Welcome

Welcome to the Sensibly Sweet Journey.

As part of this journey we will share our deep understanding of consumers and sweeteners in three different parts; 1. Embracing Sweetness, 2. Sweet. Less 3. Welcome to the Sugar Shift.

Throughout our Sensibly Sweet campaign we will confirm some familiar behaviours and break some stereotypes by sharing:

- The changing relationship of consumers with sweetness

- Settling the ongoing villainous vs virtuous debate

- Why certain sweeteners are preferred and how these vary across 24 countries

Methodology

At the end of 2022, Kerry's Consumer Research and Insights team conducted a deep dive into human behavior focused on sweetness and sweeteners via a quantitative survey reaching 12,784 people across 24 countries (US, Canada, UK, Germany, France, Italy, Spain, Poland, Mexico, Brazil, Colombia, Argentina, Australia, China, India, Saudi Arabia, Egypt, Thailand, Indonesia, Malaysia, Vietnam, South Africa, Kenya, and Nigeria).

77% of global consumers consider the type of sweetener in the food and drink is the most important detail at the time of purchase.

Top 5 Insights

Natural Sweeteners, please

Taste alone does not call the shots

Younger consumers are breaking the norm

Weight gain is not my only concern

Sweetness is my companion

"Natural Sweeteners, please"

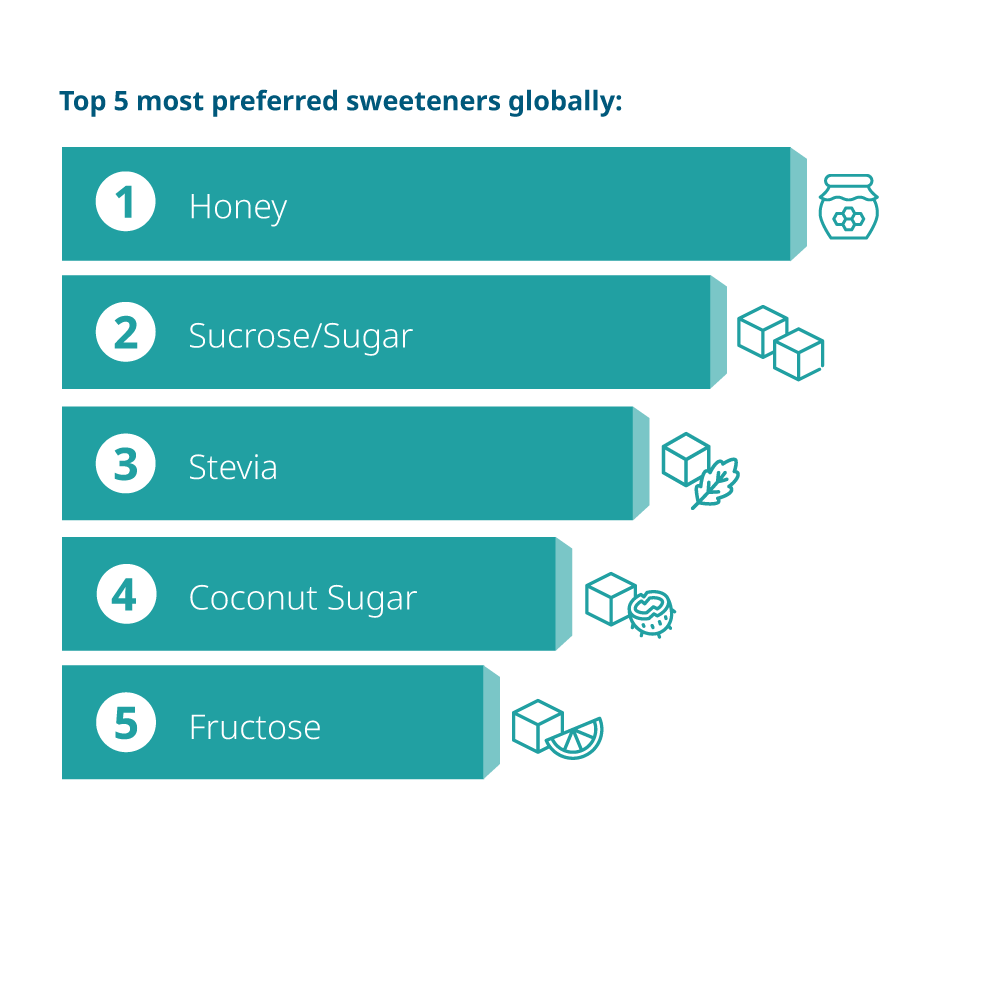

Natural sweeteners rank highest across the globe and perception is everything.

