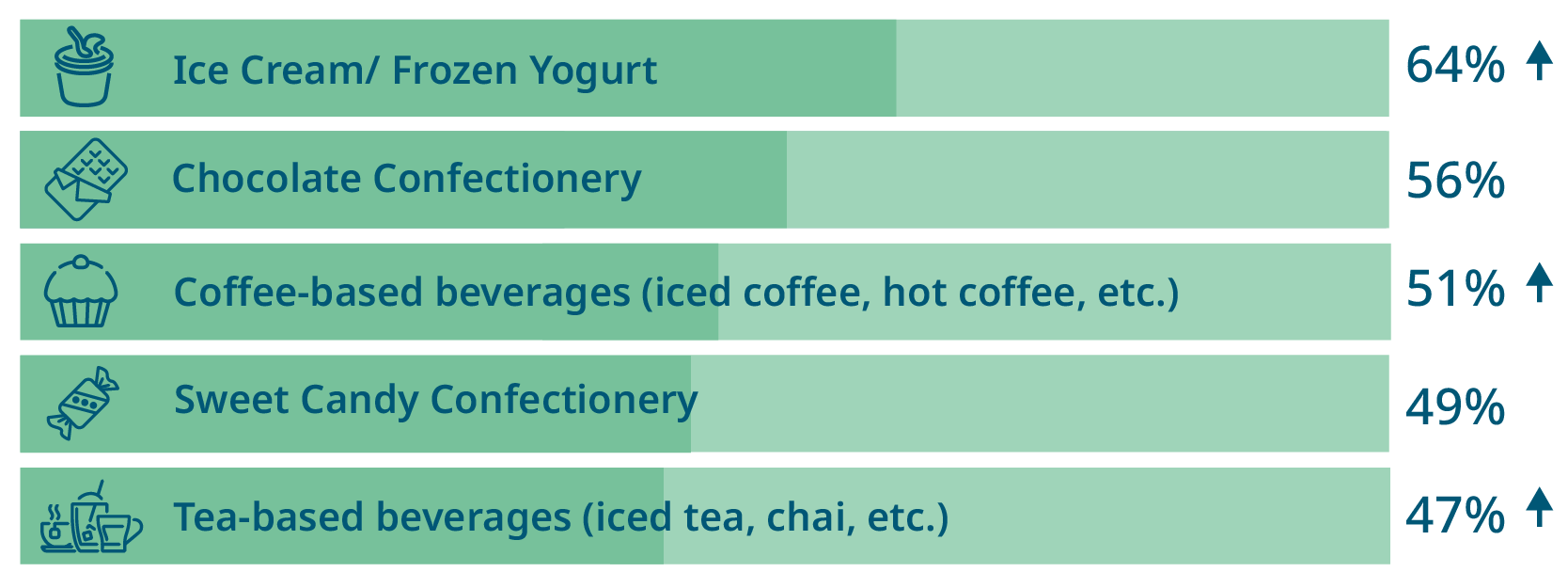

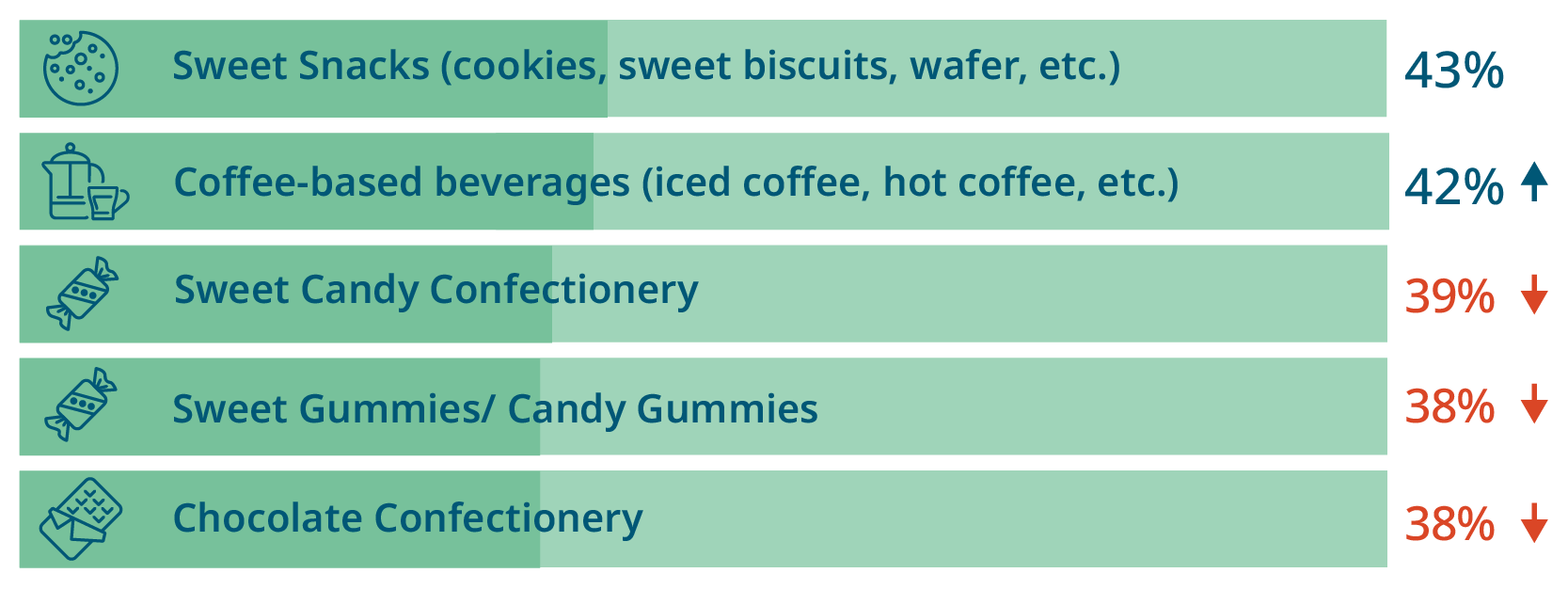

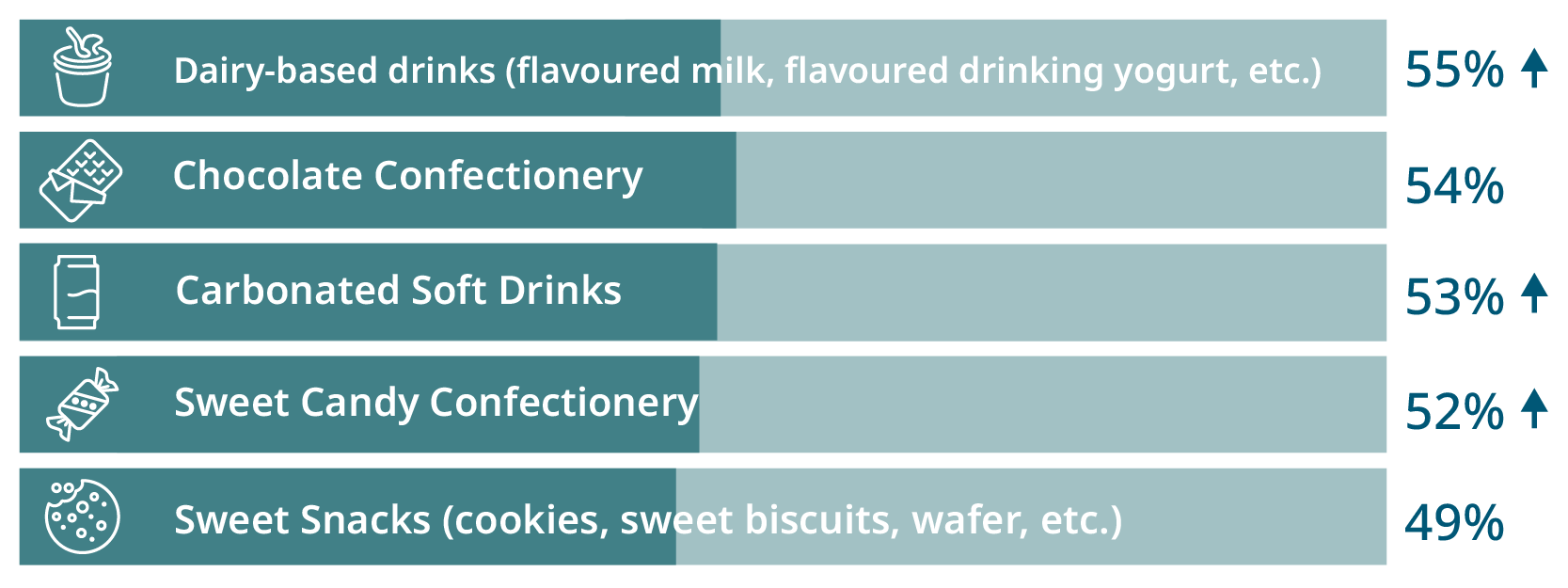