75%

of global consumers prefer a natural sweetener (such as honey, sugar, stevia). Those who did not prefer artificial sweeteners said they were bad for one’s health (55%) and had harmful side effects (41%).

Confirming Opinions

- Honey reigns supreme as the sweetener of choice across the 24 countries studied. This was also driven by its unique taste and nutritional halo

- Confusion regarding the origin (artificial or natural) continues to further strengthen people’s preferences for perceived-natural sweeteners

Natural at all costs

Taste alone does not call the shots

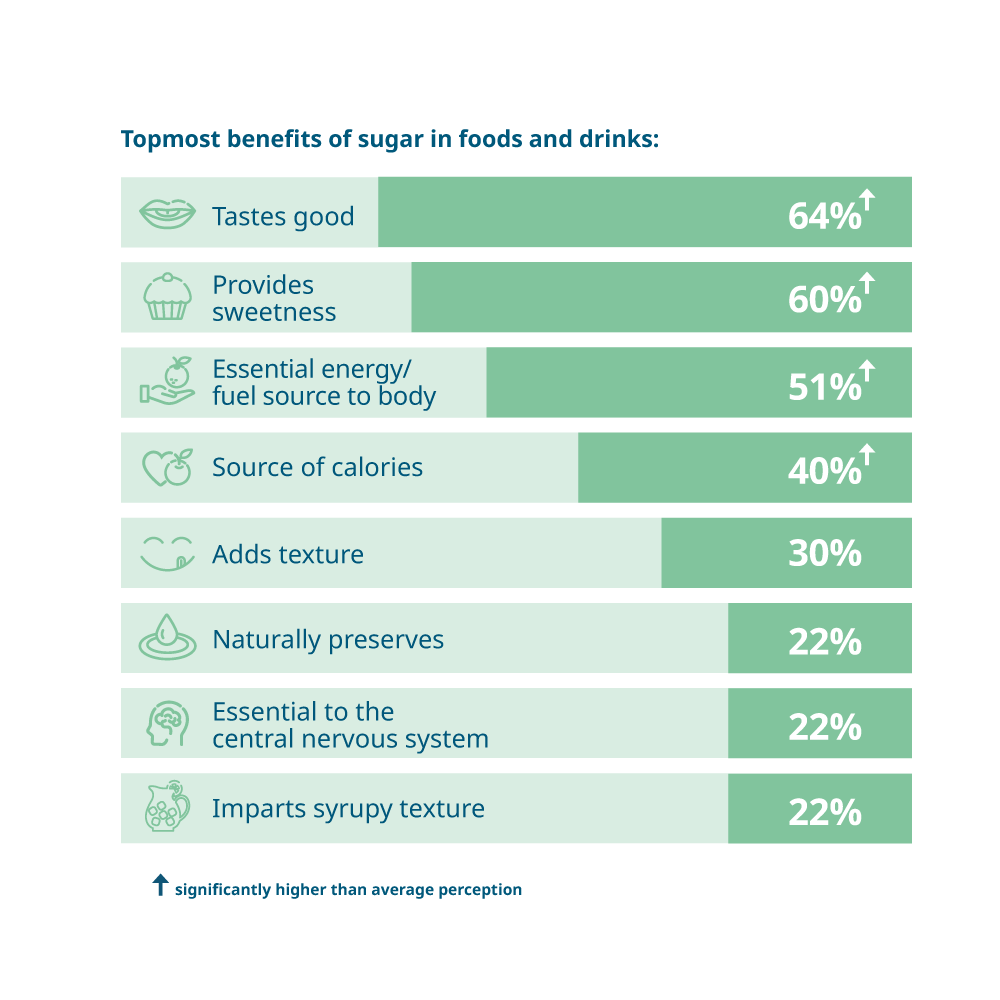

Taste remains a primary driver of sugar consumption.