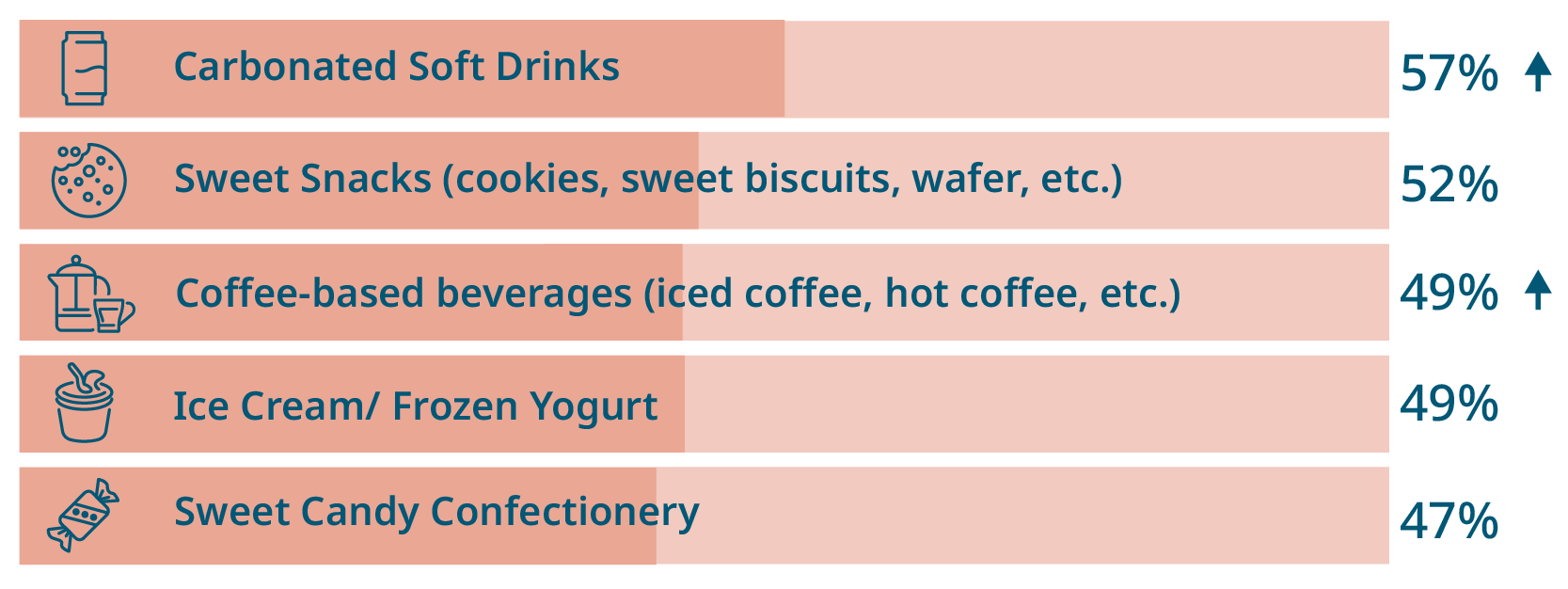

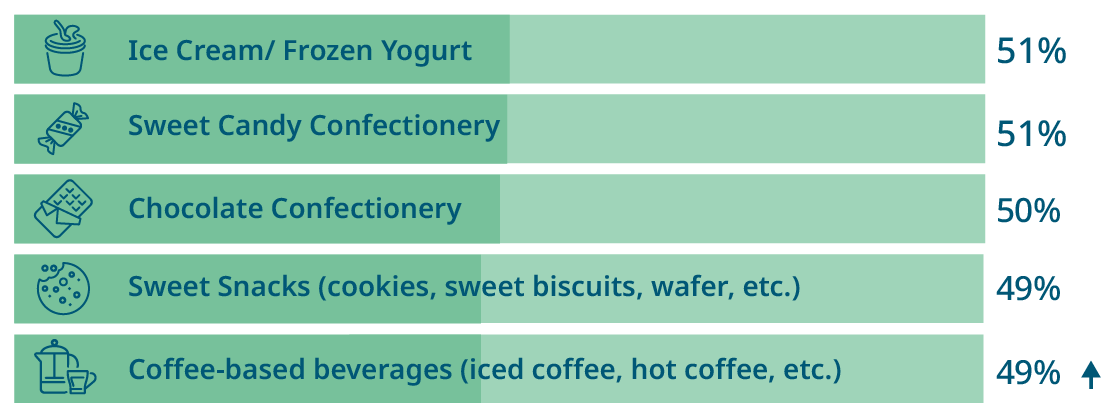

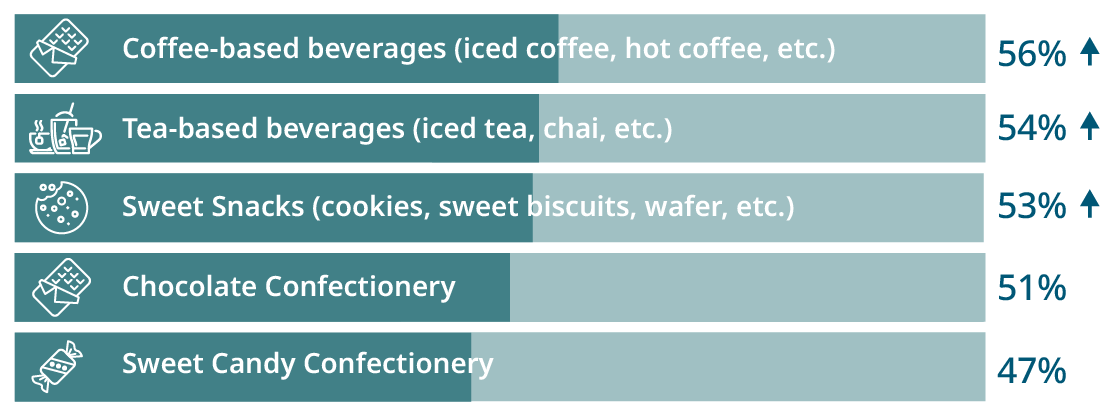

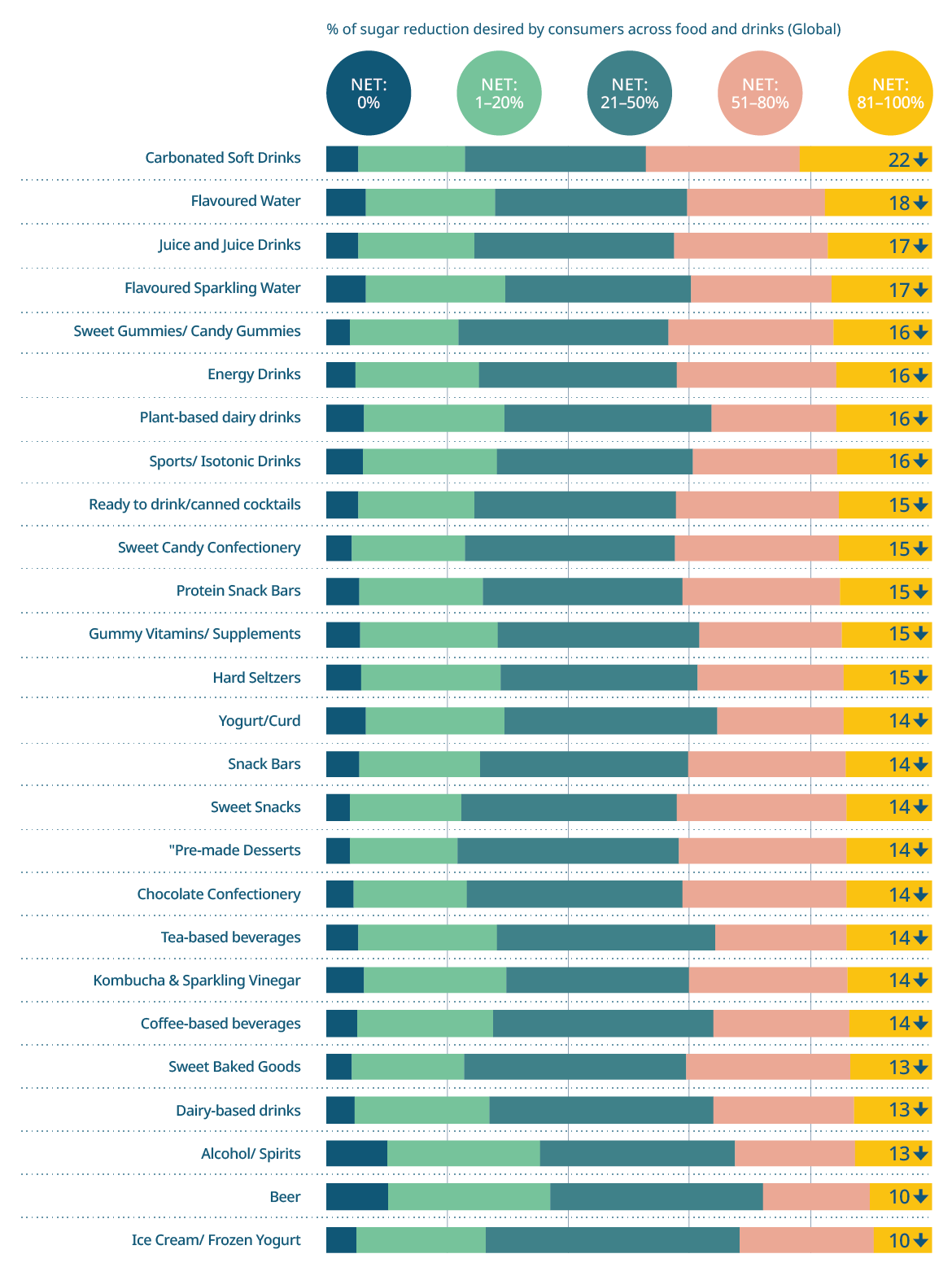