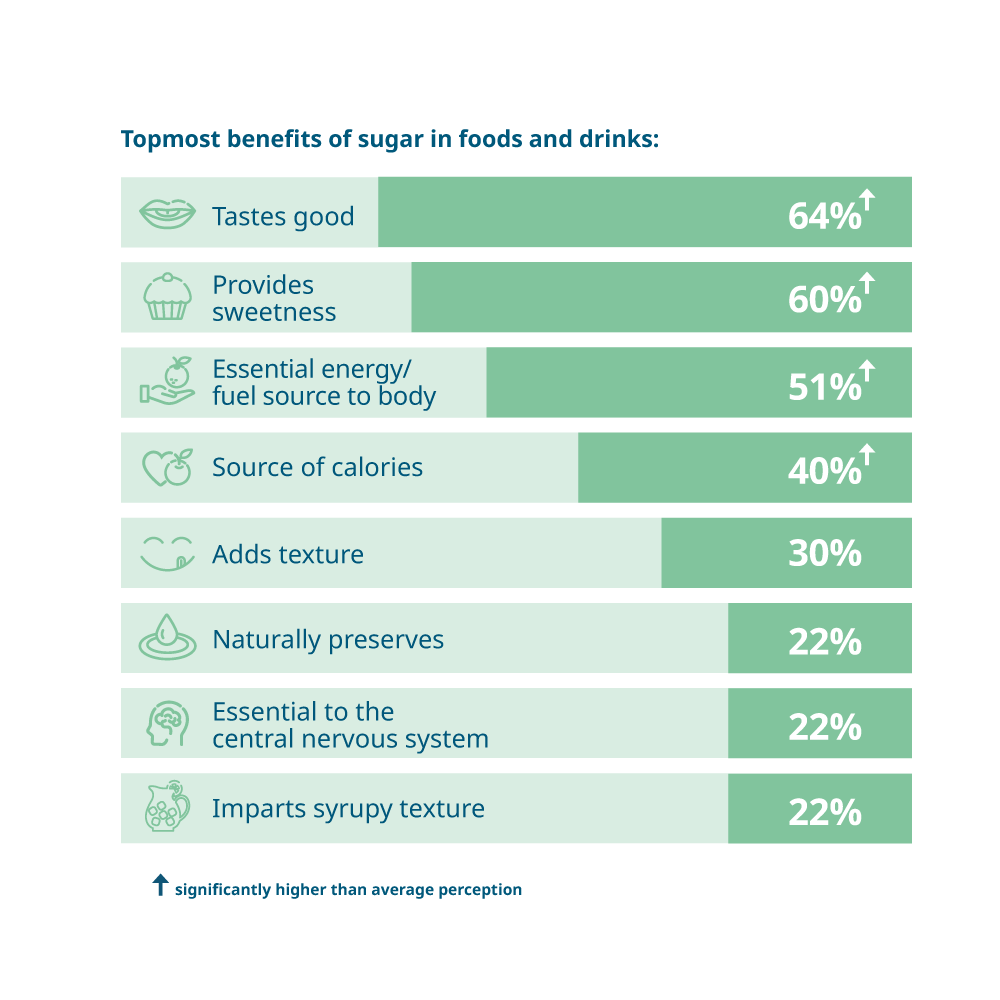

64%

of global consumers believe sugar makes food and drinks taste good. This is followed by nutritional characteristics such as its role as an energy source.

Breaking the sterotypes

The role of sugar has clearly shifted from just delivering on functional attributes such as taste, texture, mouthfeel to also address nutritional priorities.