Where do customers want to cut sugar first?

Food and drink rankings for desired sugar reduction in % amount of total

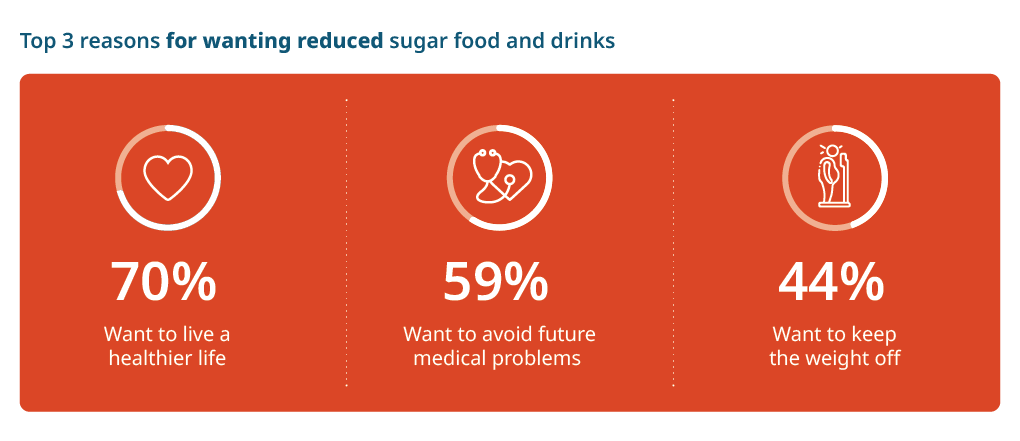

Consumers’ desire for sugar reduction varied significantly based on their underlying motivations.