The new balance

Young consumers are breaking the norm

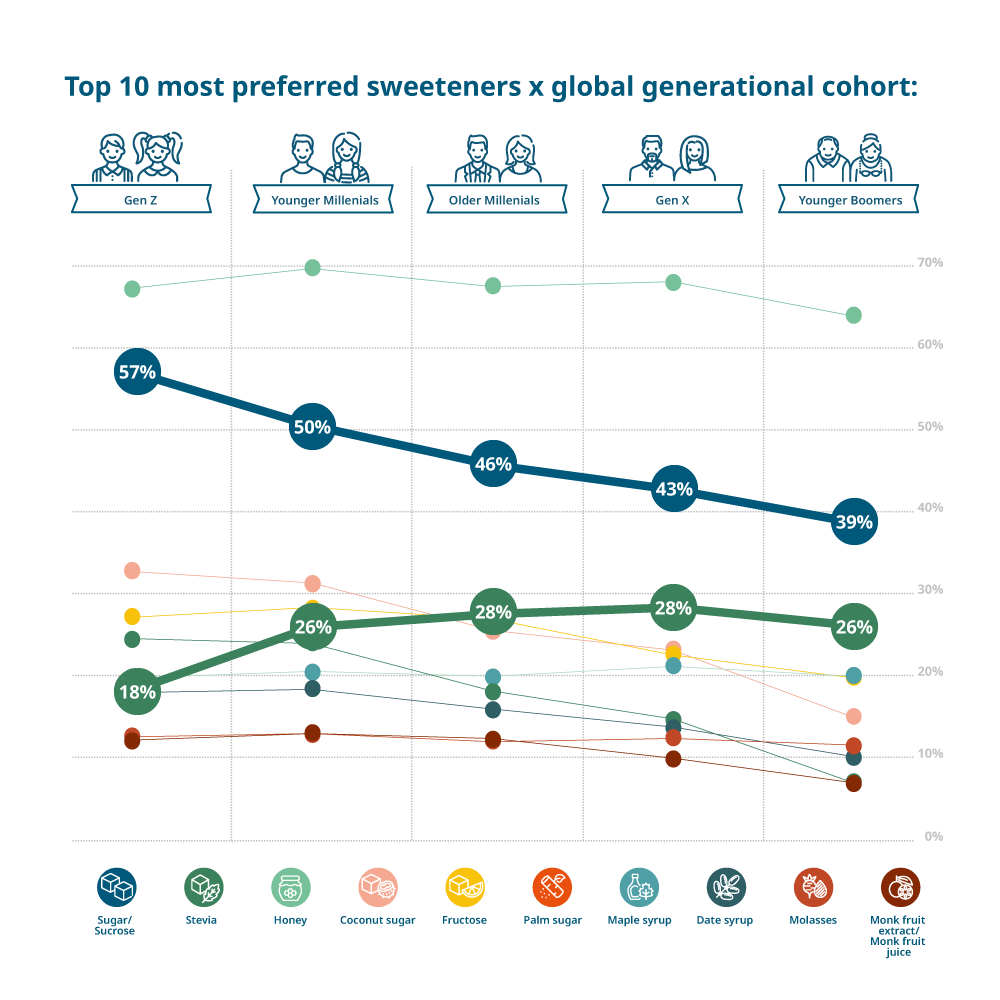

Sweetener preferences differ by generation.

Gen Z and younger millennials place greater importance on sugar in food and drinks.

36%

More than a third of consumers are sceptical of ingredients used to replace sugar in food and drinks.

92%

of Younger consumers preferred honey, sugar, coconut sugar, palm sugar, significantly more when compared to older generations.