Exploring the different relationships consumers have with sugar and sweetness, we uncovered three behaviours:

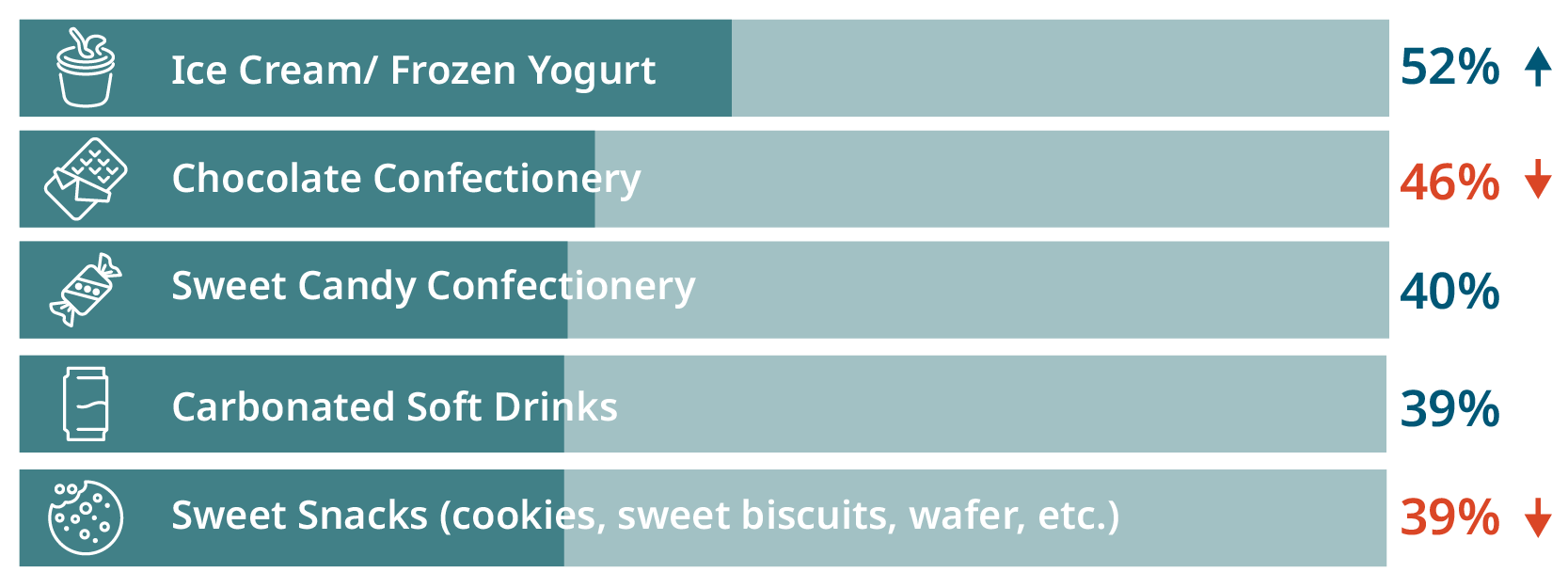

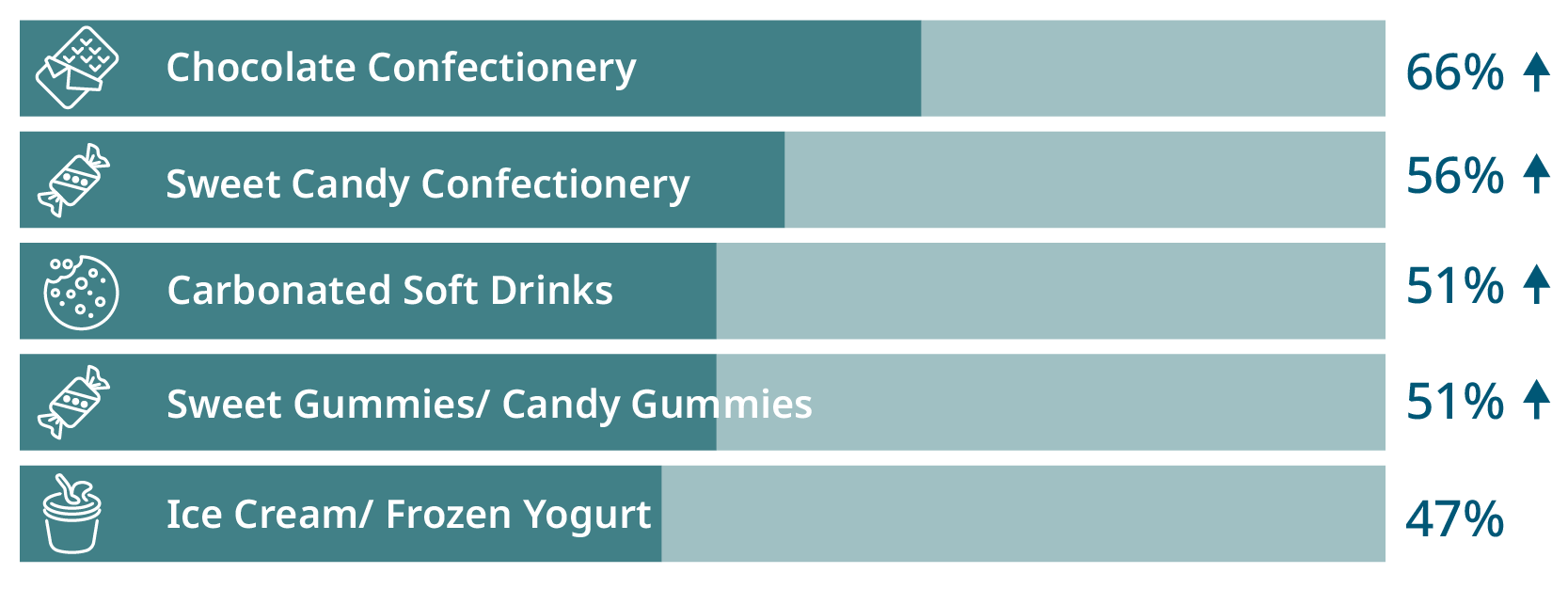

Reduced Sugar Seekers

Motivated by health and wellness, these consumers seek to reduce their sugar intake.

Zero Sugar Advocates

Driven by health and weight management, these consumers eliminate sugar consumption where possible.

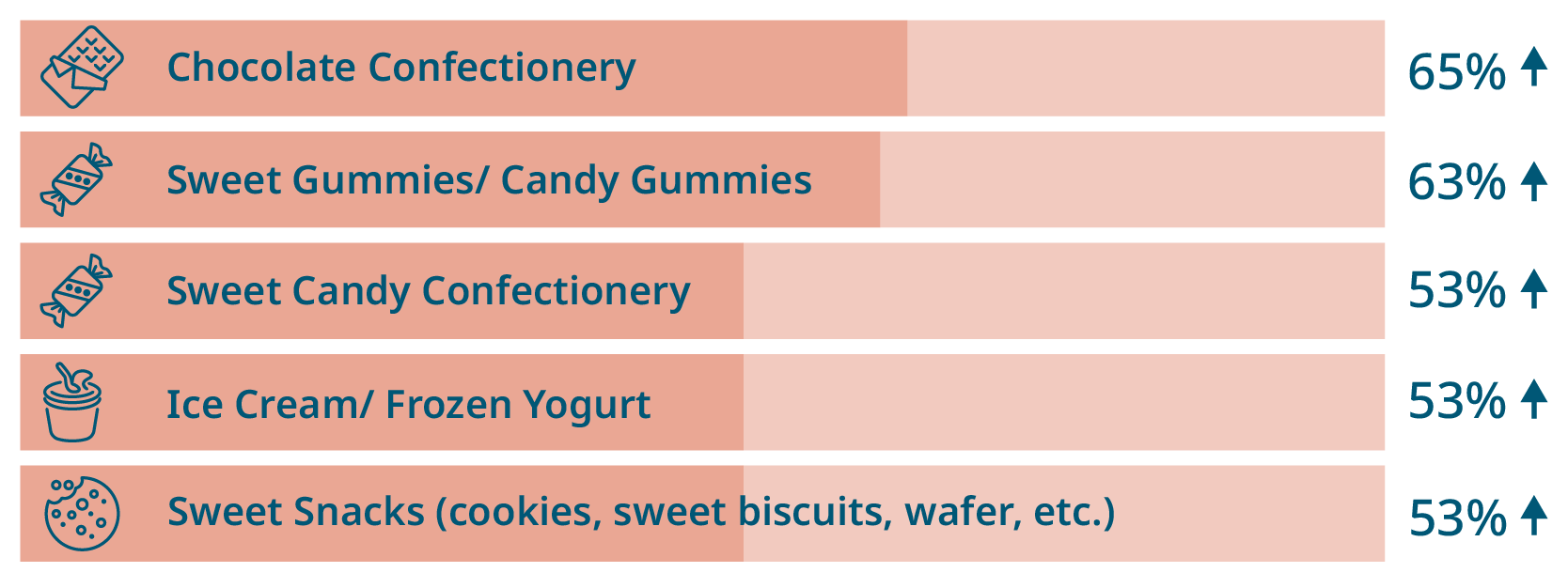

Taste Chasers

Led primarily by taste, these consumers do not prioritize sugar reduction.