Weight gain is not my only concern

Proactive health is

Rethinking sugar

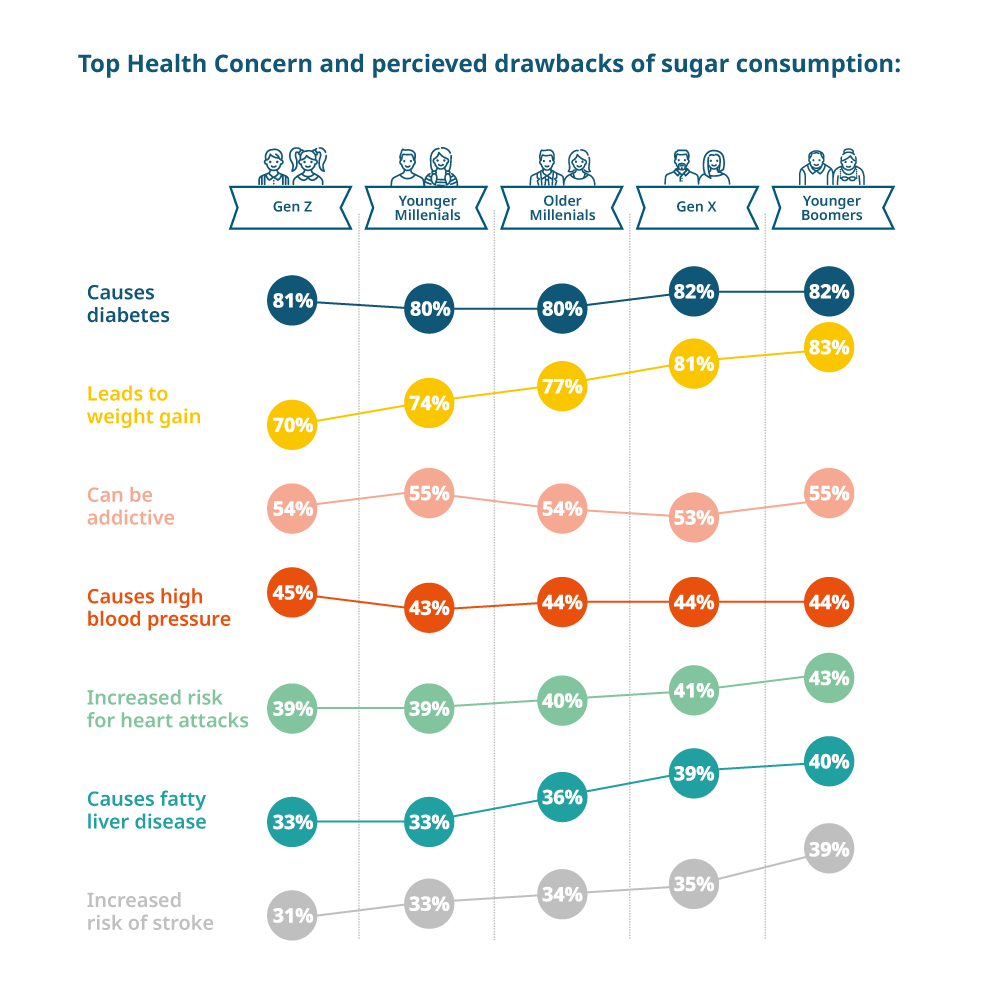

Although taste is a primary driver of consumption, customers increasingly acknowledge and turn to reduced sugar products as healthier alternatives (79% agree).

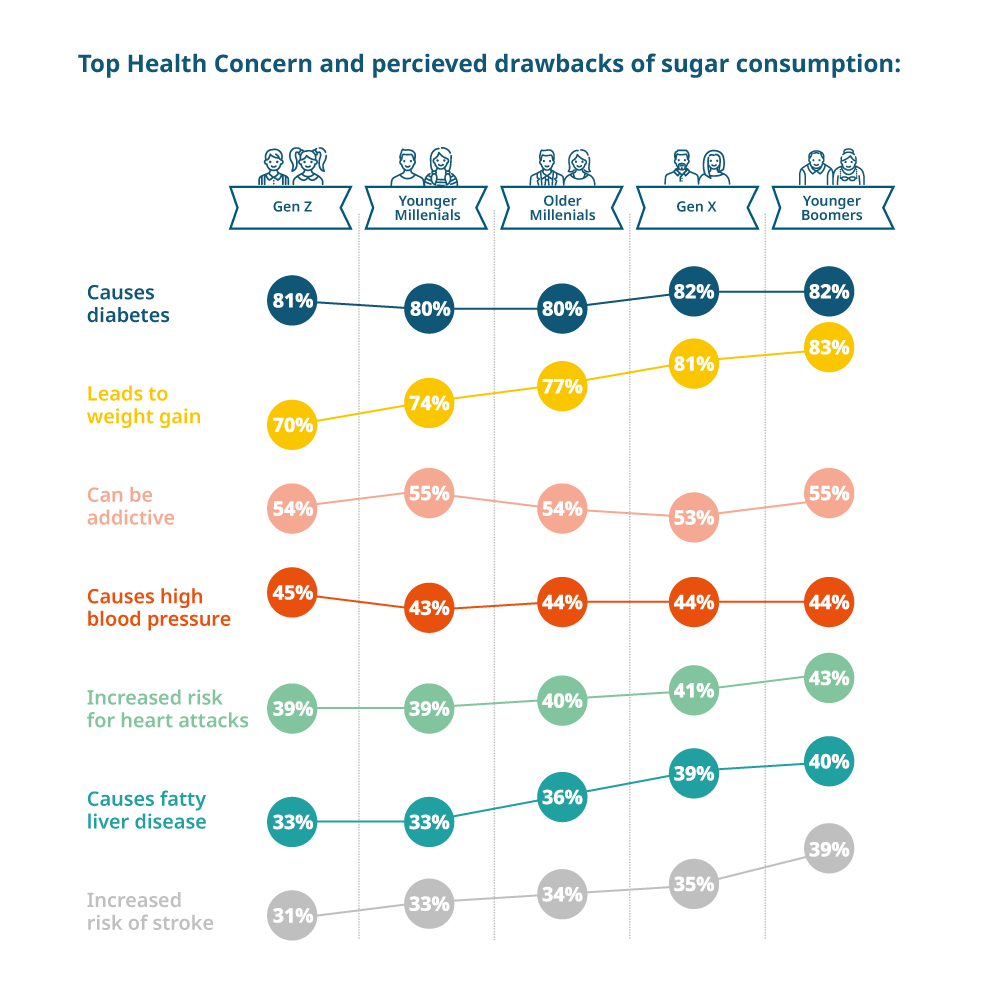

Concerns regarding weight gain add to people’s increasing concerns around diabetes, triggering addiction, high blood pressure, increased risk of heart attacks which are major deterrents to sugar

81%

of global consumers indicate diabetes and weight gain as significant drawbacks of sugar consumption.

Sweetness is my companion

The relationship with sweetness is emotional

Our traditions, communities, and childhood memories are shaped by food and drink. Woven into our cultural fibres, sweetness triggers a varied emotional response across countries and cultures. And as a result. people have a close relationship with sweetness, it is synonymous to having a companion.

For instance, Americans, Indians, Chinese, and Germans associate sweetness with happiness the most, while the Australians, Mexicans, Colombians, and the Spaniards link sweetness with unhealthy the most. Interestingly, the Thai have no negative connotations with sweetened food and drinks.

Top 10 emotions associated with sweetened food and drinks x country.

(~50% positive and ~50% negative emotions were among the choices given to people)

Happy

Energized

Satisfied/Content

Comforted

Unhealthy

Unhealthy

Energized

Happy

Satisfied/Content

Comforted

Energized

Happy

Satisfied/Content

Comforted

Unhealthy

Satisfied/Content

Happy

Energized

Comforted

Pampered

Energized

Comforted

Satisfied/Content

Happy

Alert

Pampered

Satisfied/Content

Happy

Unhealthy

Energized

Happy

Satisfied/Content

Unhealthy

Energized

Alert

Unhealthy

Satisfied/Content

Energized

Happy

Healthy

Happy

Relieved

Satisfied/Content

Comforted

Energized

Unhealthy

Happy

Energized

Comforted

Satisfied/Content

Happy

Satisfied/Content

Energized

Excited

Comforted

Energized

Satisfied/Content

Excited

Euphoric/Overjoyed

Happy

Energized

Excited

Happy

Satisfied/Content

Pampered

Energized

Happy

Euphoric/Overjoyed

Comforted

Alert

Energized

Happy

Satisfied/Content

Thirsty

Relieved

Energized

Happy

Comforted

Unhealthy

Satisfied/Content

Energized

Happy

Excited

Satisfied/Content

Unhealthy

Energized

Happy

Excited

Satisfied/Content

Unhealthy

Happy

Energized

Thirsty

Unhealthy

Excited

Happy

Energized

Satisfied/Content

Unhealthy

Thirsty

Unhealthy

Energized

Satisfied/Content

Alert

Anxious

Energized

Satisfied/Content

Thirsty

Happy

Comforted

Energized

Unhealthy

Satisfied/Content

Anxious

Happy

Energized

Satisfied/Content

Healthy

Unhealthy

Happy

Top 5 Insights

"Natural Sweeteners, please"

Natural sweeteners rank highest across the globe and perception is everything.