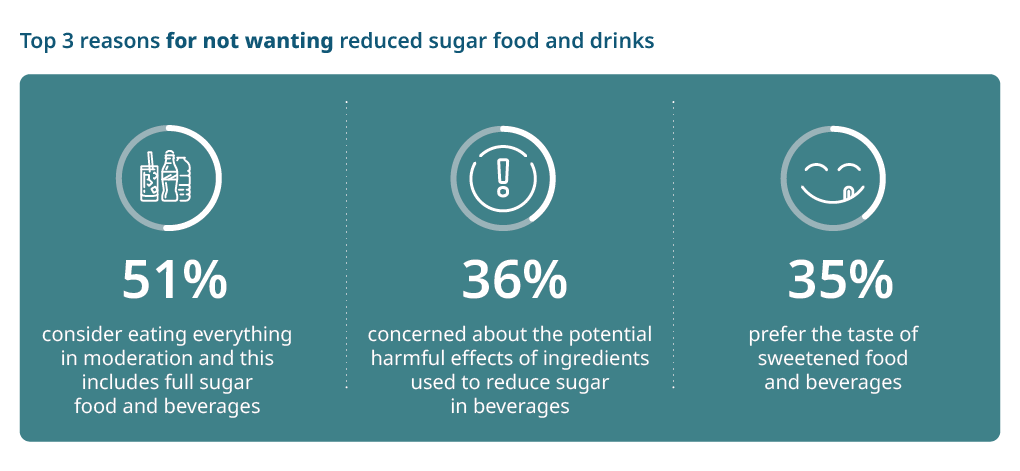

Consumer’s sweetness expectations are no longer nebulous.

They are voicing their sugar reduction desires and laying down rules.

The degree of ‘desired’ sugar reduction is complex. What sweetener? In what product? Natural or artificial? And how much?.

77%

of global consumers consider the type of sweetener used in food and drink is important.

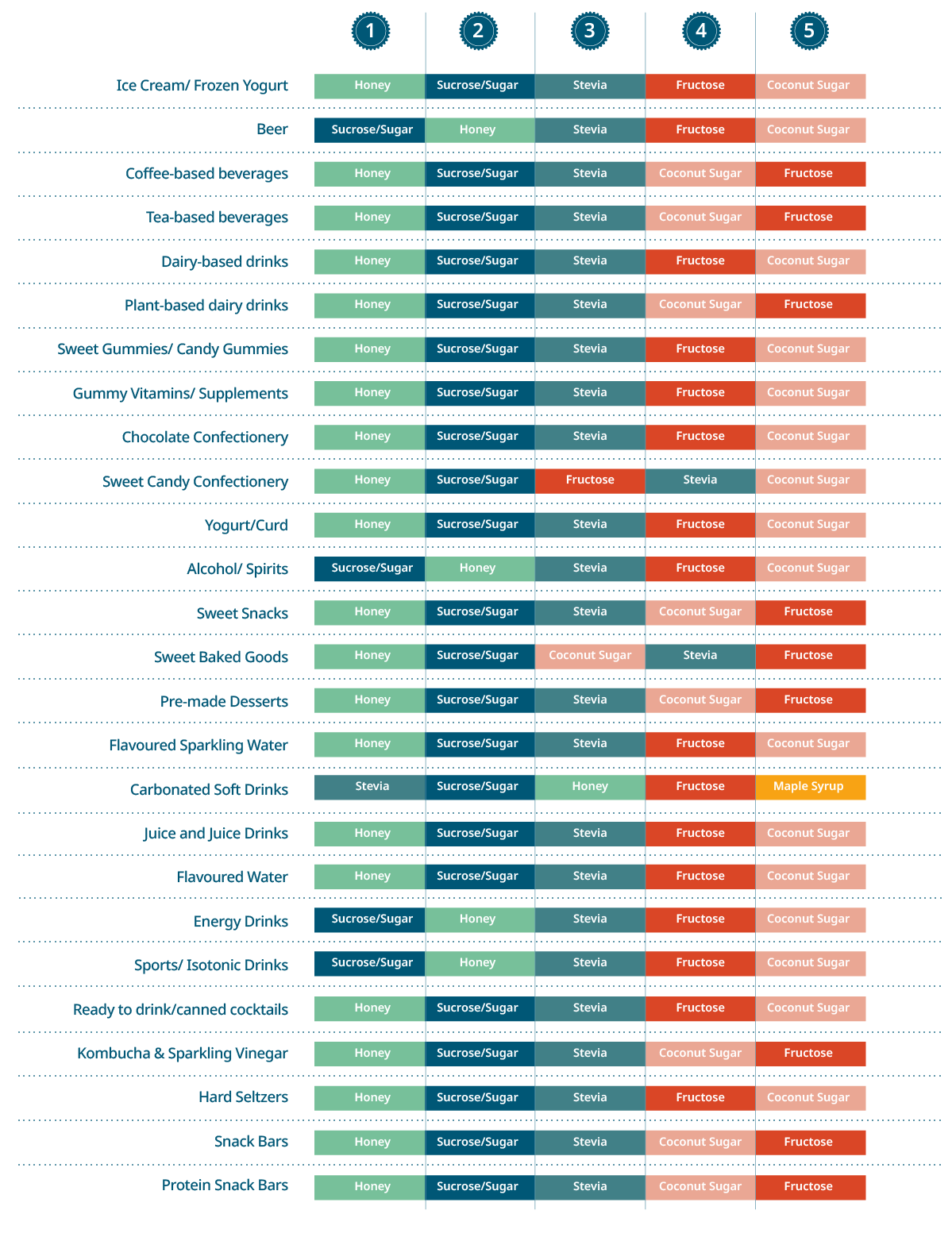

There’s lots of variables in the reduced sugar conversation, and consumers’ preferences vary considerably depending on the food or drink in question.

43%

of global consumers that are familiar with stevia, also ranked it their most preferred sweetener.

For instance, Stevia was the most preferred sweetener in sparkling water, flavoured water, kombucha, tea-based beverages, and hard seltzers. Aspartame, although artificially sourced, was popular in energy drinks and carbonated soft drinks too. The preference for these sweeteners was significantly higher than any other for this category, even displacing honey, the top sweetener of choice globally.

So, context clearly matters. Consumers care about sweetener type, but preferences also change according to specific food and drink.

Top 5 preferred sweeteners for each food type

Local nuances are key

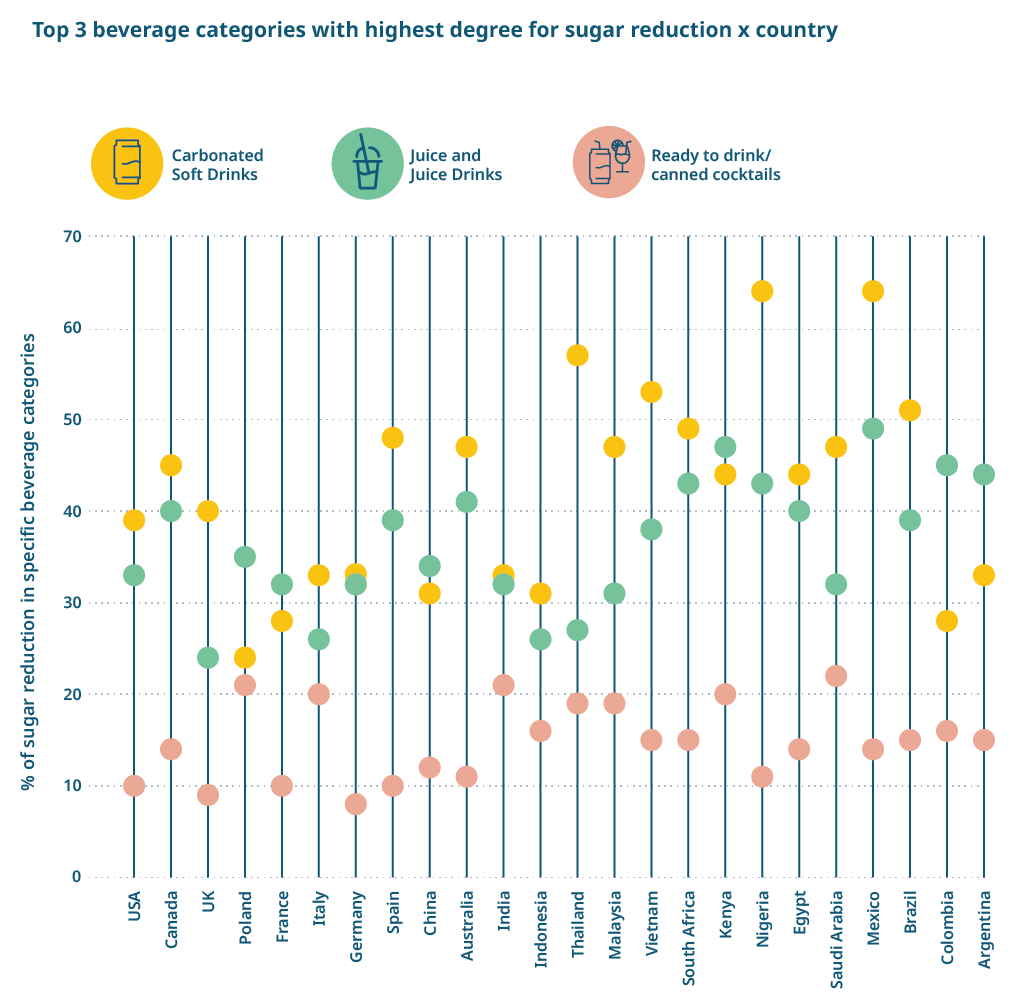

Cultural context applies even when people consider food and drinks they desire for sugar reduction. For instance, while US consumers state they want reduced sugar ice cream/frozen yogurt, their neighbouring Canadian consumers over-index on sweet baked goods and snack/granola bars.

Beverages are in high focus in countries across Asia Pacific, Africa, Spain, and Latin America with Mexico, Nigeria, Thailand, Vietnam, Brazil, South Africa, and Spain over indexing in their need for reduced sugar carbonated soft drinks.

The visual below illustrates how the 24 countries differ in their desire for sugar reduction in the top 3 beverage categories that they desire the highest degree for sugar reduction (amount of sugar to be reduced).

Top 5 food and drinks consumer desire sugar reduction x country

![]() Significantly higher than average perception

Significantly higher than average perception ![]() Significantly lower than average perception

Significantly lower than average perception

Unlock Sustainable Sweetness

Sustainability is key for sweetened food & drinks

A sugar shift that's sweet for the planet

Everyday we’re creating innovative sweet solutions that support our mission to bring great-tasting sustainable nutrition to two billion consumers by 2030.

Our leading-edge Tastesense technology and latest innovation, Tastesense Advanced, bring us so much closer to this critical goal. Reduced sugar food and beverages that are better for people and planet.

Return to the top