75%

of global consumers prefer a natural sweetener (such as honey, sugar, stevia). Those who did not prefer artificial sweeteners said they were bad for one’s health (55%) and had harmful side effects (41%).

Confirming Opinions

- Honey reigns supreme as the sweetener of choice across the 24 countries studied. This was also driven by its unique taste and nutritional halo

- Confusion regarding the origin (artificial or natural) continues to further strengthen people’s preferences for perceived-natural sweeteners

Natural at all costs

Taste alone does not call the shots

Taste remains a primary driver of sugar consumption.

64%

of global consumers believe sugar makes food and drinks taste good. This is followed by nutritional characteristics such as its role as an energy source.

Breaking the sterotypes

The role of sugar has clearly shifted from just delivering on functional attributes such as taste, texture, mouthfeel to also address nutritional priorities.

The new balance

Young consumers are breaking the norm

Sweetener preferences differ by generation.

Gen Z and younger millennials place greater importance on sugar in food and drinks.

36%

More than a third of consumers are sceptical of ingredients used to replace sugar in food and drinks.

92%

of Younger consumers preferred honey, sugar, coconut sugar, palm sugar, significantly more when compared to older generations.

Weight gain is not my only concern

Proactive health is

Rethinking sugar

Although taste is a primary driver of consumption, customers increasingly acknowledge and turn to reduced sugar products as healthier alternatives (79% agree).

Concerns regarding weight gain add to people’s increasing concerns around diabetes, triggering addiction, high blood pressure, increased risk of heart attacks which are major deterrents to sugar

81%

of global consumers indicate diabetes and weight gain as significant drawbacks of sugar consumption.

Sweetness is my companion

The relationship with sweetness is emotional

Our traditions, communities, and childhood memories are shaped by food and drink. Woven into our cultural fibres, sweetness triggers a varied emotional response across countries and cultures. And as a result. people have a close relationship with sweetness, it is synonymous to having a companion.

For instance, Americans, Indians, Chinese, and Germans associate sweetness with happiness the most, while the Australians, Mexicans, Colombians, and the Spaniards link sweetness with unhealthy the most. Interestingly, the Thai have no negative connotations with sweetened food and drinks.

Top 10 emotions associated with sweetened food and drinks x country.

(~50% positive and ~50% negative emotions were among the choices given to people)

Happy

Energized

Satisfied/Content

Comforted

Unhealthy

Unhealthy

Energized

Happy

Satisfied/Content

Comforted

Energized

Happy

Satisfied/Content

Comforted

Unhealthy

Satisfied/Content

Happy

Energized

Comforted

Pampered

Energized

Comforted

Satisfied/Content

Happy

Alert

Pampered

Satisfied/Content

Happy

Unhealthy

Energized

Happy

Satisfied/Content

Unhealthy

Energized

Alert

Unhealthy

Satisfied/Content

Energized

Happy

Healthy

Happy

Relieved

Satisfied/Content

Comforted

Energized

Unhealthy

Happy

Energized

Comforted

Satisfied/Content

Happy

Satisfied/Content

Energized

Excited

Comforted

Energized

Satisfied/Content

Excited

Euphoric/Overjoyed

Happy

Energized

Excited

Happy

Satisfied/Content

Pampered

Energized

Happy

Euphoric/Overjoyed

Comforted

Alert

Energized

Happy

Satisfied/Content

Thirsty

Relieved

Energized

Happy

Comforted

Unhealthy

Satisfied/Content

Energized

Happy

Excited

Satisfied/Content

Unhealthy

Energized

Happy

Excited

Satisfied/Content

Unhealthy

Happy

Energized

Thirsty

Unhealthy

Excited

Happy

Energized

Satisfied/Content

Unhealthy

Thirsty

Unhealthy

Energized

Satisfied/Content

Alert

Anxious

Energized

Satisfied/Content

Thirsty

Happy

Comforted

Energized

Unhealthy

Satisfied/Content

Anxious

Happy

Energized

Satisfied/Content

Healthy

Unhealthy

Happy

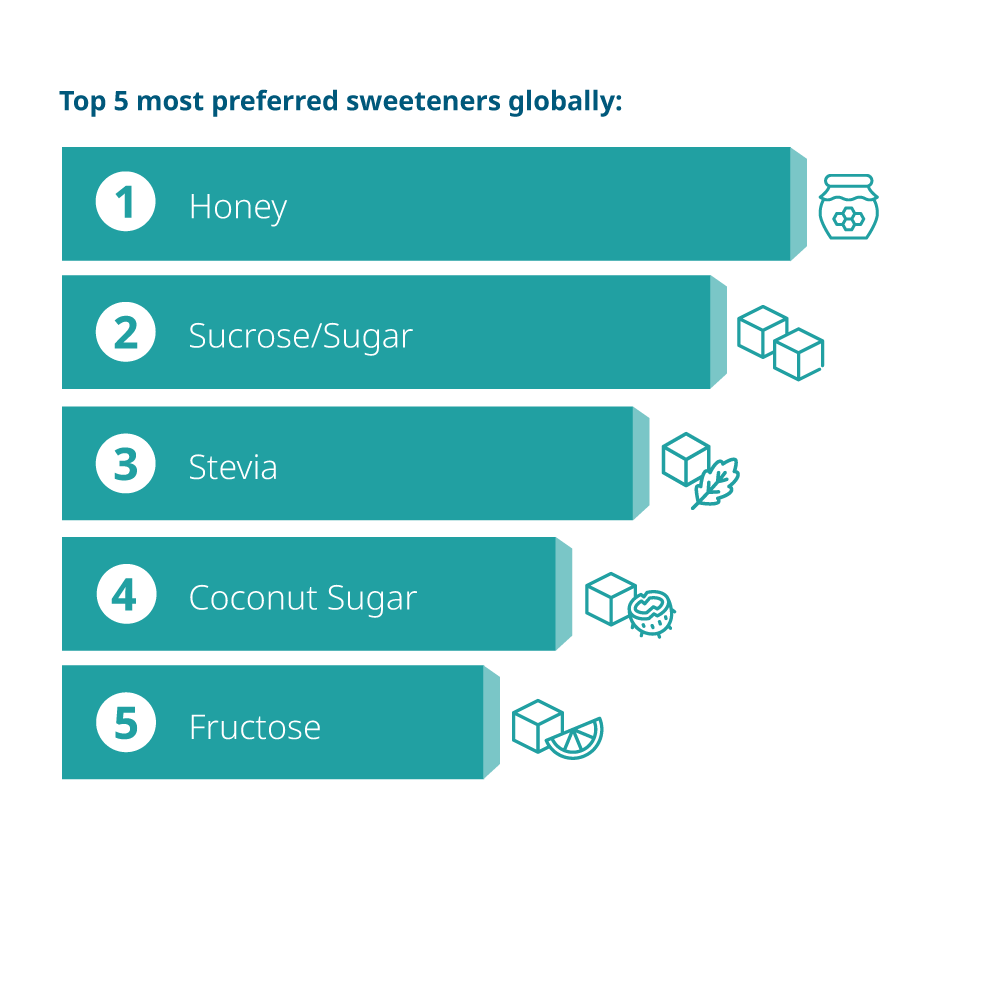

Unlocking the preference of 30 sweeteners

Honey remains the most preferred sweetener in food and drinks, but did you know the preference for other sweeteners vary greatly across each of the 24 countries studied?

Honey is also the most preffered sweetener among the Thai people, but their preference for coconut sugar and stevia is significantly higher than that for sugar/sucrose compared to the global average.

70% of Thai consumers prefer honey as a sweetener followed by 41% who prefer sugar/sucrose.

Thailand – Top 10 sweeteners

Diving into specifics

Join us as we continue the Sensibly Sweet Journey with the second part, Sweet. Less. During this part, we unveil the top preferred sweeteners in the other 23 countries.

We will also address:

- Why is sugar reduction important?

- What are the different degrees of sugar reduction?

Equipped with these insights, there’s an opportunity to bridge the gap. We’re at an innovation tipping point and consumers don’t have to compromise on sweet taste anymore. With leading-edge modulation technology, it’s possible to craft food and drinks that deliver on craveability, satisfaction and indulgence, that meet the standards people demand.

Return to the top